Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 12 Which one of the following alternatives represents the correct amount to be presented as interest paid under cash flows from operating activities section

Question 12 Which one of the following alternatives represents the correct amount to be presented as interest paid under cash flows from operating activities section in the statement of cash flows of Obani-Lababantu CC for the year ended 31 December 2019? Select one:

a. R (26 700)

b. R (24 000)

c. R (21 300)

d. R 26 700

e. R 21 300

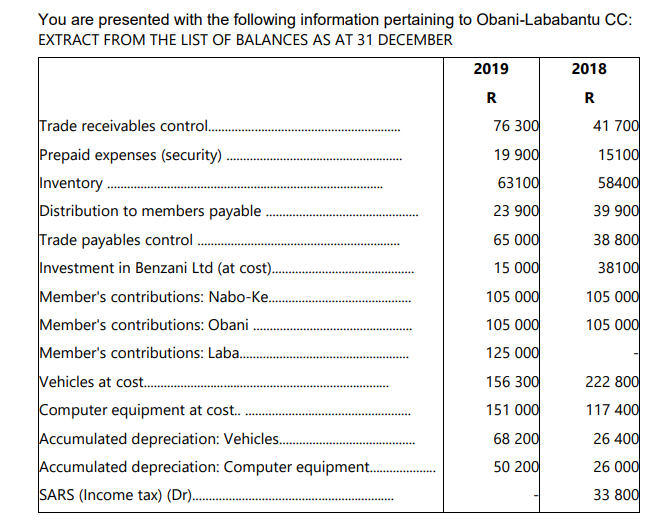

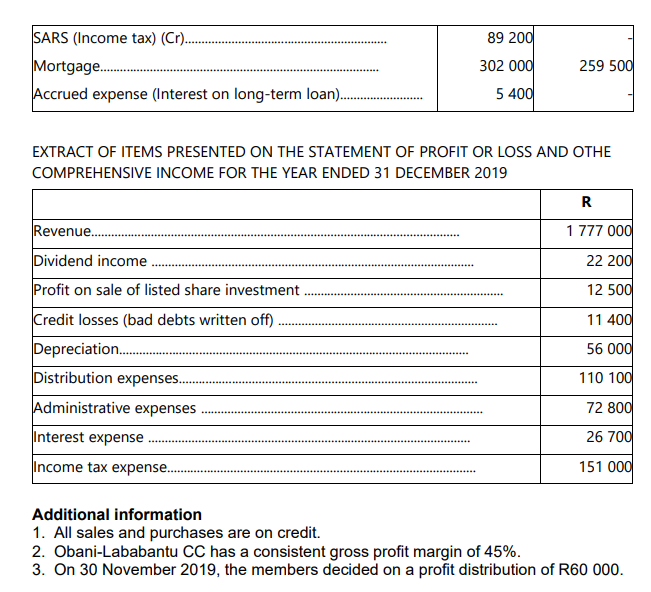

You are presented with the following information pertaining to Obani-Lababantu CC: EXTRACT FROM THE LIST OF BALANCES AS AT 31 DECEMBER 2019 2018 R R Trade receivables control.......... Prepaid expenses (security). Inventory. Distribution to members payable. Trade payables control. Investment in Benzani Ltd (at cost).. Member's contributions: Nabo-Ke.... Member's contributions: Obani Member's contributions: Lab............ Vehicles at cost.... Computer equipment at cost... Accumulated depreciation: Vehicle............ Accumulated depreciation: Computer equipment.... SARS (Income tax) (D)............. 76 300 19 900 63100 23 900 65 000 15 000 105 000 105 000 125 000 156 300 151 000 68 200 50 200 41 700 15100 58400 39 900 38 800 38100 105 000 105 000 222 800 117 400 26 400 26 000 33 800 SARS (Income tax) (Cr).. 89 200 Mortgage.... 302 000 259 500 Accrued expense (Interest on long-term loan).. 5 400 EXTRACT OF ITEMS PRESENTED ON THE STATEMENT OF PROFIT OR LOSS AND OTHE COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2019 R Revenue... 1 777 000 Dividend income 22 200 Profit on sale of listed share investment. 12 500 Credit losses (bad debts written off) 11 400 Depreciation.. 56 000 Distribution expenses.... 110 100 Administrative expenses 72 800 Interest expense 26 700 Income tax expense... 151 000 Additional information 1. All sales and purchases are on credit. 2. Obani-Lababantu CC has a consistent gross profit margin of 45%. 3. On 30 November 2019, the members decided on a profit distribution of R60 000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started