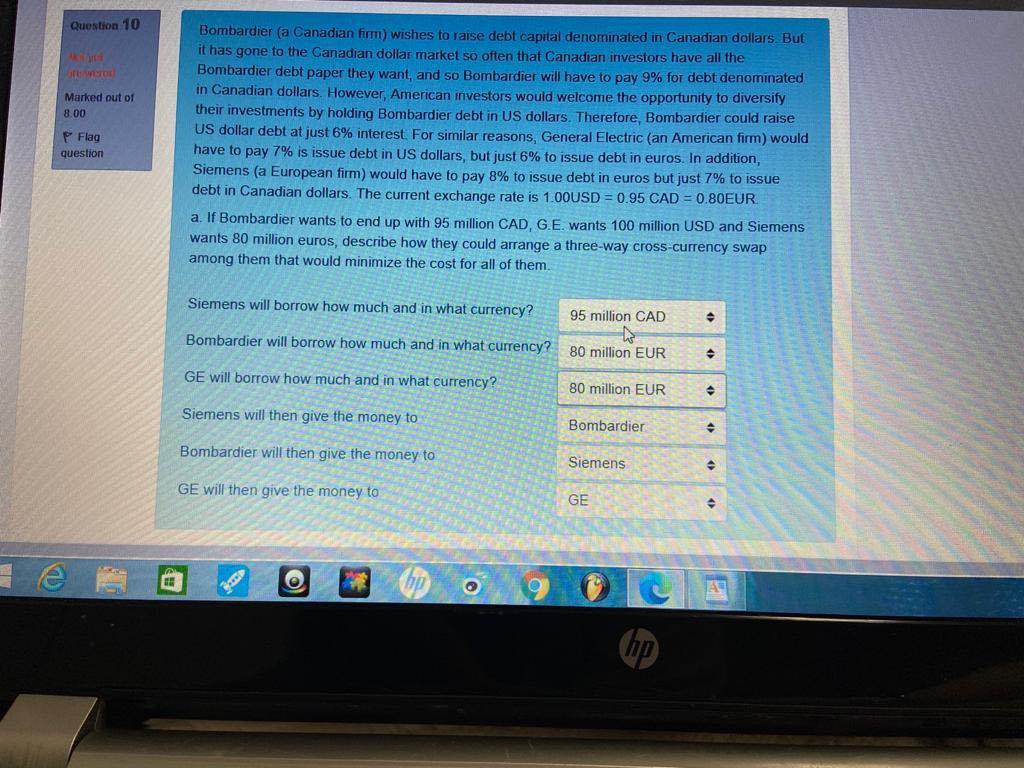

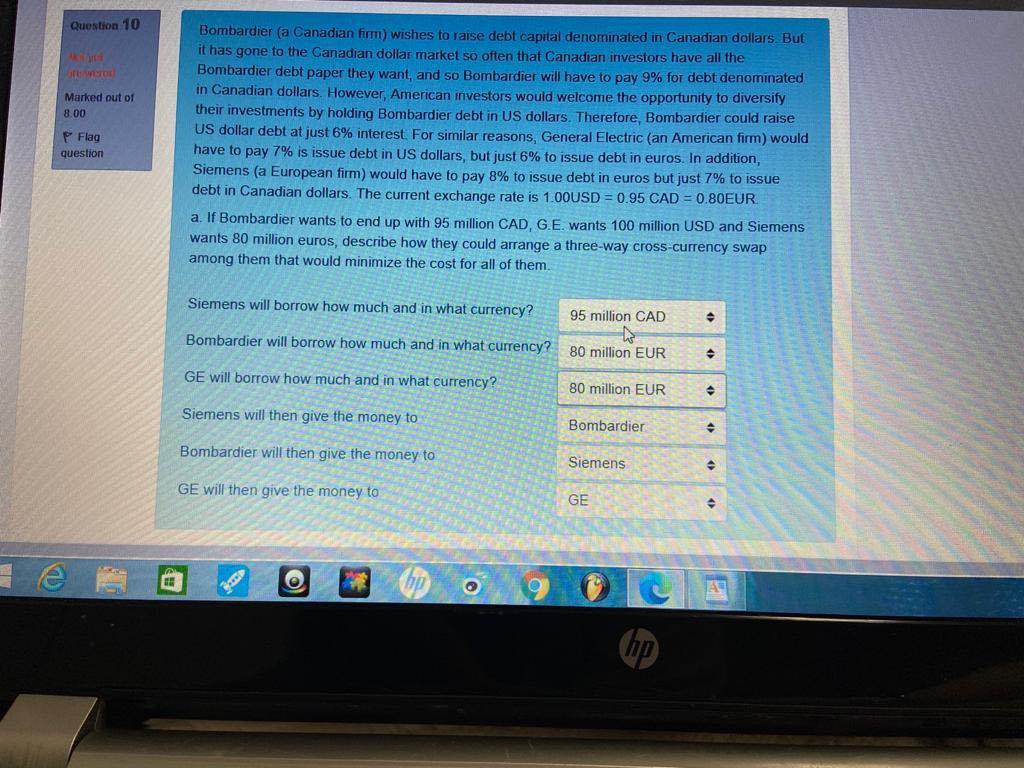

Question 10 Marked out of 8.00 Flag question Bombardier (a Canadian firm) wishes to raise debt capital denominated in Canadian dollars But it has gone to the Canadian dollar market so often that Canadian investors have all the Bombardier debt paper they want, and so Bombardier will have to pay 9% for debt denominated in Canadian dollars. However, American investors would welcome the opportunity to diversify their investments by holding Bombardier debt in US dollars. Therefore, Bombardier could raise US dollar debt at just 6% interest. For similar reasons, General Electric (an American firm) would have to pay 7% is issue debt in US dollars, but just 6% to issue debt in euros. In addition, Siemens (a European firm) would have to pay 8% to issue debt in euros but just 7% to issue debt in Canadian dollars. The current exchange rate is 1.00USD = 0.95 CAD = 0.80EUR. a. If Bombardier wants to end up with 95 million CAD, G.E. wants 100 million USD and Siemens wants 80 million euros, describe how they could arrange a three-way cross-currency swap among them that would minimize the cost for all of them. Siemens will borrow how much and in what currency? 95 million CAD Bombardier will borrow how much and in what currency? 80 million EUR GE will borrow how much and in what currency? 