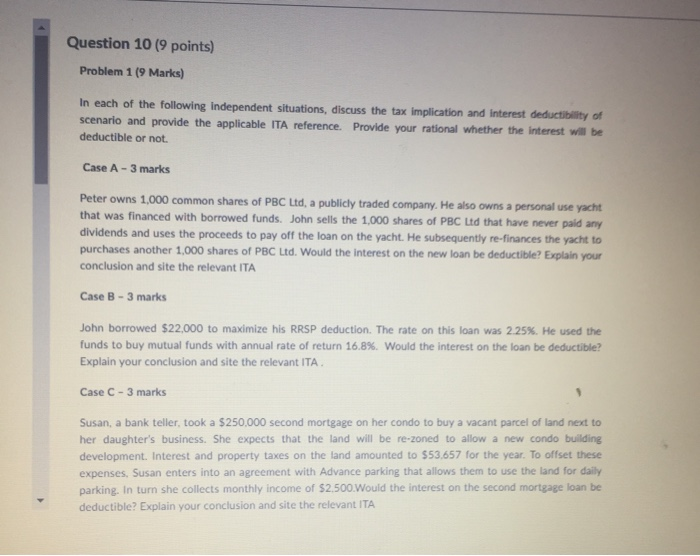

Question 10 (9 points) Problem 1 (9 Marks) In each of the following independent situations, discuss the tax implication and interest deductibility of scenario and provide the applicable ITA reference. Provide your rational whether the interest will be deductible or not. Case A - 3 marks Peter owns 1,000 common shares of PBC Ltd, a publicly traded company. He also owns a personal use yacht that was financed with borrowed funds. John sells the 1,000 shares of PBC Ltd that have never paid any dividends and uses the proceeds to pay off the loan on the yacht. He subsequently re-finances the yacht to purchases another 1,000 shares of PBC Ltd. Would the interest on the new loan be deductible? Explain your conclusion and site the relevant ITA Case B - 3 marks John borrowed $22,000 to maximize his RRSP deduction. The rate on this loan was 2.25%. He used the funds to buy mutual funds with annual rate of return 16.8%. Would the interest on the loan be deductible? Explain your conclusion and site the relevant ITA Case C - 3 marks Susan, a bank teller, took a $250.000 second mortgage on her condo to buy a vacant parcel of land next to her daughter's business. She expects that the land will be re-zoned to allow a new condo building development. Interest and property taxes on the land amounted to 553,657 for the year. To offset these expenses, Susan enters into an agreement with Advance parking that allows them to use the land for daily parking. In turn she collects monthly income of $2.500.Would the interest on the second mortgage loan be deductible? Explain your conclusion and site the relevant ITA Question 10 (9 points) Problem 1 (9 Marks) In each of the following independent situations, discuss the tax implication and interest deductibility of scenario and provide the applicable ITA reference. Provide your rational whether the interest will be deductible or not. Case A - 3 marks Peter owns 1,000 common shares of PBC Ltd, a publicly traded company. He also owns a personal use yacht that was financed with borrowed funds. John sells the 1,000 shares of PBC Ltd that have never paid any dividends and uses the proceeds to pay off the loan on the yacht. He subsequently re-finances the yacht to purchases another 1,000 shares of PBC Ltd. Would the interest on the new loan be deductible? Explain your conclusion and site the relevant ITA Case B - 3 marks John borrowed $22,000 to maximize his RRSP deduction. The rate on this loan was 2.25%. He used the funds to buy mutual funds with annual rate of return 16.8%. Would the interest on the loan be deductible? Explain your conclusion and site the relevant ITA Case C - 3 marks Susan, a bank teller, took a $250.000 second mortgage on her condo to buy a vacant parcel of land next to her daughter's business. She expects that the land will be re-zoned to allow a new condo building development. Interest and property taxes on the land amounted to 553,657 for the year. To offset these expenses, Susan enters into an agreement with Advance parking that allows them to use the land for daily parking. In turn she collects monthly income of $2.500.Would the interest on the second mortgage loan be deductible? Explain your conclusion and site the relevant ITA