Answered step by step

Verified Expert Solution

Question

1 Approved Answer

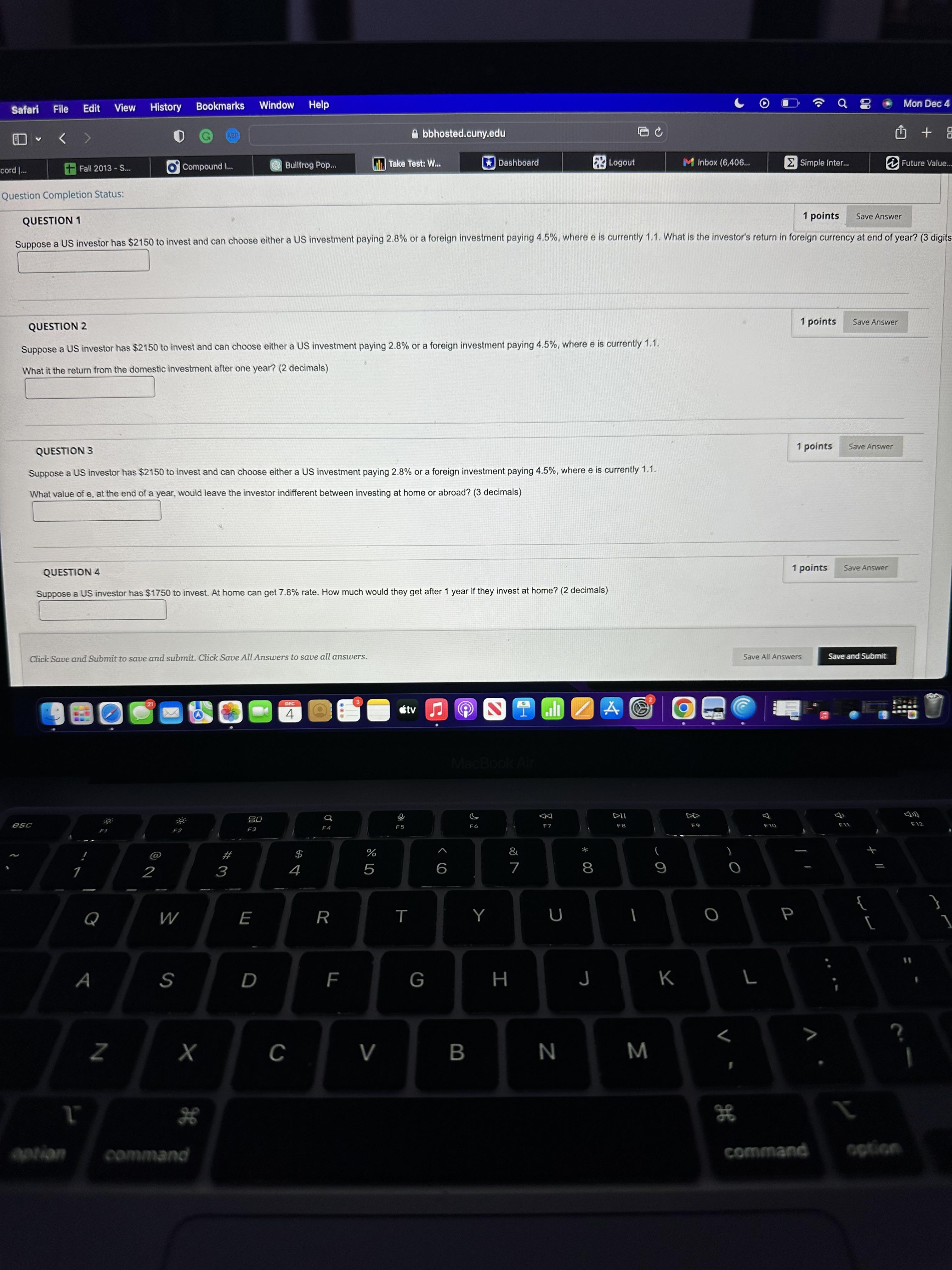

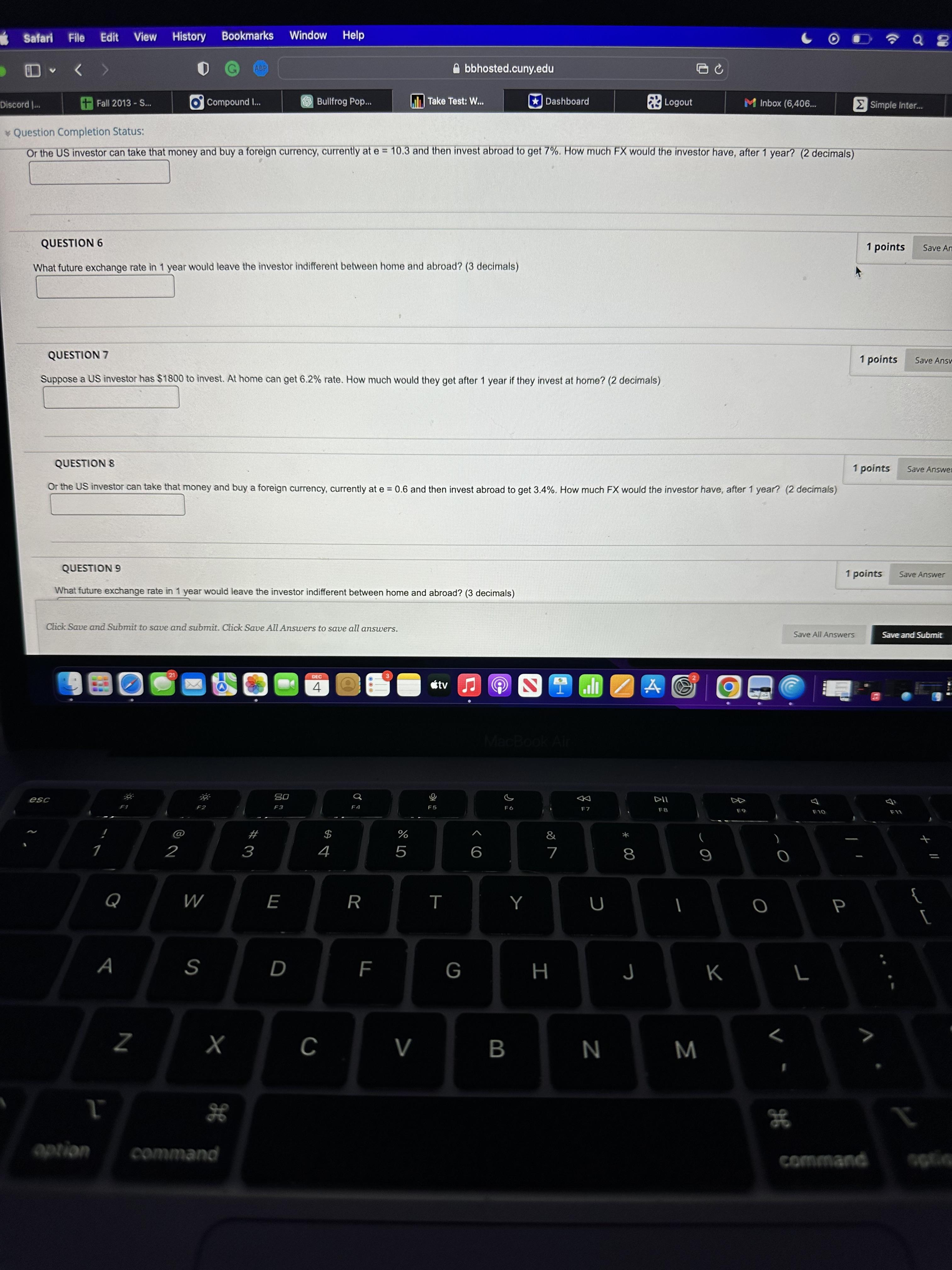

PLEASE ANSWER ACCURATELY Safari File Edit View History Bookmarks Window Help cord ... Dashboard Logout M Inbox (6,406... Simple Inter... < > ABP bbhosted.cuny.edu Fall

PLEASE ANSWER ACCURATELY

Safari File Edit View History Bookmarks Window Help cord ... Dashboard Logout M Inbox (6,406... Simple Inter... < > ABP bbhosted.cuny.edu Fall 2013 - S... Compound I... Bullfrog Pop... Take Test: W... 00 00 Mon Dec 4 + +8 Future Value..... 1 points Save Answer Suppose a US investor has $2150 to invest and can choose either a US investment paying 2.8% or a foreign investment paying 4.5%, where e is currently 1.1. What is the investor's return in foreign currency at end of year? (3 digits Question Completion Status: QUESTION 1 QUESTION 2 1 points Save Answer Suppose a US investor has $2150 to invest and can choose either a US investment paying 2.8% or a foreign investment paying 4.5%, where e is currently 1.1. What it the return from the domestic investment after one year? (2 decimals) QUESTION 3 1 points Save Answer Suppose a US investor has $2150 to invest and can choose either a US investment paying 2.8% or a foreign investment paying 4.5%, where e is currently 1.1. What value of e, at the end of a year, would leave the investor indifferent between investing at home or abroad? (3 decimals) QUESTION 4 Suppose a US investor has $1750 to invest. At home can get 7.8% rate. How much would they get after 1 year if they invest at home? (2 decimals) Click Save and Submit to save and submit. Click Save All Answers to save all answers. esc ! 1 F1 Q A 21 @ 22 F2 W S #3 80 F3 DEC 4 94 Q F4 % 2 40 5 tv F5 MacBook Air 9> 6 F6 E R T Y D 27 & A F7 A 8 * 00 2 1 points Save Answer Save All Answers Save and Submit F8 F9 F10 DII 9 LL F G H J K L P F11 GE + "/ { [ F12 1 < 7 ? X C V B N M H He command option aption 1" Z command

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started