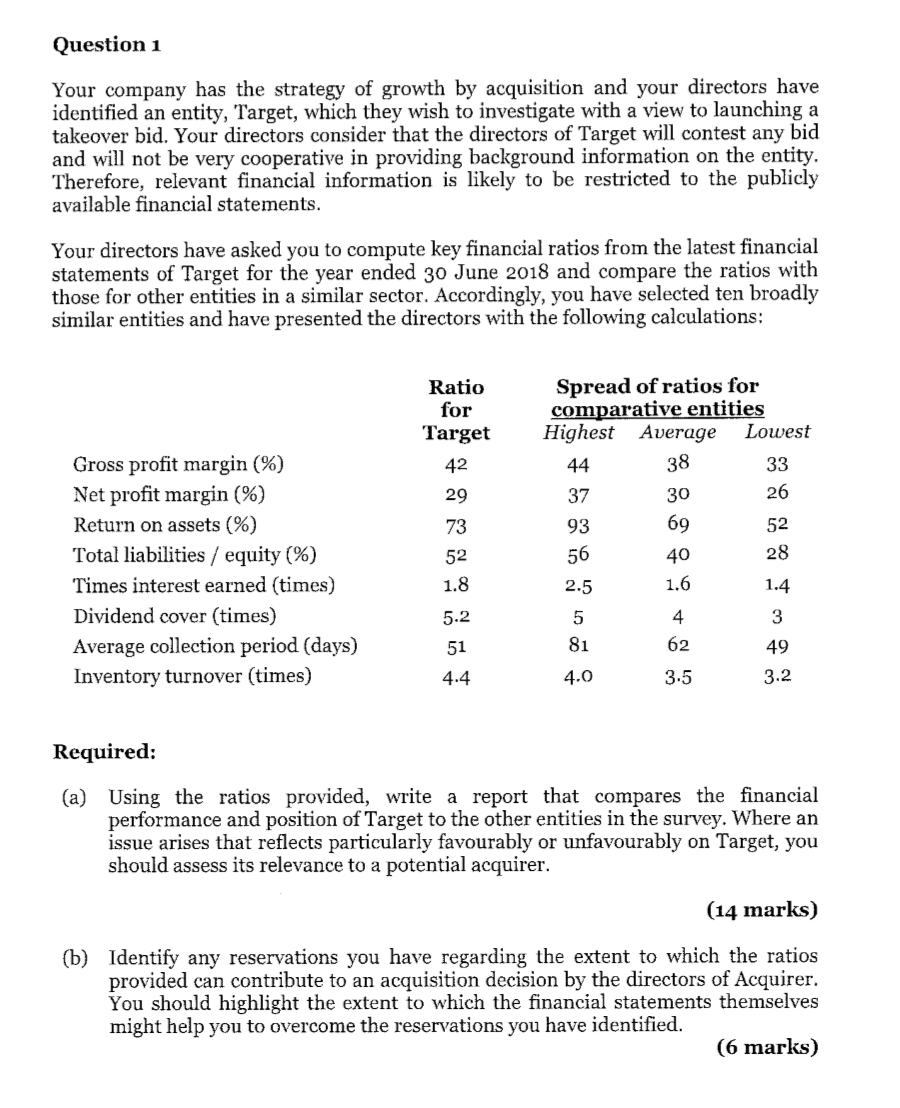

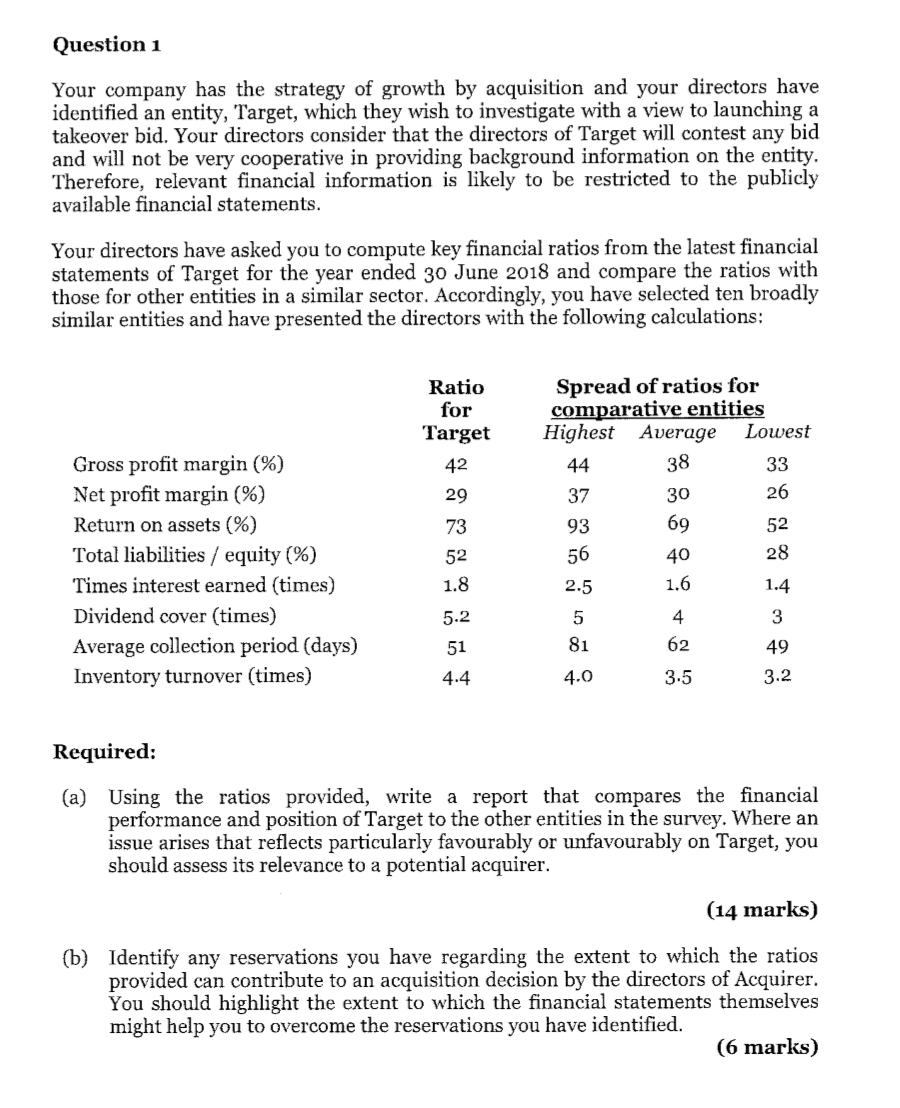

Question 1 Your company has the strategy of growth by acquisition and your directors have identified an entity, Target, which they wish to investigate with a view to launching a takeover bid. Your directors consider that the directors of Target will contest any bid and will not be very cooperative in providing background information on the entity. Therefore, relevant financial information is likely to be restricted to the publicly available financial statements. Your directors have asked you to compute key financial ratios from the latest financial statements of Target for the year ended 30 June 2018 and compare the ratios with those for other entities in a similar sector. Accordingly, you have selected ten broadly similar entities and have presented the directors with the following calculations: Ratio for Target 42 Spread of ratios for comparative entities Highest Average Lowest 44 38 33 Gross profit margin (%) Net profit margin (%) Return on assets (%) Total liabilities / equity (%) Times interest earned (times) Dividend cover (times) Average collection period (days) Inventory turnover (times) Required: (a) Using the ratios provided, write a report that compares the financial performance and position of Target to the other entities in the survey. Where an issue arises that reflects particularly favourably or unfavourably on Target, you should assess its relevance to a potential acquirer. (14 marks) (b) Identify any reservations you have regarding the extent to which the ratios provided can contribute to an acquisition decision by the directors of Acquirer. You should highlight the extent to which the financial statements themselves might help you to overcome the