Answered step by step

Verified Expert Solution

Question

1 Approved Answer

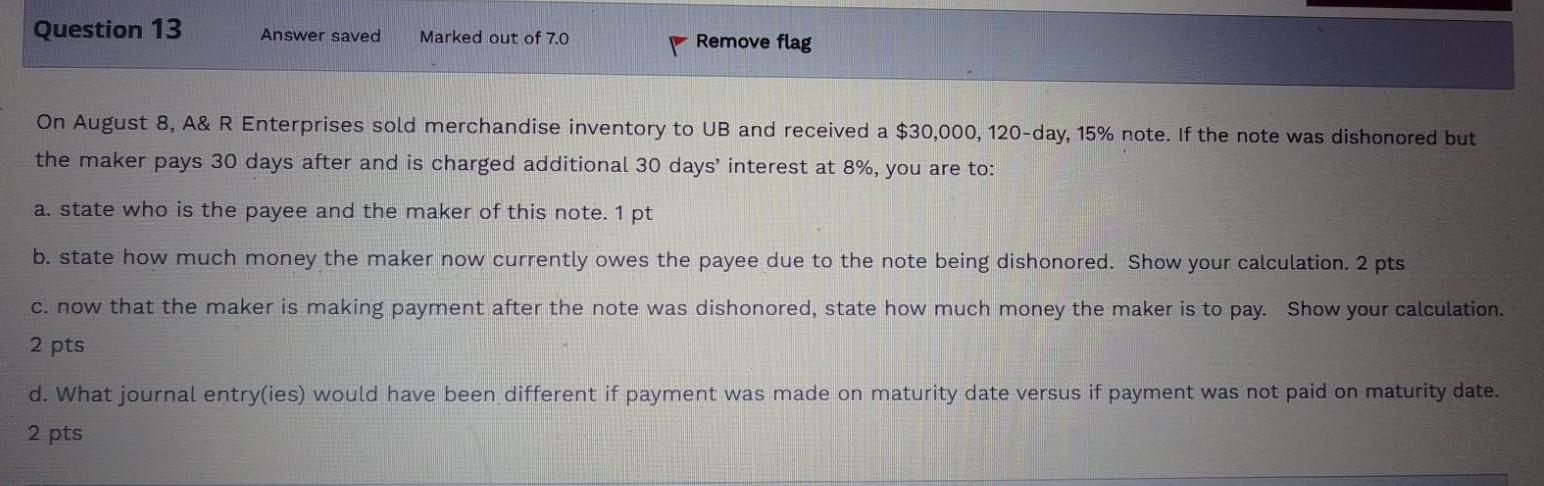

Question 13 Answer saved Marked out of 7.0 Remove flag On August 8, A&R Enterprises sold merchandise inventory to UB and received a $30,000, 120-day,

