Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Renata Ltd grants 250 share options to each of its 400 employees. Each grant is conditional upon the employee working for Renata for the

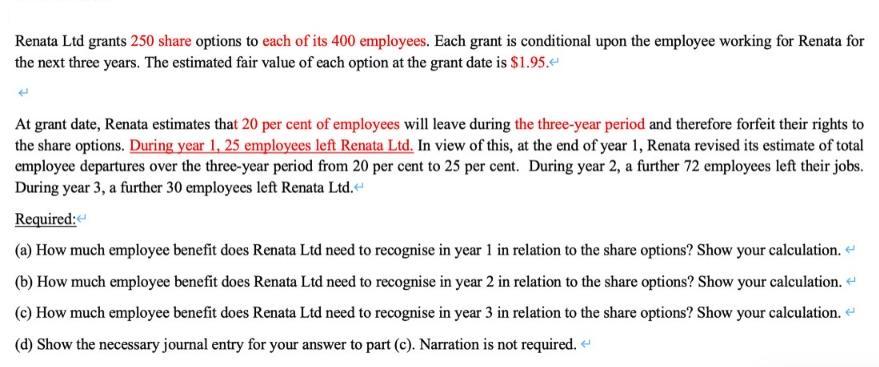

Renata Ltd grants 250 share options to each of its 400 employees. Each grant is conditional upon the employee working for Renata for the next three years. The estimated fair value of each option at the grant date is $1.95. < At grant date, Renata estimates that 20 per cent of employees will leave during the three-year period and therefore forfeit their rights to the share options. During year 1, 25 employees left Renata Ltd. In view of this, at the end of year 1, Renata revised its estimate of total employee departures over the three-year period from 20 per cent to 25 per cent. During year 2, a further 72 employees left their jobs. During year 3, a further 30 employees left Renata Ltd. < Required: (a) How much employee benefit does Renata Ltd need to recognise in year 1 in relation to the share options? Show your calculation. (b) How much employee benefit does Renata Ltd need to recognise in year 2 in relation to the share options? Show your calculation. < (c) How much employee benefit does Renata Ltd need to recognise in year 3 in relation to the share options? Show your calculation. (d) Show the necessary journal entry for your answer to part (c). Narration is not required.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the employee benefit that Renata Ltd needs to recognize in year 1 we need to determine the number of options that will ultimately vest ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started