Answered step by step

Verified Expert Solution

Question

1 Approved Answer

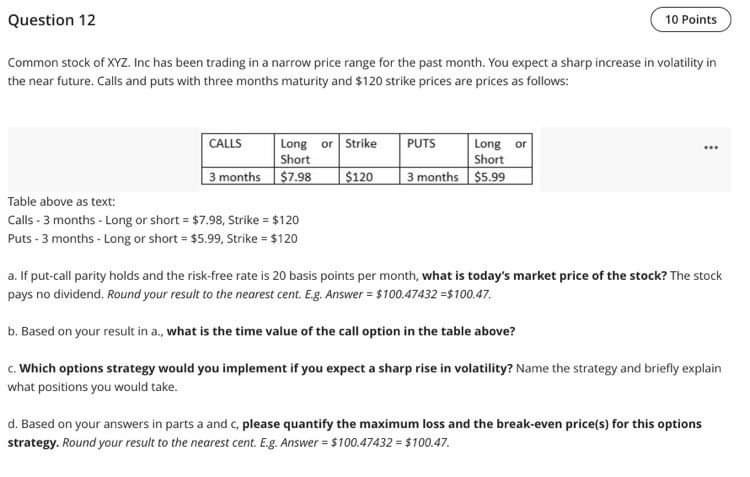

Question 12 10 Points Common stock of XYZ. Inc has been trading in a narrow price range for the past month. You expect a sharp

Question 12 10 Points Common stock of XYZ. Inc has been trading in a narrow price range for the past month. You expect a sharp increase in volatility in the near future. Calls and puts with three months maturity and $120 strike prices are prices as follows: ... PUTS Long or Short 3 months $5.99 CALLS Long or Strike Short 3 months $7.98 $120 Table above as text: Calls - 3 months - Long or short = $7.98, Strike = $120 Puts - 3 months - Long or short = $5.99, Strike = $120 a. If put-call party holds and the risk-free rate is 20 basis points per month, what is today's market price of the stock? The stock pays no dividend, Round your result to the nearest cent. Eg. Answer = $100.47432 =$100.47. b. Based on your result in a., what is the time value of the call option in the table above? c. Which options strategy would you implement if you expect a sharp rise in volatility? Name the strategy and briefly explain what positions you would take. d. Based on your answers in parts a and please quantify the maximum loss and the break-even price(s) for this options strategy. Round your result to the nearest cent. Eg. Answer = $100.47432 = $100.47

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started