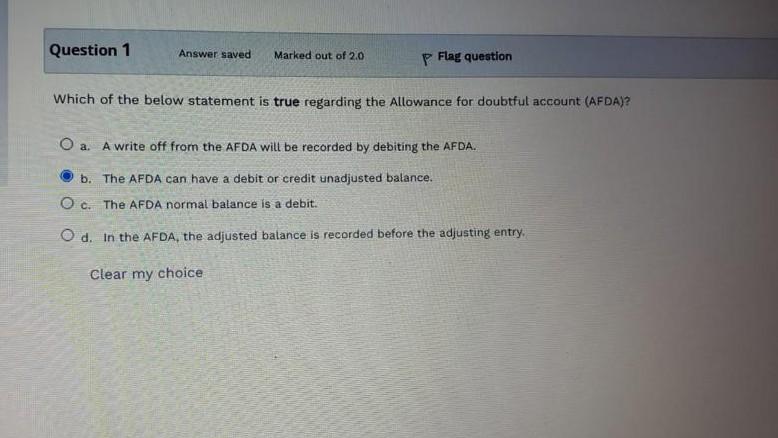

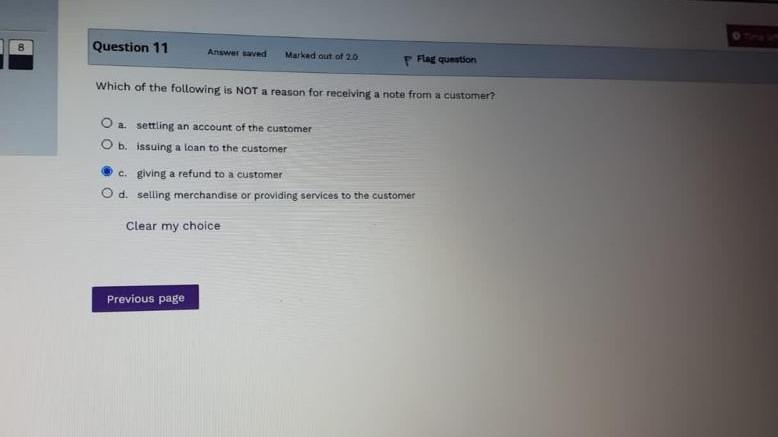

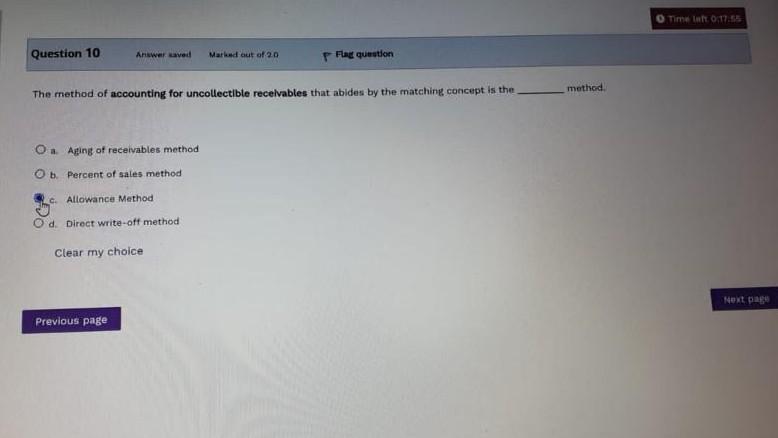

Question 13 Answer saved Marked out of 7.0 Remove flag On August 8, A&R Enterprises sold merchandise inventory to UB and received a $30,000, 120-day, 15% note. If the note was dishonored but the maker pays 30 days after and is charged additional 30 days' interest at 8%, you are to: a. state who is the payee and the maker of this note. 1 pt b. state how much money the maker now currently owes the payee due to the note being dishonored. Show your calculation. 2 pts c. now that the maker is making payment after the note was dishonored, state how much money the maker is to pay. Show your calculation. 2 pts d. What journal entry(ies) would have been different if payment was made on maturity date versus if payment was not paid on maturity date. 2 pts Question 1 Answer saved Marked out of 2.0 P Flag question Which of the below statement is true regarding the Allowance for doubtful account (AFDA)? O a. A write off from the AFDA will be recorded by debiting the AFDA. b. The AFDA can have a debit or credit unadjusted balance. O c. The AFDA normal balance is a debit. O d. In the AFDA, the adjusted balance is recorded before the adjusting entry Clear my choice B Question 11 Answer saved Marked out of 2.0 Flag question Which of the following is NOT a reason for receiving a note from a customer? O a settling an account of the customer O b. issuing a loan to the customer c. giving a refund to a customer Od selling merchandise or providing services to the customer Clear my choice Previous page Time 0.17.55 Question 10 Answer ved Marked out of 2.0 P Flag question method The method of accounting for uncollectible receivables that abide by the matching concept is the O a Aging of receivables method Ob Percent of sales method c. Allowance Method Od. Direct write-off method Clear my choice Next page Previous page

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started