Question

Question 1 You are a UK-based wealth manager. You manage a portfolio currently valued at 1 million on behalf of a UK-based client. Your client

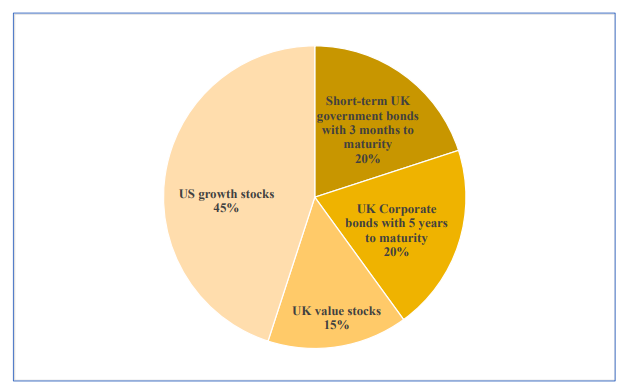

Question 1 You are a UK-based wealth manager. You manage a portfolio currently valued at 1 million on behalf of a UK-based client. Your client is planning to retire in 10 years and the portfolio is the main form of retirement savings for your client. The graph shows the asset allocation in your clients portfolio. The percentages indicate allocations to asset classes

Answers to the questions below do not require calculations, but some students may find it helpful to present formulas to support their arguments. Wherever possible, refer to finance concepts and theory in each question below. See Next Page Short-term UK government bonds with 3 months to maturity 20% UK Corporate bonds with 5 years to maturity 20% UK value stocks 15% US growth stocks 45% 5QQMN532 Page 3 of 3

a) What are the main risks for your client associated with this portfolio? You need to refer to the portfolio shown above, be detailed in your answer and refer to finance theory and concepts. [40 marks]

b) What would the effect of an increase in interest rates by 2% be on the value of the portfolio shown above? [20 marks]

c) If your client decided to retire in 5 years' time, would you advise your client that changes in the portfolio allocation are needed? Why or why not? [20 marks]

d) Would you describe the asset allocation in the chart as following an integrated or a strategic asset allocation strategy? Explain your reasoning.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started