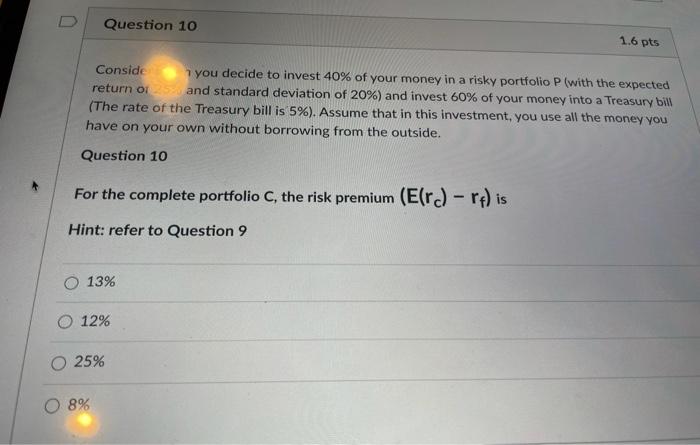

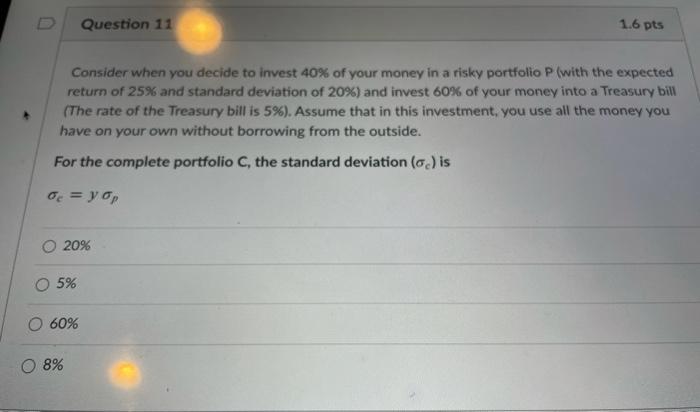

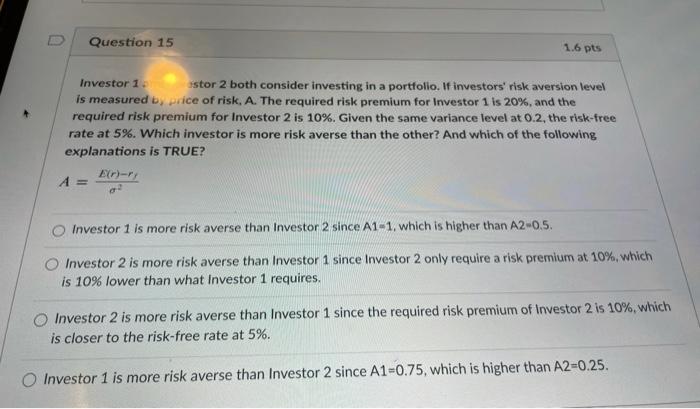

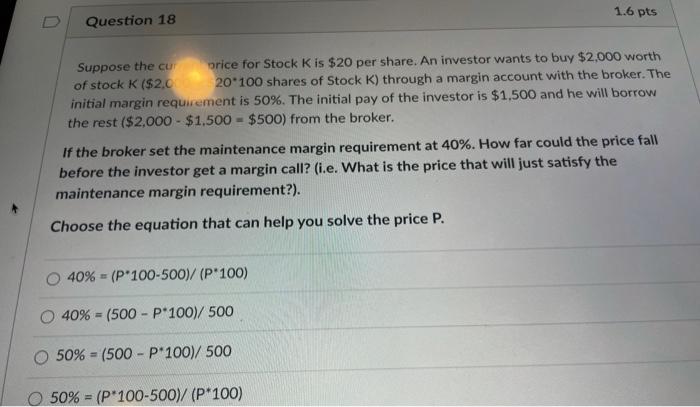

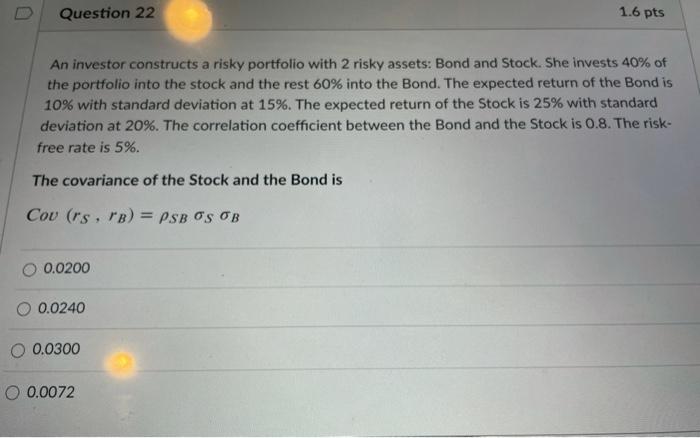

Question 10 1.6 pts Conside you decide to invest 40% of your money in a risky portfolio P (with the expected return of and standard deviation of 20%) and invest 60% of your money into a Treasury bill (The rate of the Treasury bill is 5%). Assume that in this investment, you use all the money you have on your own without borrowing from the outside. Question 10 For the complete portfolio C, the risk premium (E(r) - rp) is Hint: refer to Question 9 13% 12% O 25% O 8% D Question 11 1.6 pts Consider when you decide to invest 40% of your money in a risky portfolio P(with the expected return of 25% and standard deviation of 20%) and invest 60% of your money into a Treasury bill (The rate of the Treasury bill is 5%). Assume that in this investment, you use all the money you have on your own without borrowing from the outside. For the complete portfolio C, the standard deviation () is 0 = y op 20% O 5% O 60% 8% Question 15 1.6 pts Investor 1. istor 2 both consider investing in a portfolio. If investors' risk aversion level is measured by price of risk, A. The required risk premium for Investor 1 is 20%, and the required risk premium for Investor 2 is 10%. Given the same variance level at 0.2, the risk-free rate at 5%. Which investor is more risk averse than the other? And which of the following explanations is TRUE? A= E-ry Investor 1 is more risk averse than Investor 2 since A1-1, which is higher than