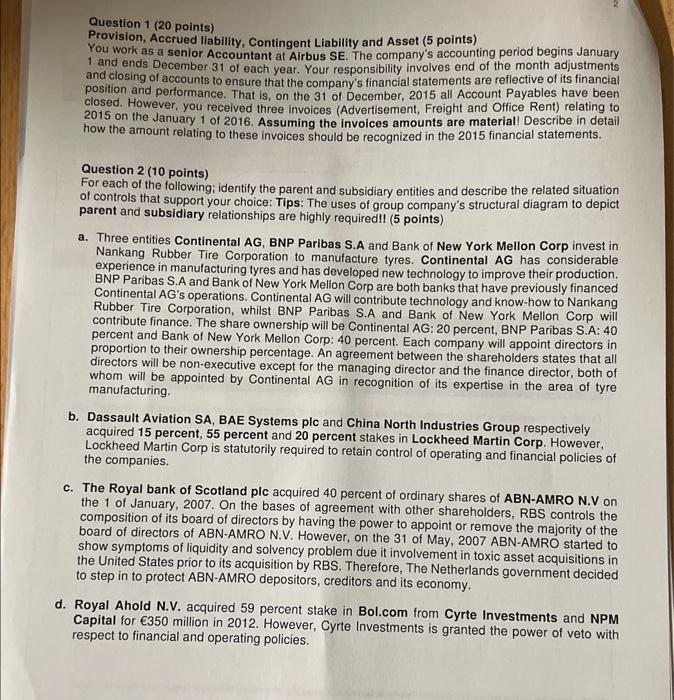

Question 1(20 points) Provision, Accrued liability, Contingent Liability and Asset (5 points) You work as a senior Accountant at Alrbus SE. The company's accounting period begins January 1 and ends December 31 of each year. Your responsibility involves end of the month adjustments and closing of accounts to ensure that the company's financial statements are reflective of its financial position and performance. That is, on the 31 of December, 2015 all Account Payables have been closed. However, you received three invoices (Advertisement, Freight and Office Rent) relating to 2015 on the January 1 of 2016. Assuming the involces amounts are material! Describe in detail how the amount relating to these invoices should be recognized in the 2015 financial statements. Question 2 (10 points) For each of the following; identify the parent and subsidiary entities and describe the related situation of controls that support your choice: Tips: The uses of group company's structural diagram to depict parent and subsidiary relationships are highly required!! (5 points) a. Three entities Continental AG, BNP Paribas S.A and Bank of New York Mellon Corp invest in Nankang Rubber Tire Corporation to manufacture tyres. Continental AG has considerable experience in manufacturing tyres and has developed new technology to improve their production. BNP Paribas S.A and Bank of New York Mellon Corp are both banks that have previously financed Continental AG's operations. Continental AG will contribute technology and know-how to Nankang Rubber Tire Corporation, whilst BNP Paribas S.A and Bank of New York Mellon Corp will contribute finance. The share ownership will be Continental AG: 20 percent, BNP Paribas S.A: 40 percent and Bank of New York Mellon Corp: 40 percent. Each company will appoint directors in proportion to their ownership percentage. An agreement between the shareholders states that all directors will be non-executive except for the managing director and the finance director, both of whom will be appointed by Continental AG in recognition of its expertise in the area of tyre manufacturing. b. Dassault Aviation SA, BAE Systems plc and China North Industries Group respectively acquired 15 percent, 55 percent and 20 percent stakes in Lockheed Martin Corp. However, Lockheed Martin Corp is statutorily required to retain control of operating and financial policies of the companies. c. The Royal bank of Scotland plc acquired 40 percent of ordinary shares of ABN-AMRO N.V on the 1 of January, 2007. On the bases of agreement with other shareholders, RBS controls the composition of its board of directors by having the power to appoint or remove the majority of the board of directors of ABN-AMRO N.V. However, on the 31 of May, 2007 ABN-AMRO started to show symptoms of liquidity and solvency problem due it involvement in toxic asset acquisitions in the United States prior to its acquisition by RBS. Therefore, The Netherlands government decided to step in to protect ABN-AMRO depositors, creditors and its economy. d. Royal Ahold N.V. acquired 59 percent stake in Bol.com from Cyrte Investments and NPM Capital for 350 million in 2012 . However, Cyrte Investments is granted the power of veto with respect to financial and operating policies