Answered step by step

Verified Expert Solution

Question

1 Approved Answer

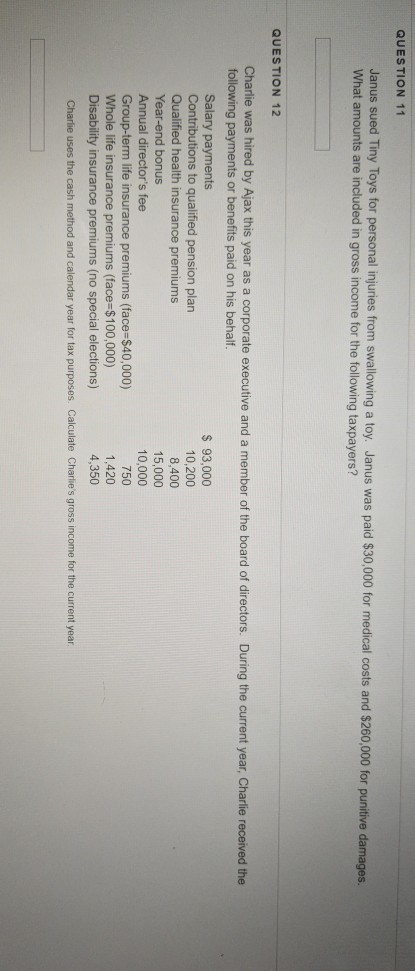

QUESTION 11 Janus sued Tiny Toys for personal injuries from swallowing a toy. Janus was paid $30,000 for medical costs and $260,000 for punitive damages.

QUESTION 11 Janus sued Tiny Toys for personal injuries from swallowing a toy. Janus was paid $30,000 for medical costs and $260,000 for punitive damages. What amounts are included in gross income for the following taxpayers? QUESTION 12 Charlie was hired by Ajax this year as a corporate executive and a member of the board of directors. During the current year, Charlie received the following payments or benefits paid on his behalf. Salary payments Con Qualified health insurance premiums Year-end bonus Annual director's fee 93,000 10,200 8,400 15,000 10,000 750 1,420 4,350 to qualified pension plan life insurance premiums (face-$40,000) Whole life insurance premiums (face-$100,000) Disability insurance premiums (no special elections) Charlie uses the cash method and calendar year for tax purposes. Calculate Charlie's gross income for the current year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started