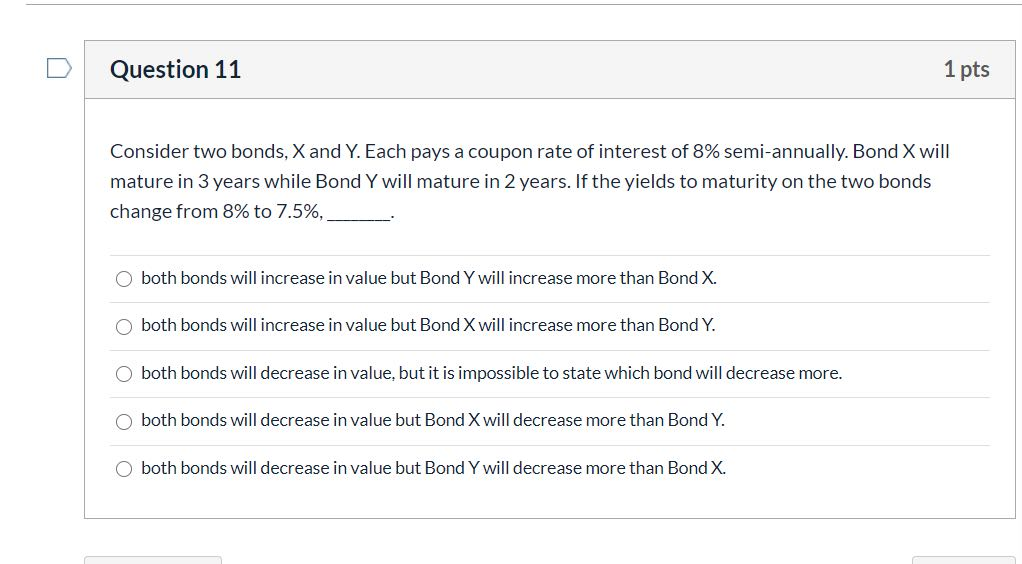

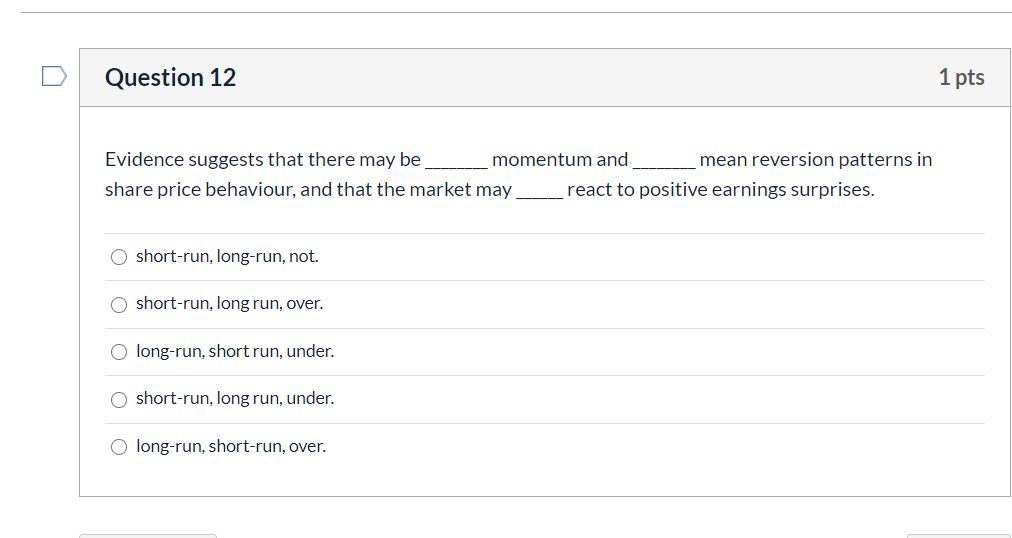

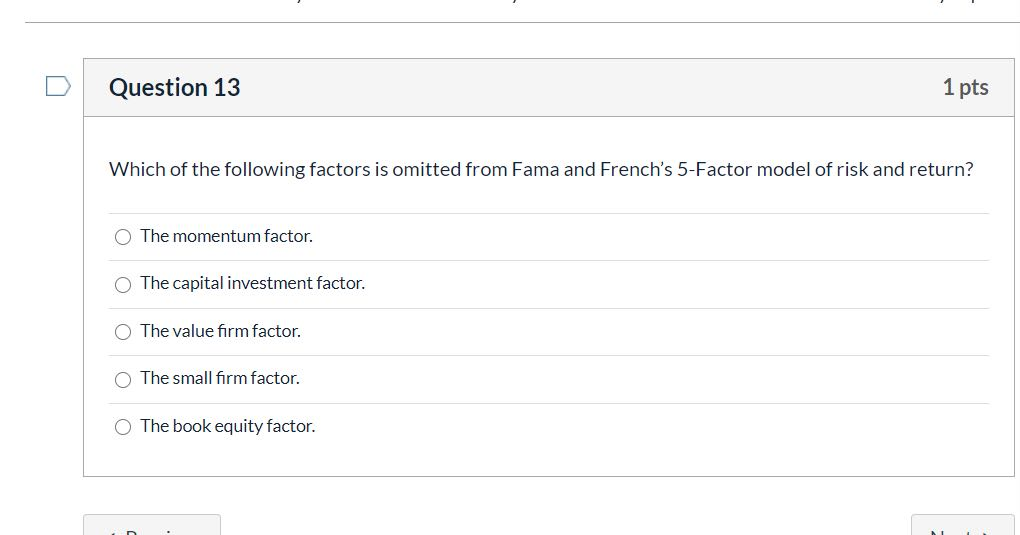

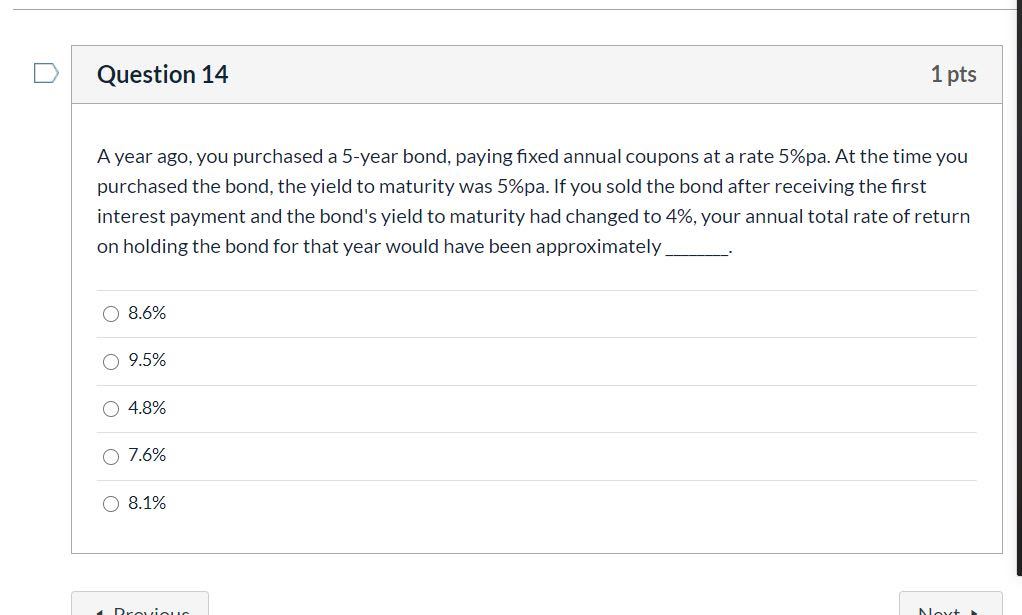

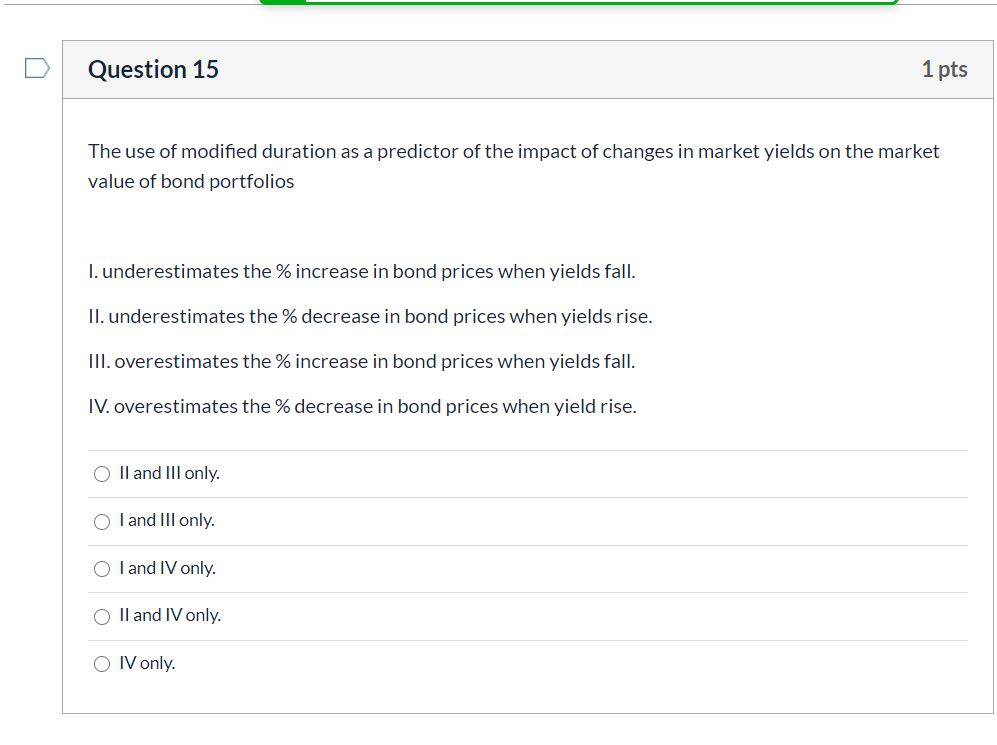

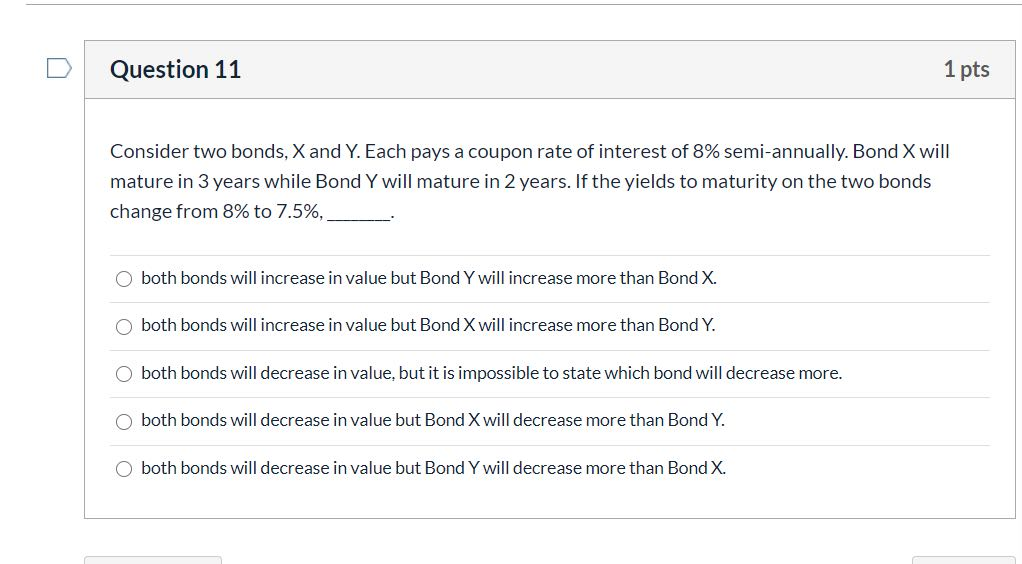

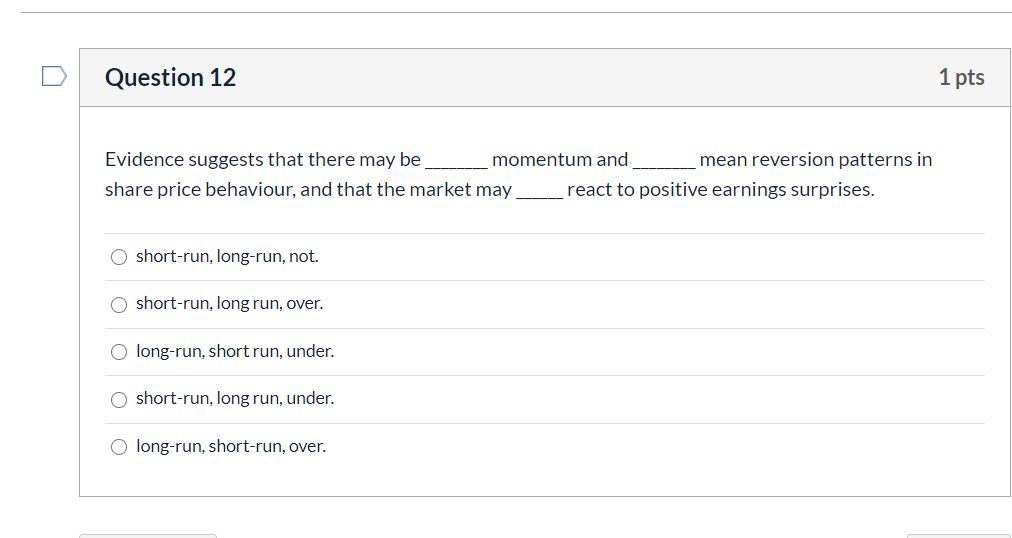

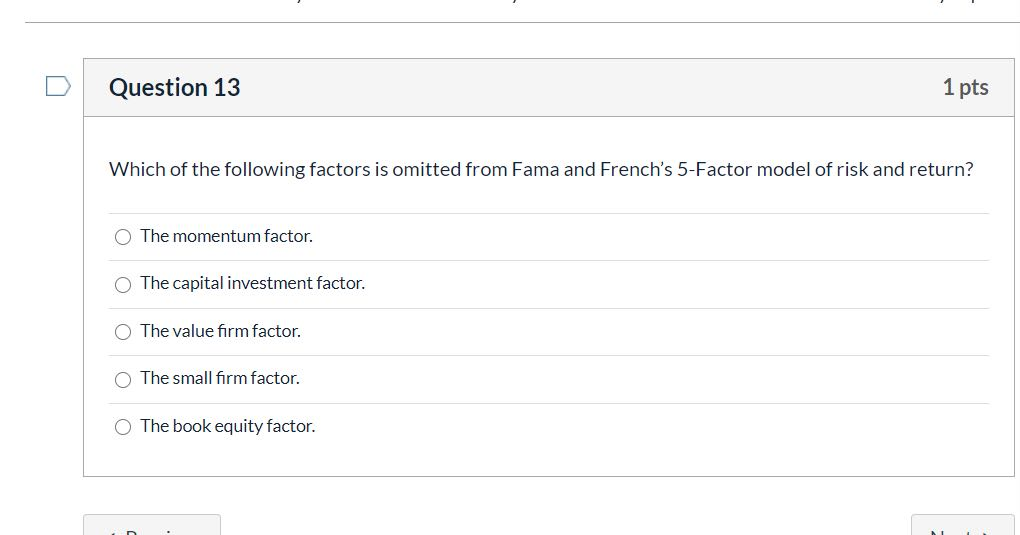

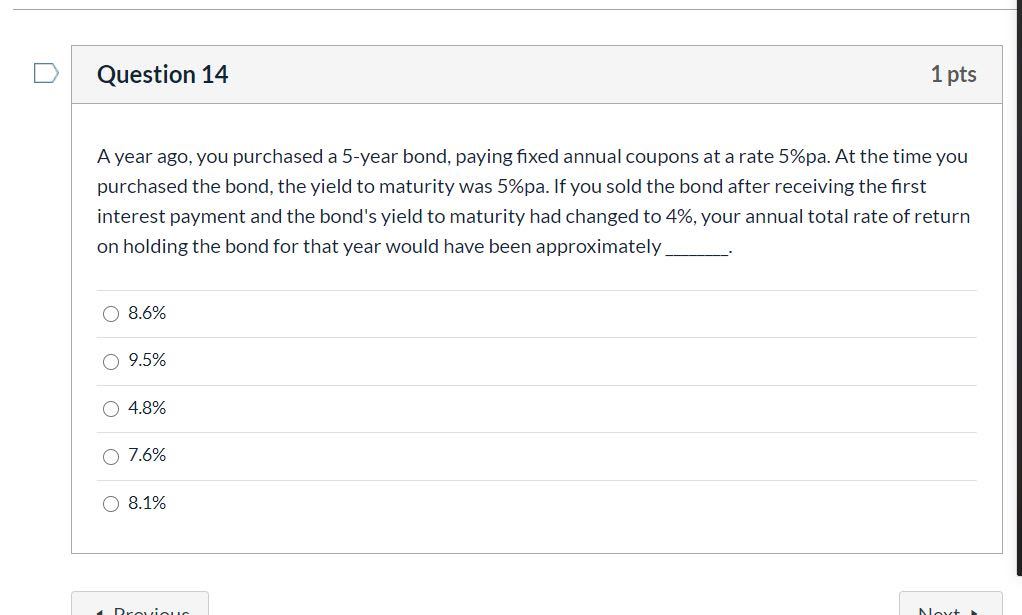

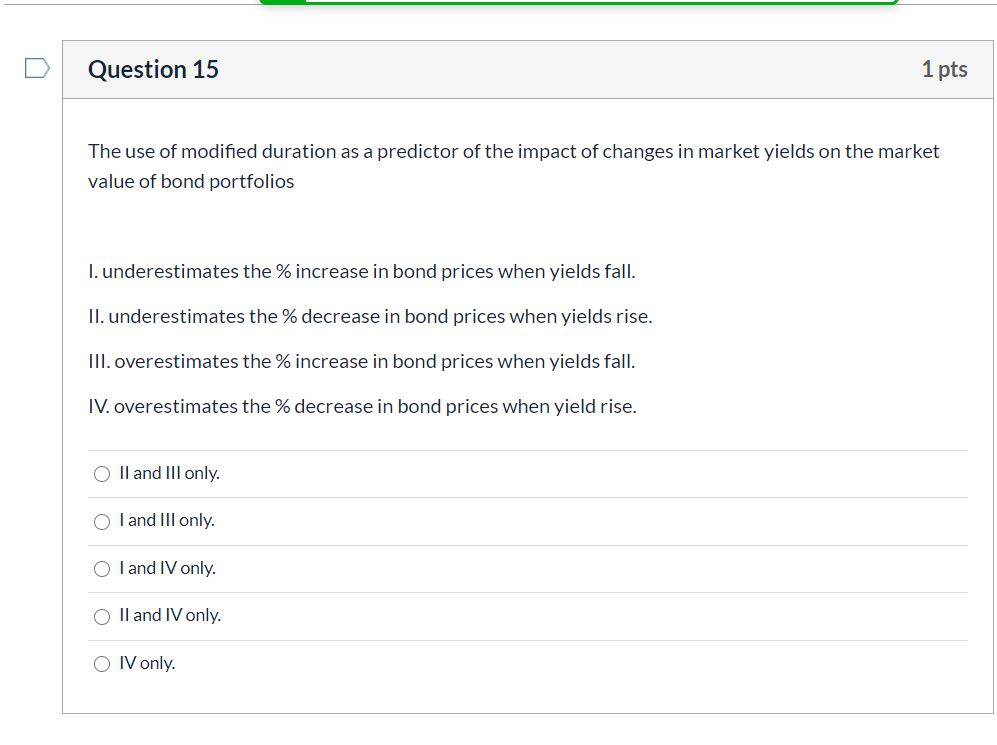

Question 11 1 pts Consider two bonds, X and Y. Each pays a coupon rate of interest of 