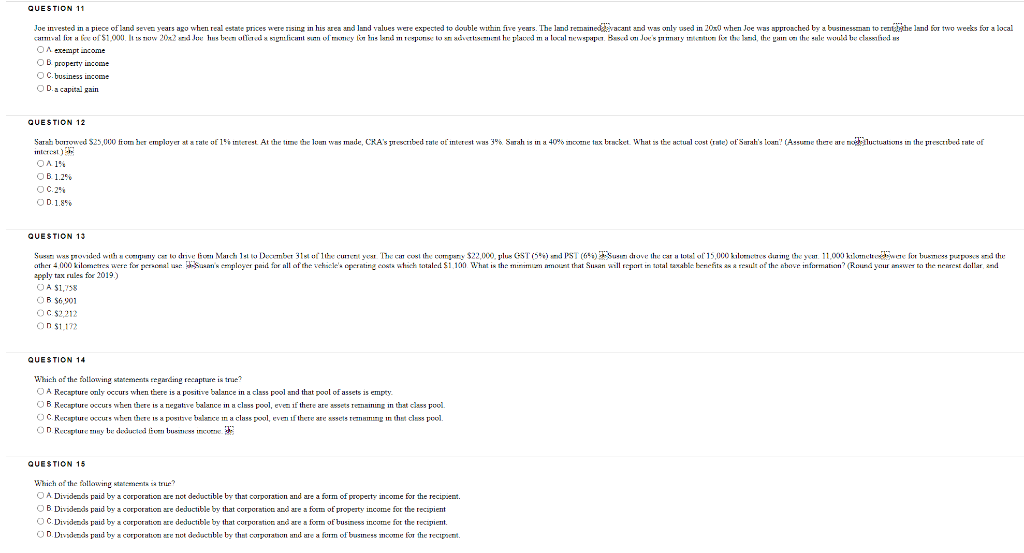

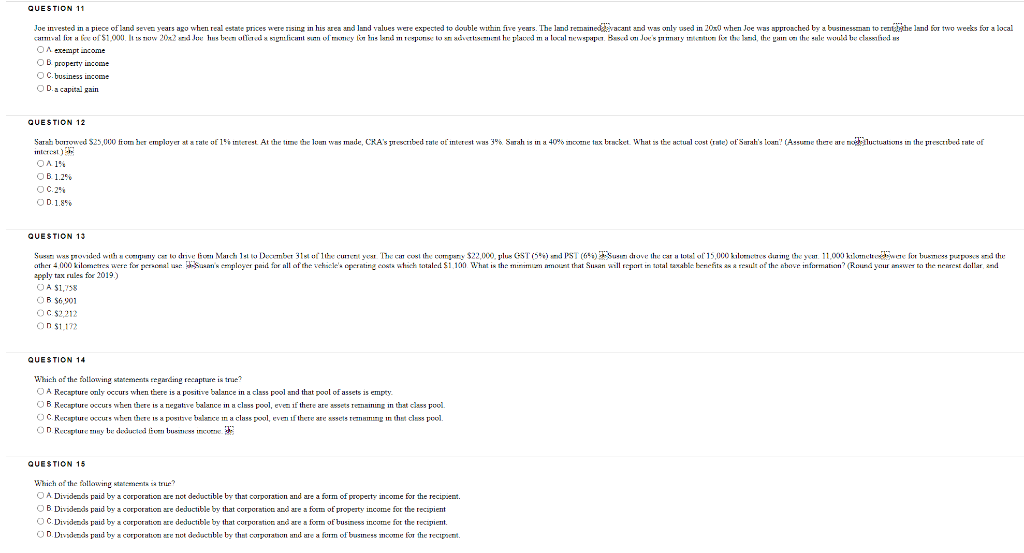

QUESTION 11 Joe invested in a piece of land seven years ago when real estate prices were rising in his area and land values were expected to double within five years. The land remained vacant and was only used in 200 when Joe was approached by a businessman to remehe land for two weeks for a local Gammallista lor 1.000. It w 2002 od Joe hus benattinad Kundlicant sum of money on insland in response to nadvloei he placed m a local newspapa Besad ni Joe's normaty nice list the land, the pain the sale would be classified as O except income OB property income C. business income OD. a capital gain QUESTION 12 Sarah bolowed $25,000 from her employer at a rate of 1'e interest At the time the loan was made, CRA's prescribed rate of interest was 3% Suah us in a 40% mome tax bracket. What is the actual vost (rule) of Sarah's loan (Assume there are no luctuations in the prescube rate of int OA1% OB 1.25 OC.2% OD 1.896 QUESTION 13 Suxxe was proved a conquest la chive March 1st to December 31st of its content year. The can as the curgery $22,000 plus GST (5%) and PST (6) Buschove the cast alustall 15.000 kilometres dimgi yan 11.000 kkmetwee liebsmuse pepe sed the other 4.000 kilometres were for personaie Same employer paid for all of the vehicles operating costa che totale si 100 What is the marrim imot that Suat wall report in total taxable benefite 282 meat of the nove informat? (Round your awer to the newest dallar and upply tax rules for 2019.) O A $1,758 OB $6,901 OC $2212 On $1122 QUESTION 14 Which of the following statements regarding recapture is true? O A Recapture only occurs when there is a positive balance in a class pool and that pool of assets is empty. OB Recepture occurs when there is a negatze balance in a class pool, even if there are assets remaining in that class pool OC Recepture occurs when there is a positive bilance in a class pool, even if there are assets ng in the class pool. OD Reglure may be deducted from busca C QUESTION 15 Which of the following menit sa ne? O A Dividends paid by a corporation are not decoctible by that corporation and are a form of property income for the recipient. OB Dividends paid by a corporation are deductible by that corporation and are a form of property income for the recipient OC Divadends paid by a corporation are deductible by that corporation and are a form of business income for the recipient OD Divadends paid by a corporation are not deductible by the corporation and are