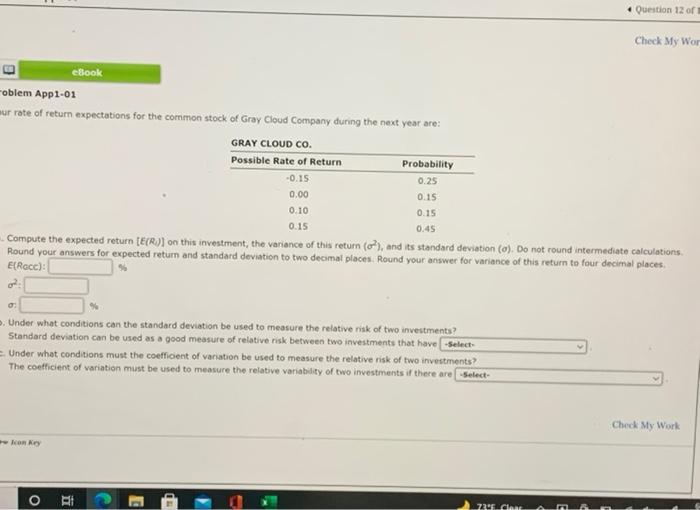

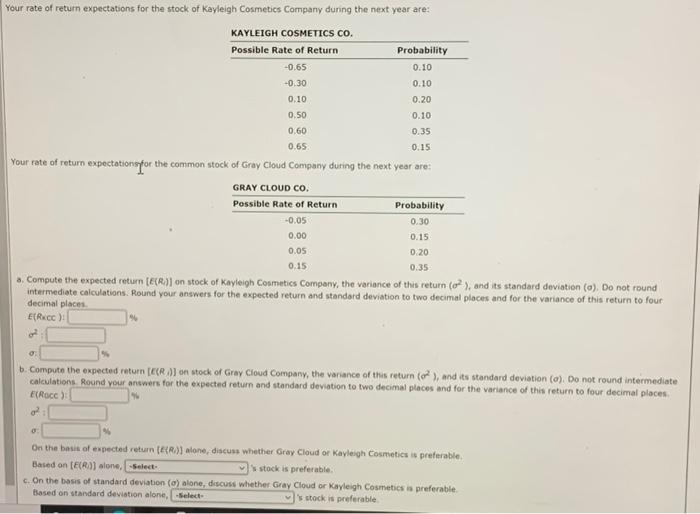

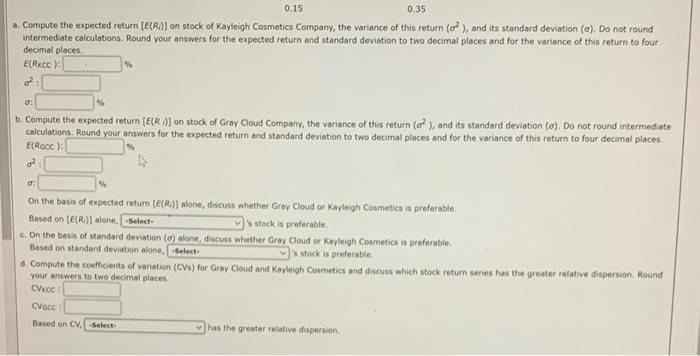

Question 12 of Check My Wor eBook -oblem App1-01 mur rate of return expectations for the common stock of Gray Cloud Company during the next year are: GRAY CLOUD CO. Possible Rate of Return Probability -0.15 0.00 0.15 0.10 0.15 Compute the expected return (ER)] on this investment, the variance of this return (oP), and its standard deviation (). Do not round intermediate calculations. Round your answers for expected return and standard deviation to two decimal places. Round your answer for variance of this return to four decimal places E[Racc) op 0.25 0.15 0.45 0 Under what conditions can the standard deviation be used to measure the relative risk of two investments? Standard deviation can be used as a good measure of relative risk between two investments that have select Under what conditions must the coefficient of variation be used to measure the relative risk of two investments The coefficient of variation must be used to measure the relative variability of two investments if there are select Check My Work Romey o HA 720 Cha Am Your rate of return expectations for the stock of Kayleigh Cosmetics Company during the next year are: KAYLEIGH COSMETICS CO. Possible Rate of Return Probability -0.65 0.10 -0.30 0.10 0.10 0.20 0.50 0.10 0.60 0.35 0.65 0.15 Your rate of return expectation for the common stock of Gray Cloud Company during the next year are: GRAY CLOUD CO. Possible Rate of Return Probability -0.05 0.30 0.00 0.15 0.05 0.20 0.15 0.35 2. Compute the expected return (ER)) on stock of Kayleigh Cosmetics Company, the variance of this return (o?), and its standard deviation (a). Do not round intermediate calculations. Round your answers for the expected return and standard deviation to two decimal places and for the variance of this return to four decimal places Efecc): 0 b. Compute the expected return ER DJ on stock of Gray Cloud Company, the variance of this return (on), and its standard deviation (a). Do not round intermediate calculations. Round your answers for the expected return and standard deviation to two decimal places and for the variance of this return to four decimal places E(Rocc) o? 0 On the basis of expected return (HR)} alone, discuss whether Gray Cloud or Kayleigh Cosmetics is preferable, Based on (ER)) alone, Select stock is preferable c. On the basis of standard deviation (o) alone, discuss whether Gray Cloud or Kayleigh Coumetics is preferable. s stack is preferable Based on standard deviation alone, Select 0.15 0.35 Compute the expected return (ER)) on stock of Kayleigh Cosmetics Company, the variance of this return (o?), and its standard deviation (a). Do not round intermediate calculations. Round your answers for the expected return and standard deviation to two decimal places and for the variance of this return to four decimal places E(RxCc: OP 0 b. Compute the expected return ECR )) on stock of Gray Cloud Company, the variance of this return (02), and its standard deviation (a). Do not round intermediate calculations, Round your answers for the expected return and standard deviation to two decimal places and for the variance of this return to four decimal places E(Rocc): On the basis of expected return [E(R)} alone, discuss whether Gray Cloud or Kayleigh Cosmetics is preferable. Based on (ER)) alone, Select 's stock is preferable c. On the basis of standard deviation (e) alone, discuss whether Gray Cloud or Kayleigh Cosmetics is preferable Based on standard deviation alone, Select stock is preferable d. Compute the coefficients of variation (CV) for Gray Cloud and Kayleigh Cometics and discuss which stock return series has the greater relative dispersion, Round your answers to two decimal places CVC CVoce Based on CV. Select has the greater relative dispersion