Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 12 0.41 Sapp Trucking's balance sheet shows a total of noncalable $45 milion long-term debt with a coupon rate of 8.00% and a yield

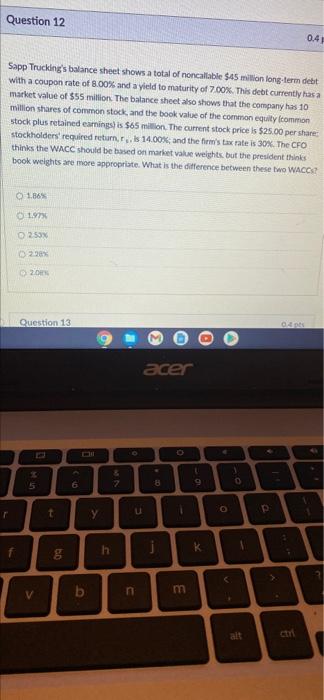

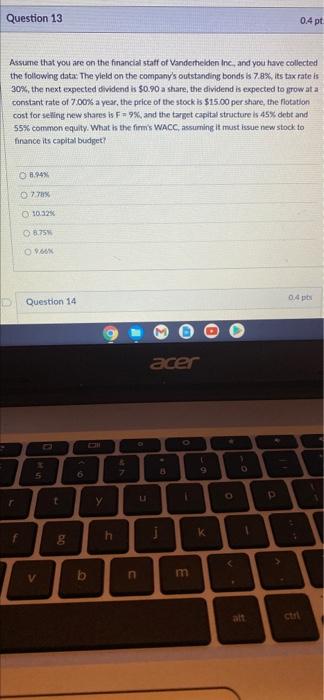

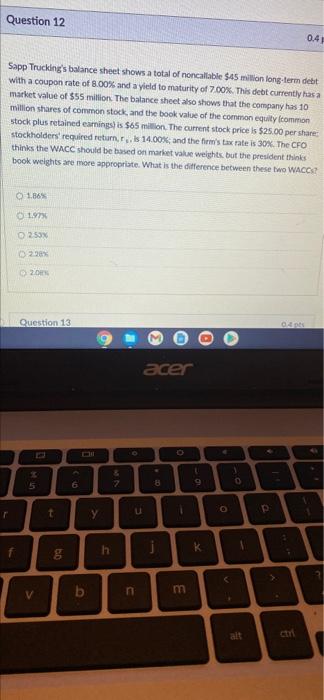

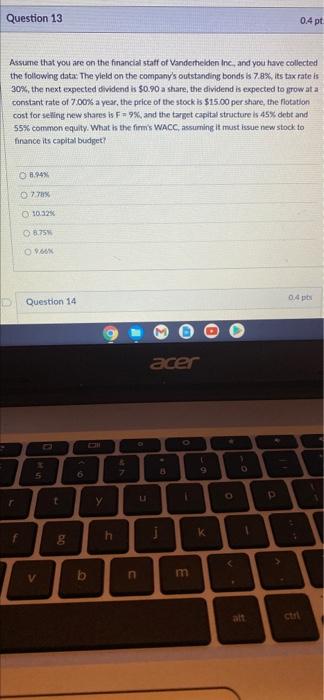

Question 12 0.41 Sapp Trucking's balance sheet shows a total of noncalable $45 milion long-term debt with a coupon rate of 8.00% and a yield to maturity of 700%. This debt currently has a market value of $55 million. The balance sheet also shows that the company has 10 million shares of common stock, and the book value of the common equity common stock plus retained earnings) is $65 million. The current stock price is $25.00 per share stockholders' required return, ris 14.00%, and the firm's tax rate is 30%. The CFO thinks the WACC should be based on market value weights but the president thinks book weights are more appropriate. What is the difference between these two WACCO 1.86% 1.97 250x 0296 20 Question 13 acer 5 7 6 B 9 5 0 T t y f h j K EO C j f h K &

Question 12 0.41 Sapp Trucking's balance sheet shows a total of noncalable $45 milion long-term debt with a coupon rate of 8.00% and a yield to maturity of 700%. This debt currently has a market value of $55 million. The balance sheet also shows that the company has 10 million shares of common stock, and the book value of the common equity common stock plus retained earnings) is $65 million. The current stock price is $25.00 per share stockholders' required return, ris 14.00%, and the firm's tax rate is 30%. The CFO thinks the WACC should be based on market value weights but the president thinks book weights are more appropriate. What is the difference between these two WACCO 1.86% 1.97 250x 0296 20 Question 13 acer 5 7 6 B 9 5 0 T t y f h j K EO C j f h K &

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started