8% semi-annually. Bond X will mature in 3 years while Bond Y will mature in 2 years. If the yields to maturity on the two bonds change from 8% to 7.5%, both bonds will increase in value but Bond Y will increase more than Bond X. both bonds will increase in value but Bond X will increase more than Bond Y. O both bonds will decrease in value, but it is impossible to state which bond will decrease more. both bonds will decrease in value but Bond X will decrease more than Bond Y. both bonds will decrease in value but Bond Y will decrease more than Bond X. Question 12 1 pts Evidence suggests that there may be momentum and mean reversion patterns in share price behaviour, and that the market may react to positive earnings surprises. short-run, long-run, not. short-run, long run, over. long-run, short run, under. short-run, long run, under. long-run, short-run, over. 1 pts Question 13 U Which of the following factors is omitted from Fama and French's 5-Factor model of risk and return? O The momentum factor. The capital investment factor. O The value firm factor. The small firm factor. O The book equity factor. Question 14 1 pts A year ago, you purchased a 5-year bond, paying fixed annual coupons at a rate 5%pa. At the time you purchased the bond, the yield to maturity was 5%pa. If you sold the bond after receiving the first interest payment and the bond's yield to maturity had changed to 4%, your annual total rate of return on holding the bond for that year would have been approximately 8.6% 9.5% 4.8% 7.6% 08.1% Prouinc Maut Question 15 1 pts The use of modified duration as a predictor of the impact of changes in market yields on the market value of bond portfolios I. underestimates the % increase in bond prices when yields fall. II. underestimates the % decrease in bond prices when yields rise. III. overestimates the % increase in bond prices when yields fall. IV. overestimates the % decrease in bond prices when yield rise. O II and Ill only. O land Ill only. O I and IV only. O II and IV only. O IV only