Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Provide Journal entries on required dates using IFRS During the fiscal year ended August 31,2023, Avalon Ltd. had some transactions involving investments. Your task is

Provide Journal entries on required dates using IFRS

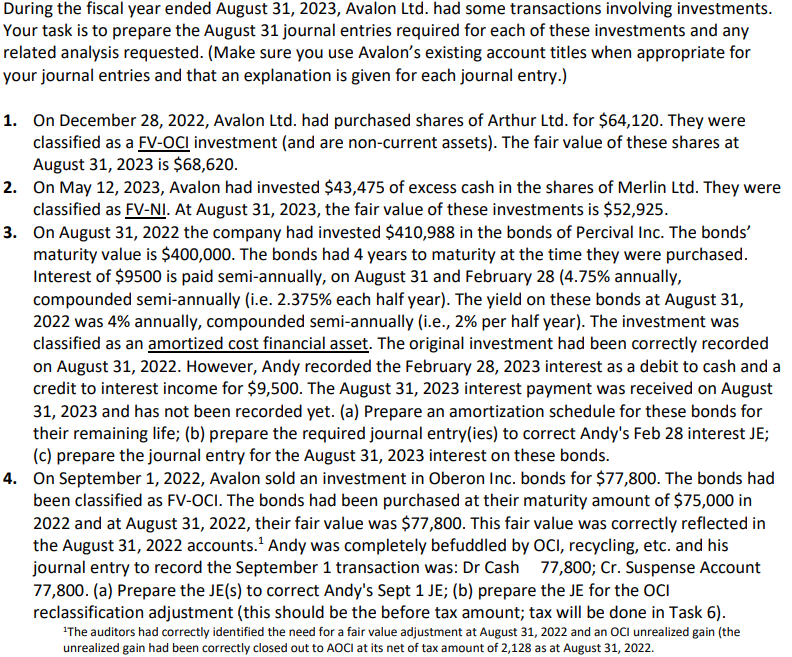

During the fiscal year ended August 31,2023, Avalon Ltd. had some transactions involving investments. Your task is to prepare the August 31 journal entries required for each of these investments and any related analysis requested. (Make sure you use Avalon's existing account titles when appropriate for your journal entries and that an explanation is given for each journal entry.) 1. On December 28, 2022, Avalon Ltd. had purchased shares of Arthur Ltd. for $64,120. They were classified as a FVOCl investment (and are non-current assets). The fair value of these shares at August 31,2023 is $68,620. 2. On May 12,2023 , Avalon had invested $43,475 of excess cash in the shares of Merlin Ltd. They were classified as FV-NI. At August 31, 2023, the fair value of these investments is $52,925. 3. On August 31, 2022 the company had invested $410,988 in the bonds of Percival Inc. The bonds' maturity value is $400,000. The bonds had 4 years to maturity at the time they were purchased. Interest of $9500 is paid semi-annually, on August 31 and February 28 (4.75\% annually, compounded semi-annually (i.e. 2.375% each half year). The yield on these bonds at August 31 , 2022 was 4% annually, compounded semi-annually (i.e., 2% per half year). The investment was classified as an amortized cost financial asset. The original investment had been correctly recorded on August 31, 2022. However, Andy recorded the February 28, 2023 interest as a debit to cash and a credit to interest income for $9,500. The August 31, 2023 interest payment was received on August 31, 2023 and has not been recorded yet. (a) Prepare an amortization schedule for these bonds for their remaining life; (b) prepare the required journal entry(ies) to correct Andy's Feb 28 interest JE; (c) prepare the journal entry for the August 31, 2023 interest on these bonds. 4. On September 1, 2022, Avalon sold an investment in Oberon Inc. bonds for $77,800. The bonds had been classified as FV-OCI. The bonds had been purchased at their maturity amount of $75,000 in 2022 and at August 31, 2022, their fair value was $77,800. This fair value was correctly reflected in the August 31, 2022 accounts. 1 Andy was completely befuddled by OCI, recycling, etc. and his journal entry to record the September 1 transaction was: Dr Cash 77,800; Cr. Suspense Account 77,800. (a) Prepare the JE(s) to correct Andy's Sept 1JE; (b) prepare the JE for the OCI reclassification adjustment (this should be the before tax amount; tax will be done in Task 6). 1 The auditors had correctly identified the need for a fair value adjustment at August 31,2022 and an OCI unrealized gain (theStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started