Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 13 (1 point) Martin buys a 10 year corporate bond for $10,000 that was issued by a medical supply firm. In turn, that

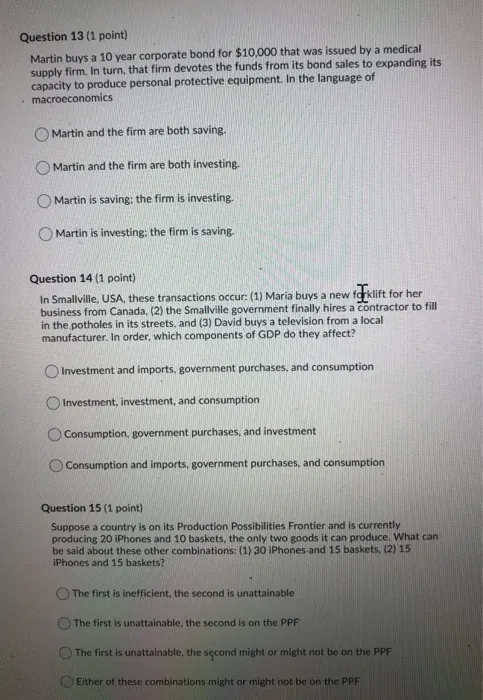

Question 13 (1 point) Martin buys a 10 year corporate bond for $10,000 that was issued by a medical supply firm. In turn, that firm devotes the funds from its bond sales to expanding its capacity to produce personal protective equipment. In the language of macroeconomics Martin and the firm are both saving. Martin and the firm are both investing. Martin is saving: the firm is investing. Martin is investing: the firm is saving. Question 14 (1 point) w forklift for her In Smallville, USA, these transactions occur: (1) Maria buys a new business from Canada, (2) the Smallville government finally hires a contractor to fill in the potholes in its streets, and (3) David buys a television from a local manufacturer. In order, which components of GDP do they affect? Investment and imports, government purchases, and consumption Investment, investment, and consumption Consumption, government purchases, and investment Consumption and imports, government purchases, and consumption. Question 15 (1 point) Suppose a country is on its Production Possibilities Frontier and is currently producing 20 iPhones and 10 baskets, the only two goods it can produce. What can be said about these other combinations: (1) 30 iPhones and 15 baskets, (2) 15 iPhones and 15 baskets? The first is inefficient, the second is unattainable The first is unattainable, the second is on the PPF The first is unattainable, the second might or might not be on the PPF Either of these combinations might or might not be on the PPF

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Question 13 Martin is investing the firm is saving While both Martin and the firm are act...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started