80 million EUR Siemens will then give the money to Bombardier Bombardier will then give the money to Siemens GE will then give the money to GE Question 10 Marked out of 8.00 Flag question Bombardier (a Canadian firm) wishes to raise debt capital denominated in Canadian dollars But it has gone to the Canadian dollar market so often that Canadian investors have all the Bombardier debt paper they want, and so Bombardier will have to pay 9% for debt denominated in Canadian dollars. However, American investors would welcome the opportunity to diversify their investments by holding Bombardier debt in US dollars. Therefore, Bombardier could raise US dollar debt at just 6% interest. For similar reasons, General Electric (an American firm) would have to pay 7% is issue debt in US dollars, but just 6% to issue debt in euros. In addition, Siemens (a European firm) would have to pay 8% to issue debt in euros but just 7% to issue debt in Canadian dollars. The current exchange rate is 1.00USD = 0.95 CAD = 0.80EUR. a. If Bombardier wants to end up with 95 million CAD, G.E. wants 100 million USD and Siemens wants 80 million euros, describe how they could arrange a three-way cross-currency swap among them that would minimize the cost for all of them. Siemens will borrow how much and in what currency? 95 million CAD Bombardier will borrow how much and in what currency? 80 million EUR GE will borrow how much and in what currency? 80 million EUR Siemens will then give the money to Bombardier Bombardier will then give the money to Siemens GE will then give the money to GE