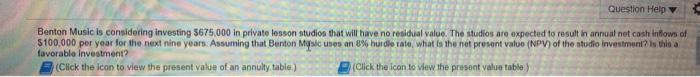

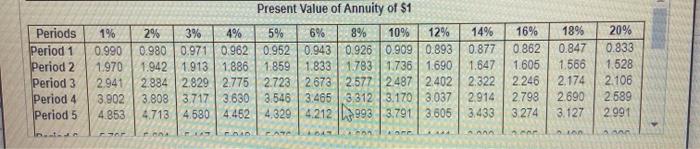

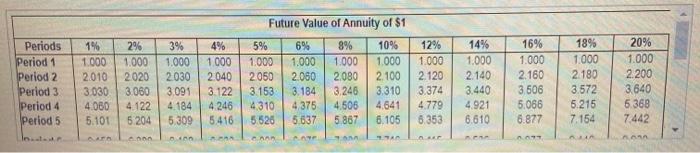

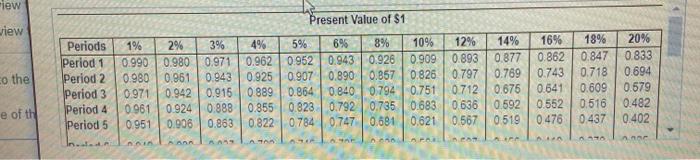

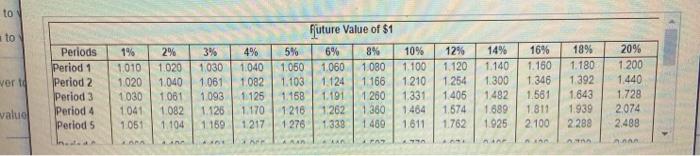

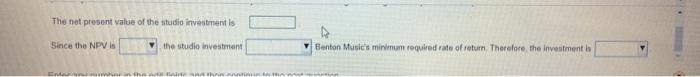

Question Help Benton Music is considering investing 5675.000 in private lesson studion that will have no residual value. The studios are expected to result in annual net cash Intows of $100.000 per year for the next nine years. Assuming that Benton Msic uses an 8% hurdle tate, what is the net present value (NPV) of the studio investment? Is this a favorable Investment? (Click the icon to view the present value of an annulty table) (Click the icon to view the present value table 89 Periods Period 1 Period 2 Period 3 Period 4 Period 5 1% 0.990 1.970 2.941 3.902 4.853 Present Value of Annuity of $1 2% 3% 4% 5% 6% 10% 12% 14% 16% 0.980 0.971 | 0.962 | 0.952 0.943 0.926 0.909 0.893 0.877 0.862 1.942 1913 1.886 1.859 1.833 1783 1736 1.690 1.647 1.605 2.884 2.829 2.775 2.7232 673 2.577 2487 2402 2.322 2.246 3.808 3.717 3.630 3.546 3.465 3.312 3.170 3,037 2.914 2798 4.713 45804462 4.320 421219993 | 3.791 3605 3.433 3274 18% 0.847 1.566 2,174 2.690 3.127 20% 0.833 1.528 2106 2.589 2991 AN LA Periods Period 1 Period 2 Period 3 Period 4 Period 5 1% 1.000 2010 3.030 4.000 5.101 2% 1.000 2020 3.060 4122 5.204 3% 1.000 2030 3091 4.184 5,309 4% 1.000 2040 3.122 4246 5.416 Future Value of Annuity of $1 5% 6% 8% 10% 1.000 1.000 1.000 1.000 2050 2.060 2.080 2.100 3.153 3.184 3.246 3.310 4310 4 375 4.506 4,641 5.526 5,637 5.867 6.105 12% 1.000 2.120 3.374 4.779 6.353 14% 1.000 2.140 3.440 4.921 6.610 16% 1.000 2.160 3.506 5.066 6.877 18% 1.000 2.180 3.572 5.215 7.154 20% 1.000 2.200 3.640 6.368 7442 BE BRA AN PARA iew view co the Periods Period 1 Period 2 Period 3 Period 4 Period 5 1% 29 0.990 0.980 0.980 0.961 0.971 0.942 0961 0.924 0.951 0.006 Present Value of $1 3% 4% 5% 6% 8% 10% 12% 14% 16% 0.971 0.962 0.952 0.943 0.926 0.909 0.893 0.877 0.862 0.943 0.925 0.907 0.890 0.857 0.826 0.797 0.769 0.743 0.916 0.889 0.864 0.840 0.792 0.751 0.712 0.675 0.641 0.888 0.855 0.823 0.792 0.735 0.683 0636 0.592 0.552 0.863 0.822 0784 0.747 0.681 0.621 0.567 0519 0.476 18% 20% 0.847 0.833 0.718 0.694 0.609 0.579 0.516 0.482 0.437 0.402 e of the APAR to to 2% Periods Period 1 Period 2 Period 3 Period 4 Period 5 vert 1% 1010 1.020 1030 1041 1051 1.020 1.040 1 061 1.082 1.104 3% 1030 1.061 1093 1.126 1 159 4% 1.040 1082 1125 1.170 1217 Future Value of $1 5% 6% 8% 10% 1.050 1.060 1080 1.100 1.103 1.124 1 166 1.210 1.158 1.191 1280 1.331 1216 1262 1 360 1464 1276 1333 1.469 1611 12% 1.120 1254 1.405 1.574 1.762 14% 1.140 1.300 1.482 1.689 1.925 16% 1.160 1.346 1.561 1.811 2.100 18% 1.180 1.392 1643 1939 2 288 20% 1.200 1.440 1.728 2074 2.488 value Are VA AR The not present value of the studio investment is Since the NPV IS the studio investment Benton Music's minimum required rate of return Therefore, the investment la