question 11.11

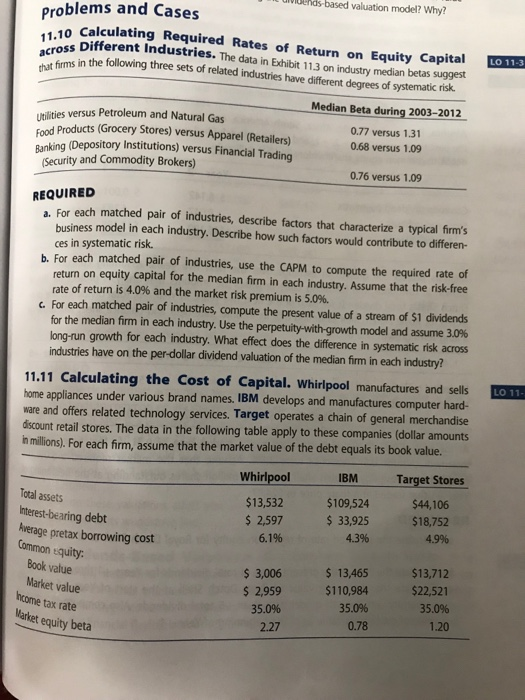

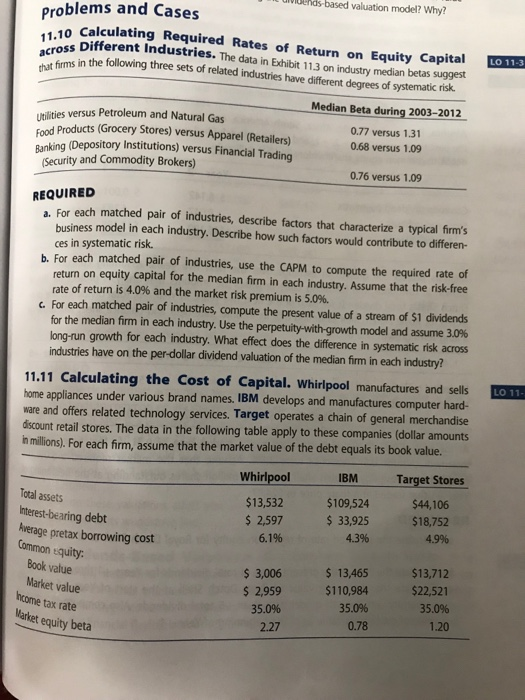

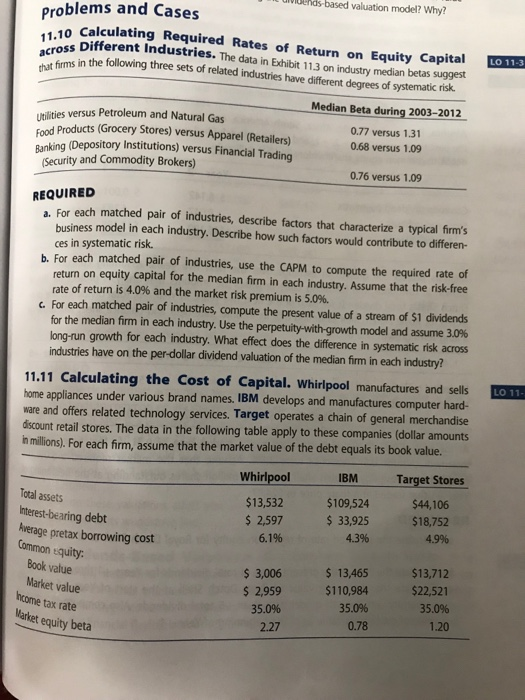

oends based valuation model? Why? problems and Cases Calculating Required Rates of Return on Equity Capital Lo113 ross Different Industries. The data in Exhibit 113 on industry median betas suggest ac irms in the following three sets of related industries have different degrees of ystematic risk. that Median Beta during 2003-2012 utlities versus Petroleum and Natural Gas food Products (Grocery Stores) versus Apparel (Retailers) Ranking (Depository Institutions) versus Financial Trading 0.77 versus 1.31 0.68 versus 1.09 Security and Commodity Brokers) 0.76 versus 1.09 REQUIRED a. For each matched pair of industries, describe factors that characterize a typical firm's business model in each industry. Describe how such factors would contribute to differen- ces in systematic risk. b. For each matched pair of industries, use the CAPM to compute the required rate of return on equity capital for the median firm in each industry. Assume that the risk-free rate of return is 40% and the market risk premium is 5.0%. . For each matched pair of industries, compute the present value of a stream of $1 dividends for the median firm in each industry. Use the perpetuity-with-growth model and assume 30% long-run growth for each industry. What effect does the difference in systematic risk across industries have on the per-dollar dividend valuation of the median firm in each industry? 11.11 Calculating the Cost of Capital. Whirlpool manufactures and sells LO 11 home appliances under various brand names, IBM develops and manufactures computer hard- ware and offers related technology services. Target operates a chain of general merchandise discount retail stores. The data in the following table apply to these companies (dollar amounts h illins). or each firm, assume that the market value of the debt equals its book value. Target Stores IBM $109,524 33,925 Whirlpool Total assets Interest-bearing debt Average pretax borrowing cost Common equity: $13,532 $ 2,597 $44,106 $18,752 4.9% 6.1% 43% $13,712 Book value Market value 3,006 2,959 35.0% 2.27 13,465 $110,984 35.0% 0.78 $22,521 35.0% 1.20 hcome tax rate Market equity beta options are allowed In 40 Risk-Adjusted Expected Rates of Return and the Dividends Valuation Approach CHAPTER 11 REQUIRED a. Assume that the intermediate-term yields on US. government Treasury securities are 3.5%. Assume that the market risk premium is 5.0%. Compute the cost of equity capital for each of the three companies. b. Compute the weighted-average cost of capital for each of the three companies. c. Compute the unlevered market (asset) beta for each of the three companies. d. Assume that each company is a candidate for a potential leveraged buyout. The buyers intend to implement a capital structure that has 75% debt (with a pretax borrowing cost of 8096) and 25% common equity. Project the weighted-average cost of capital for each company based on the new capital structure. To what extent do these revised weighted average costs of capital differ from those computed in Requirement b? 11.12 Calculation of Dividends-Based Value. Royal Dutch troleum and petrochemicals company. It engages primarily in the exploration, pr sale of crude oil and natural gas and the manufacture, transportation, and sale and petrochemical products. The company operates in approximately 200 count America, Europe, Asia-Pacific, Africa, South America, and the Middle East. Assume tit the past three years (Year -2, -1, and 0), Royal Dutch Shell generated the following to lends to common equity shareholders (in USD millions): Shell is a pe on, and of petroleum Year -2 Year-1 Year0 mmon dividend payments ck repurchases Total dividends $ 8,142