A2-0.5. Investor 2 is more risk averse than Investor 1 since Investor 2 only require a risk premium at 10%, which is 10% lower than what Investor 1 requires. Investor 2 is more risk averse than Investor 1 since the required risk premium of Investor 2 is 10%, which is closer to the risk-free rate at 5%. Investor 1 is more risk averse than Investor 2 since A1=0.75, which is higher than A2=0.25. 1.6 pts D Question 18 Suppose the cu price for Stock K is $20 per share. An investor wants to buy $2,000 worth of stock K ($2.0 20*100 shares of Stock K) through a margin account with the broker. The initial margin requirement is 50%. The initial pay of the investor is $1.500 and he will borrow the rest ($2,000 - $1.500 - $500) from the broker. If the broker set the maintenance margin requirement at 40%. How far could the price fall before the investor get a margin call? (i.e. What is the price that will just satisfy the maintenance margin requirement?). Choose the equation that can help you solve the price P. 40% = (P-100-500)/(P'100) 40% = (500 - P100)/500 50% = (500 - P100)/ 500 50% = (P 100-500)/(P 100) Question 22 1.6 pts An investor constructs a risky portfolio with 2 risky assets: Bond and Stock. She invests 40% of the portfolio into the stock and the rest 60% into the Bond. The expected return of the Bond is 10% with standard deviation at 15%. The expected return of the Stock is 25% with standard deviation at 20%. The correlation coefficient between the Bond and the Stock is 0.8. The risk- free rate is 5%. The covariance of the Stock and the Bond is Cou (r's. B) = PsB O OB 0.0200 O 0.0240 0 0.0300 O 0.0072