reservations you have identified. (6 marks) Question 1 Your company has the strategy of growth by acquisition and your directors have identified an entity, Target, which they wish to investigate with a view to launching a takeover bid. Your directors consider that the directors of Target will contest any bid and will not be very cooperative in providing background information on the entity. Therefore, relevant financial information is likely to be restricted to the publicly available financial statements. Your directors have asked you to compute key financial ratios from the latest financial statements of Target for the year ended 30 June 2018 and compare the ratios with those for other entities in a similar sector. Accordingly, you have selected ten broadly similar entities and have presented the directors with the following calculations: Ratio for Target 42 Spread of ratios for comparative entities Highest Average Lowest 44 38 33 Gross profit margin (%) Net profit margin (%) Return on assets (%) Total liabilities / equity (%) Times interest earned (times) Dividend cover (times) Average collection period (days) Inventory turnover (times) Required: (a) Using the ratios provided, write a report that compares the financial performance and position of Target to the other entities in the survey. Where an issue arises that reflects particularly favourably or unfavourably on Target, you should assess its relevance to a potential acquirer. (14 marks) (b) Identify any reservations you have regarding the extent to which the ratios provided can contribute to an acquisition decision by the directors of Acquirer. You should highlight the extent to which the financial statements themselves might help you to overcome the reservations you have identified. (6 marks)