Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question #10 Risk/Variance & Mergers Part 1: Answer each of the five (5) True/False questions below (1 point each): A. Portfolio variance will never

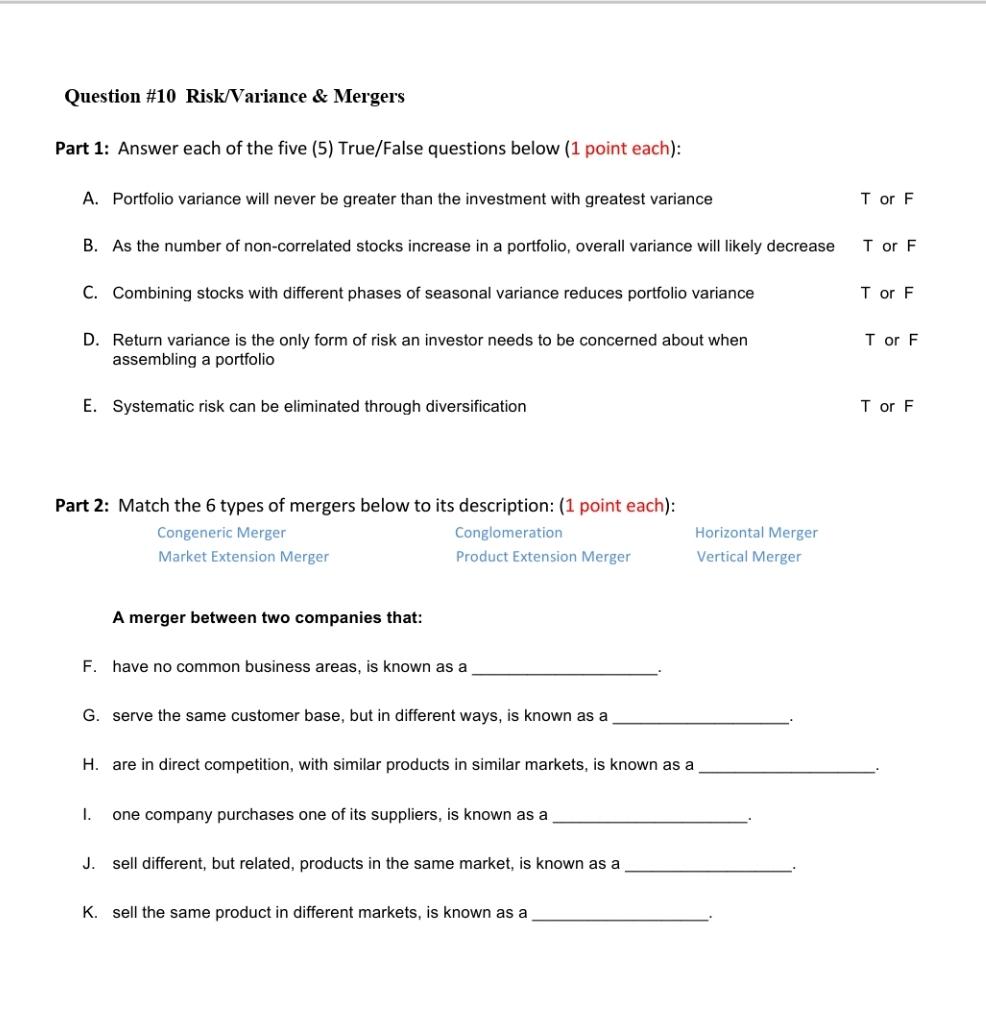

Question #10 Risk/Variance & Mergers Part 1: Answer each of the five (5) True/False questions below (1 point each): A. Portfolio variance will never be greater than the investment with greatest variance T or F B. As the number of non-correlated stocks increase in a portfolio, overall variance will likely decrease T or F C. Combining stocks with different phases of seasonal variance reduces portfolio variance T or F T or F D. Return variance is the only form of risk an investor needs to be concerned about when assembling a portfolio E. Systematic risk can be eliminated through diversification Part 2: Match the 6 types of mergers below to its description: (1 point each): Congeneric Merger Market Extension Merger Conglomeration Product Extension Merger A merger between two companies that: F. have no common business areas, is known as a G. serve the same customer base, but in different ways, is known as a H. are in direct competition, with similar products in similar markets, is known as a 1. one company purchases one of its suppliers, is known as a J. sell different, but related, products in the same market, is known as a K. sell the same product in different markets, is known as a Horizontal Merger Vertical Merger T or F

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started