a form of business more for the recipient. QUESTION 11 Joe invested in a piece of land seven years ago when real estate prices were rising in his area and land values were expected to double within five years. The land remained vacant and was only used in 200 when Joe was approached by a businessman to remehe land for two weeks for a local Gammallista lor 1.000. It w 2002 od Joe hus benattinad Kundlicant sum of money on insland in response to nadvloei he placed m a local newspapa Besad ni Joe's normaty nice list the land, the pain the sale would be classified as O except income OB property income C. business income OD. a capital gain QUESTION 12 Sarah bolowed $25,000 from her employer at a rate of 1'e interest At the time the loan was made, CRA's prescribed rate of interest was 3% Suah us in a 40% mome tax bracket. What is the actual vost (rule) of Sarah's loan (Assume there are no luctuations in the prescube rate of int OA1% OB 1.25 OC.2% OD 1.896 QUESTION 13 Suxxe was proved a conquest la chive March 1st to December 31st of its content year. The can as the curgery $22,000 plus GST (5%) and PST (6) Buschove the cast alustall 15.000 kilometres dimgi yan 11.000 kkmetwee liebsmuse pepe sed the other 4.000 kilometres were for personaie Same employer paid for all of the vehicles operating costa che totale si 100 What is the marrim imot that Suat wall report in total taxable benefite 282 meat of the nove informat? (Round your awer to the newest dallar and upply tax rules for 2019.) O A $1,758 OB $6,901 OC $2212 On $1122 QUESTION 14 Which of the following statements regarding recapture is true? O A Recapture only occurs when there is a positive balance in a class pool and that pool of assets is empty. OB Recepture occurs when there is a negatze balance in a class pool, even if there are assets remaining in that class pool OC Recepture occurs when there is a positive bilance in a class pool, even if there are assets ng in the class pool. OD Reglure may be deducted from busca C QUESTION 15 Which of the following menit sa ne? O A Dividends paid by a corporation are not decoctible by that corporation and are a form of property income for the recipient. OB Dividends paid by a corporation are deductible by that corporation and are a form of property income for the recipient OC Divadends paid by a corporation are deductible by that corporation and are a form of business income for the recipient OD Divadends paid by a corporation are not deductible by the corporation and are a form of business more for the recipient