Question

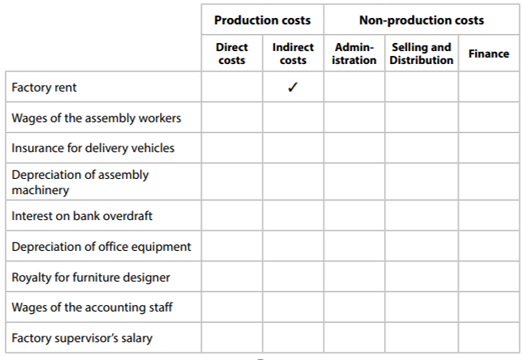

Question 1 You work for a company that makes kitchen furniture. Classify each of the following costs by placing ONE tick in the appropriate column.

Question 1

You work for a company that makes kitchen furniture. Classify each of the following costs by placing ONE tick in the appropriate column. The first entry has been done as an example.

Question 2

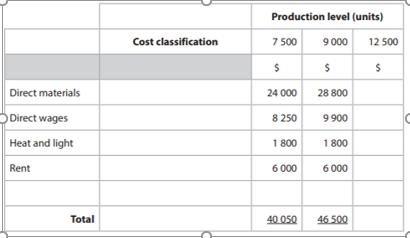

Rubys Products makes a single product, the Floss. Ruby has provided a table outlining her costs at two activity levels, 7,500 units and 9,000 units.

The business has been approached by a customer with an order that would results in increasing production to 12,500 units. If the business accepts the order, it would incure a 50% increase in rent for additional warehouse space.

Required:

- Identify the FOUR costs in the table below as being fixed, variable, semi-variable or stepped-costs. You may use each cost classification more than once.

- Calculate the costs for the 12,500 unit production run.

Question 3

Quality Food is a large restaurant. Some of the costs incurred by the business are listed below.

- Cost of heating the restaurant

- Wages of chefs

- Paper table covers

- Cost of ingredients for meals

- Maintenance contract for ovens

- Wages of waiters and waitresses

Classify the costs into the SIX categories shown in the table below.

| Costs | Direct costs | Indirect costs |

| Materials |

|

|

| Labour |

|

|

| Expenses/ Overheads |

|

|

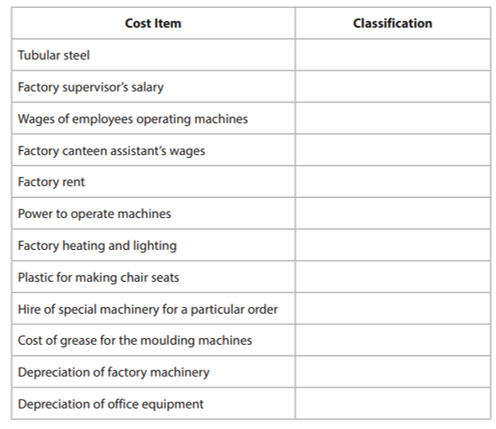

Question 4

Twist and Turn Ltd manufactures chairs for school and college use. The chairs have plastic seats and tubular steel legs. State the classification of the manufacturing costs in the table below into the appropriate category (direct materials, indirect materials, direct labour, indirect labour, direct expenses/ overheads, indirect expenses/ overheads)

Subject: Cost and Management

Production costs Non-production costs Direct Indirect Admin- Selling and costs costs Finance istration Distribution Factory rent Wages of the assembly workers Insurance for delivery vehicles Depreciation of assembly machinery Interest on bank overdraft Depreciation of office equipment Royalty for furniture designer Wages of the accounting staff Factory supervisor's salary Production level (units) Cost classification 7 500 12 500 9000 5 $ $ $ Direct materials 24 000 28 800 8 250 9 900 Direct wages Heat and light Rent 1 800 1 800 6 000 6 000 Total 40 050 46500 Cost Item Classification Tubular steel Factory supervisor's salary Wages of employees operating machines Factory canteen assistant's wages Factory rent Power to operate machines Factory heating and lighting Plastic for making chair seats Hire of special machinery for a particular order Cost of grease for the moulding machines Depreciation of factory machinery Depreciation of office equipment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started