Answered step by step

Verified Expert Solution

Question

1 Approved Answer

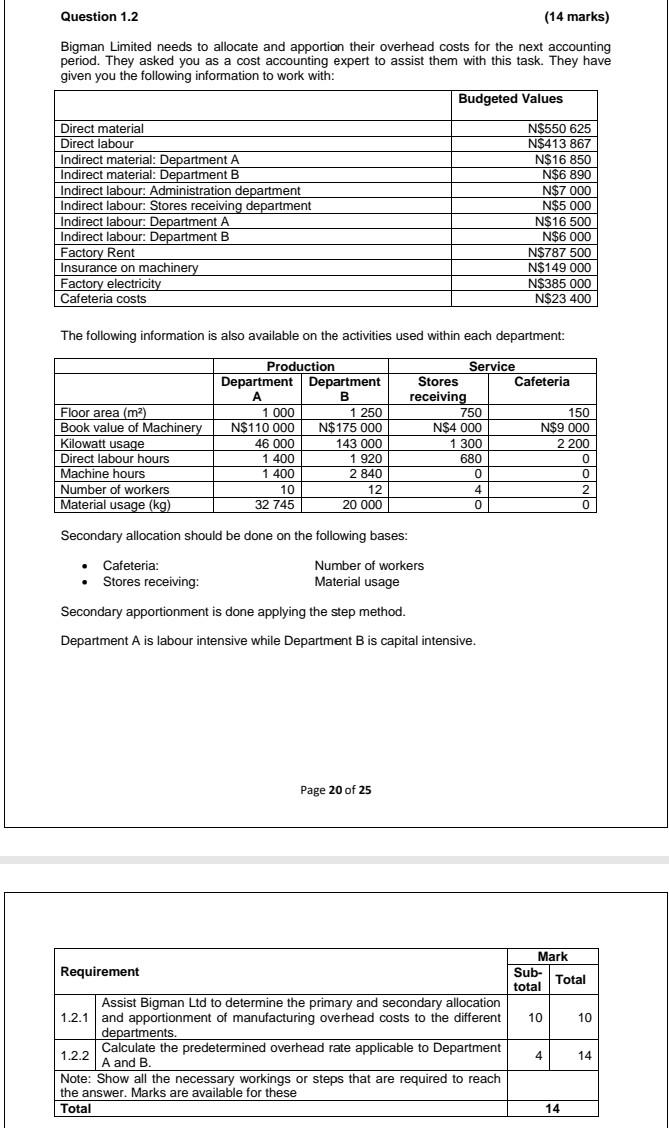

Question 1.2 (14 marks) Bigman Limited needs to allocate and apportion their overhead costs for the next accounting period. They asked you as a cost

Question 1.2 (14 marks) Bigman Limited needs to allocate and apportion their overhead costs for the next accounting period. They asked you as a cost accounting expert to assist them with this task. They have given you the following information to work with: Budgeted Values N$550 625 N$413 867 N$16 850 N$6 890 N$7 000 Direct material Direct labour Indirect material: Department A Indirect material: Department B Indirect labour: Administration department Indirect labour: Stores receiving department Indirect labour: Department A Indirect labour: Department B Factory Rent Insurance on machinery Factory electricity Cafeteria costs N$5 000 N$16 500 MCS 000 N$6 000 N$787 500 N$149 000 N$385 000 N$23 400 The following information is also available on the activities used within each department: Floor area (m2) Book value of Machinery Kilowatt usage Direct labour hours Machine hours Number of workers Material usage (kg) Production Department Department A B 1 000 1 250 N$110 000 N$175 000 46 000 143 000 1 400 1 920 1 400 2 840 10 12 32 745 20 000 Service Stores Cafeteria receiving 750 150 N$4 000 N$9 000 1 300 2 200 680 0 0 0 4 2 0 0 Secondary allocation should be done on the following bases: . Cafeteria: Stores receiving: Number of workers Material usage . Secondary apportionment is done applying the step method. Department A is labour intensive while Department B is capital intensive. Page 20 of 25 Requirement Mark Sub- Total total 10 10 Assist Bigman Ltd to determine the primary and secondary allocation 1.2.1 and apportionment of manufacturing overhead costs to the different departments. Calculate the predetermined overhead rate applicable to Department 1.2.2 A and B Note: Show all the necessary workings or steps that are required to reach the answer. Marks are available for these Total 4 14 14

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started