Answered step by step

Verified Expert Solution

Question

1 Approved Answer

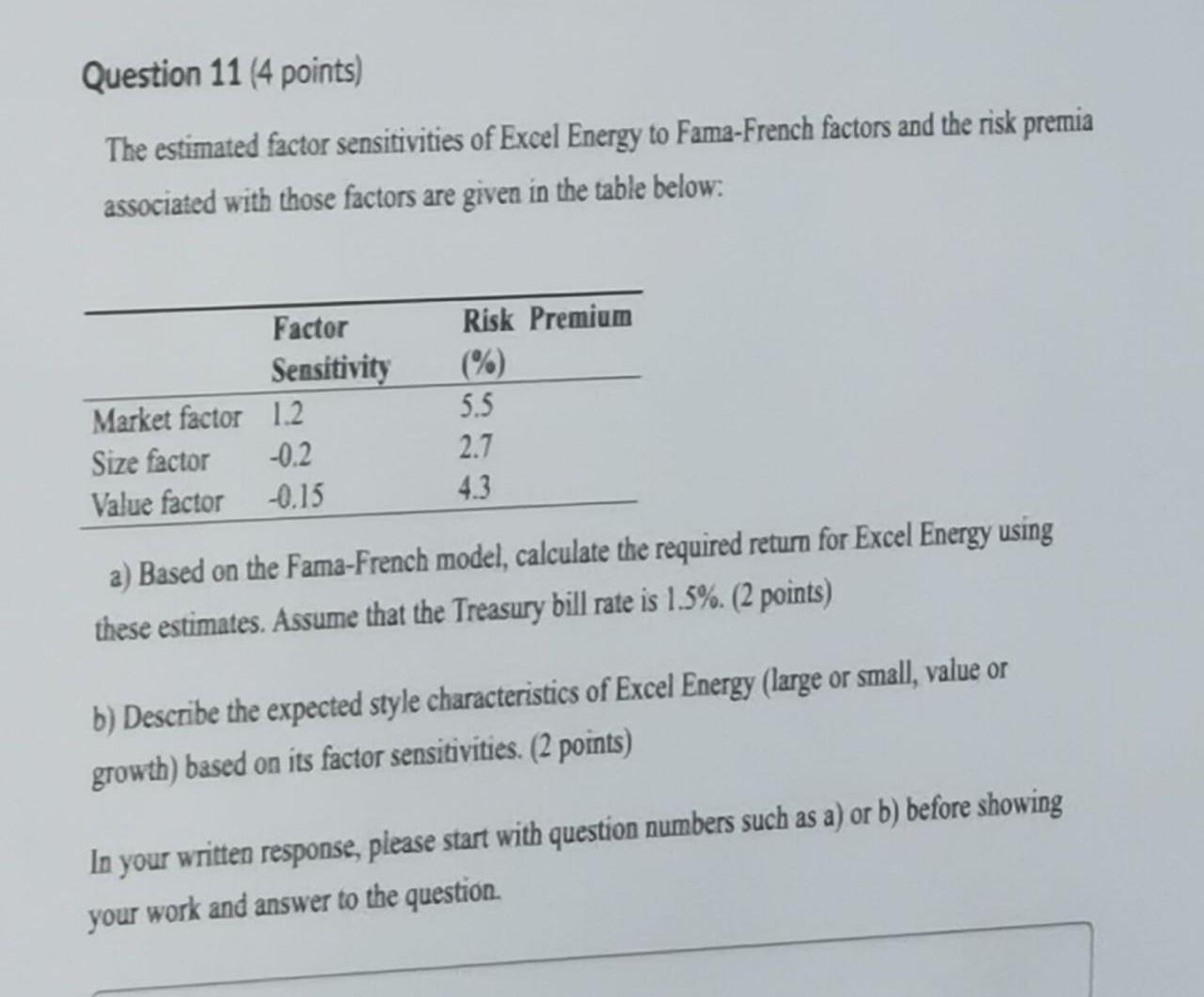

Question 11 (4 points) The estimated factor sensitivities of Excel Energy to Fama-French factors and the risk premia associated with those factors are given in

Question 11 (4 points) The estimated factor sensitivities of Excel Energy to Fama-French factors and the risk premia associated with those factors are given in the table below: Risk Premium Factor Sensitivity (%) Market factor 1.2 5.5 Size factor -0.2 2.7 Value factor -0.15 4.3 a) Based on the Fama-French model, calculate the required return for Excel Energy using these estimates. Assume that the Treasury bill rate is 1.5%. (2 points) b) Describe the expected style characteristics of Excel Energy (large or small, value or growth) based on its factor sensitivities. (2 points) In your written response, please start with question numbers such as a) or b) before showing your work and answer to the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started