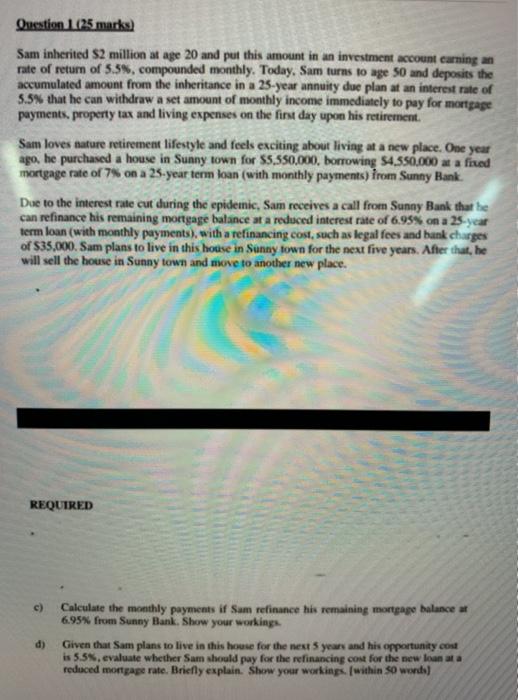

Question 1125 marks) Sam inherited $2 million at age 20 and put this amount in an investment account carning an rate of return of 5.3%, compounded monthly. Today, Sam turns to age 50 and deposits the accumulated amount from the inheritance in a 25-year annuity due plan at an interest rate of 5.5% that he can withdraw a set amount of monthly income immediately to pay for mortgage payments, property tax and living expenses on the first day upon his retirement. Sam loves nature retirement lifestyle and feels exciting about living at a new place. One year ago, he purchased a house in Sunny town for 55.550,000, borrowing $4.550.000 at a fired mortgage rate of 7% on a 25-year term loan (with monthly payments) from Sunny Bank Due to the interest rate cut during the epidemic, Sam receives a call from Sunny Bank that he can refinance his remaining mortgage balance at a reduced interest rate of 6.95% on a 23-year term loan (with monthly payments), with a refinancing cost, such as legal fees and bank charges of $35.000. Sam plans to live in this house in Sunny town for the next five years. After that, he will sell the house in Sunny town and move to another new place. REQUIRED c) d) Calculate the monthly payments if Sam refinance his remaining mortgage balance a 6.95% from Sunny Bank. Show your working Given that Sam plans to live in this house for the next 5 years and his opportunity cost is 5.5evaluate whether Sam should pay for the refinancing cost for the new loan ata reduced mortgape rate. Briefly explain. Show your workings (within So words) Question 1125 marks) Sam inherited $2 million at age 20 and put this amount in an investment account carning an rate of return of 5.3%, compounded monthly. Today, Sam turns to age 50 and deposits the accumulated amount from the inheritance in a 25-year annuity due plan at an interest rate of 5.5% that he can withdraw a set amount of monthly income immediately to pay for mortgage payments, property tax and living expenses on the first day upon his retirement. Sam loves nature retirement lifestyle and feels exciting about living at a new place. One year ago, he purchased a house in Sunny town for 55.550,000, borrowing $4.550.000 at a fired mortgage rate of 7% on a 25-year term loan (with monthly payments) from Sunny Bank Due to the interest rate cut during the epidemic, Sam receives a call from Sunny Bank that he can refinance his remaining mortgage balance at a reduced interest rate of 6.95% on a 23-year term loan (with monthly payments), with a refinancing cost, such as legal fees and bank charges of $35.000. Sam plans to live in this house in Sunny town for the next five years. After that, he will sell the house in Sunny town and move to another new place. REQUIRED c) d) Calculate the monthly payments if Sam refinance his remaining mortgage balance a 6.95% from Sunny Bank. Show your working Given that Sam plans to live in this house for the next 5 years and his opportunity cost is 5.5evaluate whether Sam should pay for the refinancing cost for the new loan ata reduced mortgape rate. Briefly explain. Show your workings (within So words)