Answered step by step

Verified Expert Solution

Question

1 Approved Answer

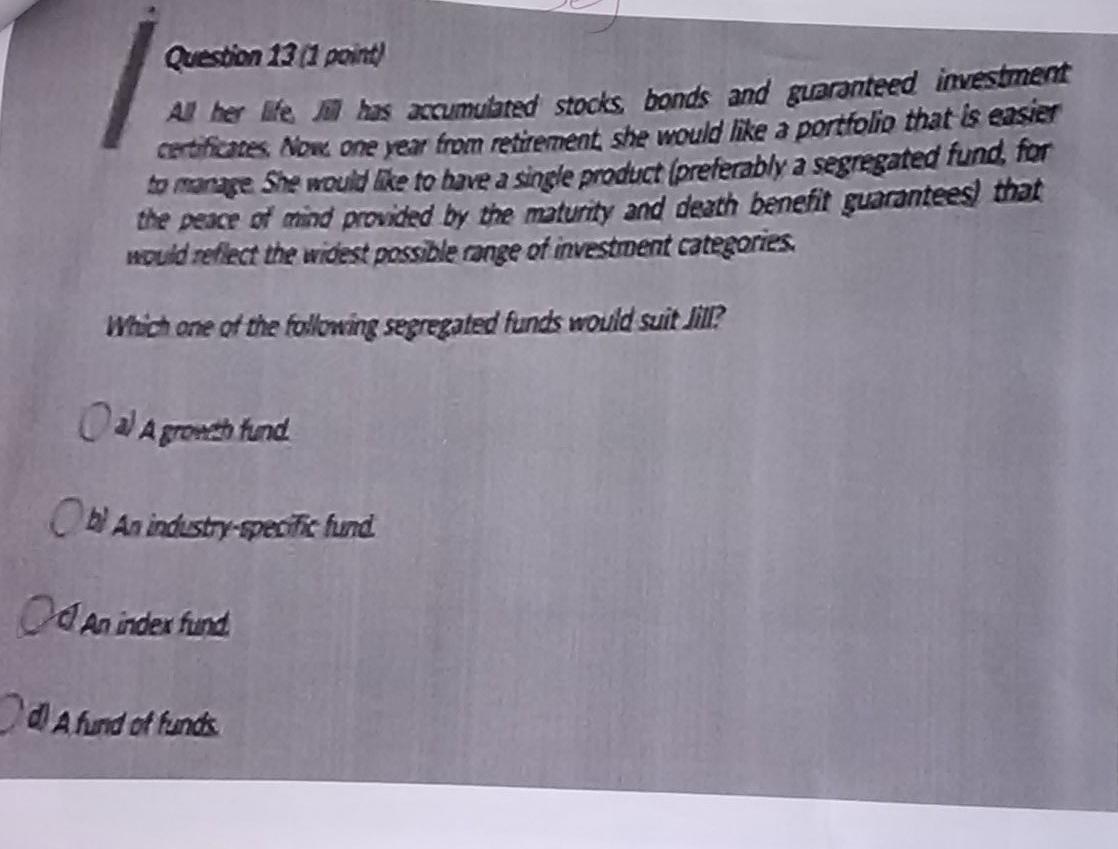

Question 13 (point Al her We ha acumulared stocks bonds and guaranteed investment certificates. Nor one year from retirement she would like a portfolio that

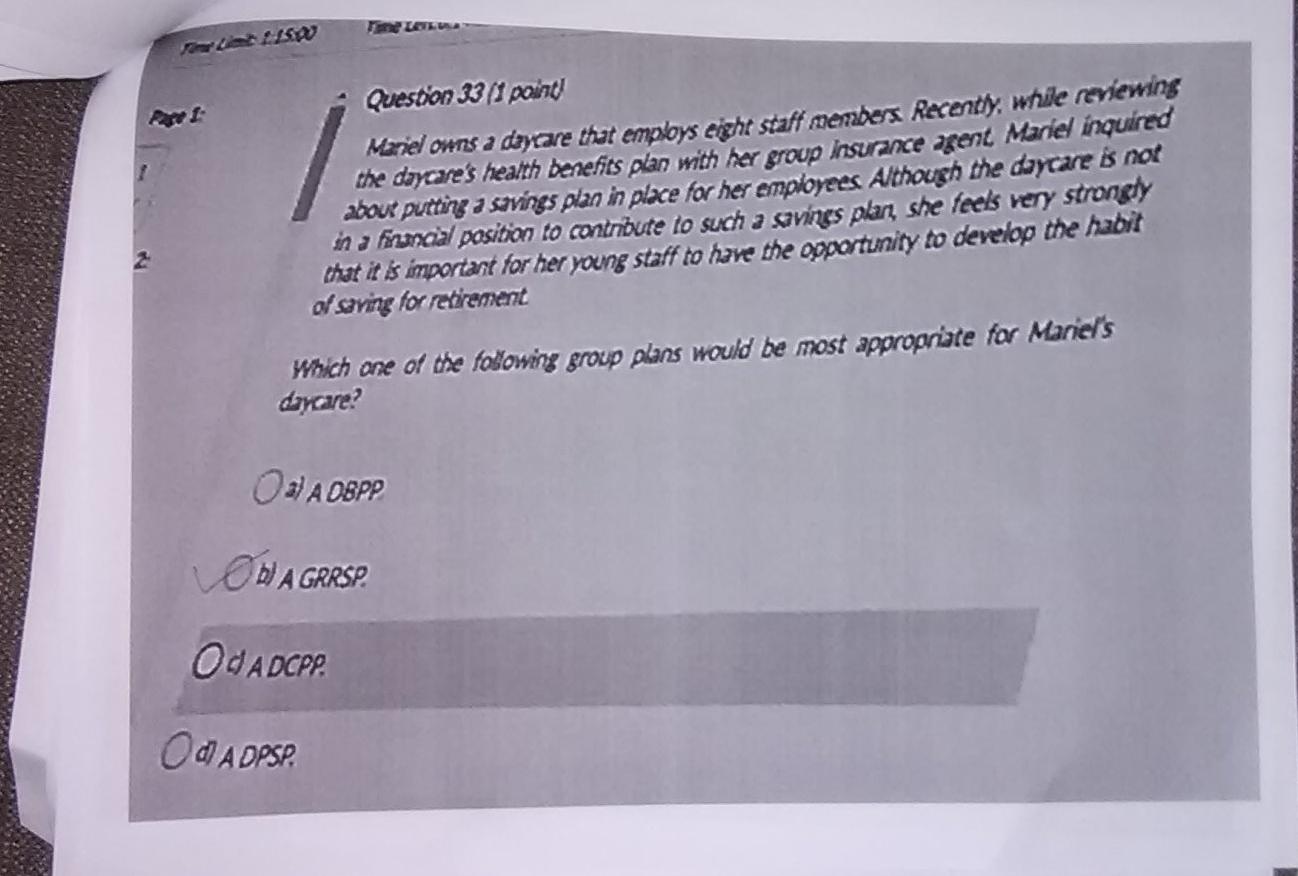

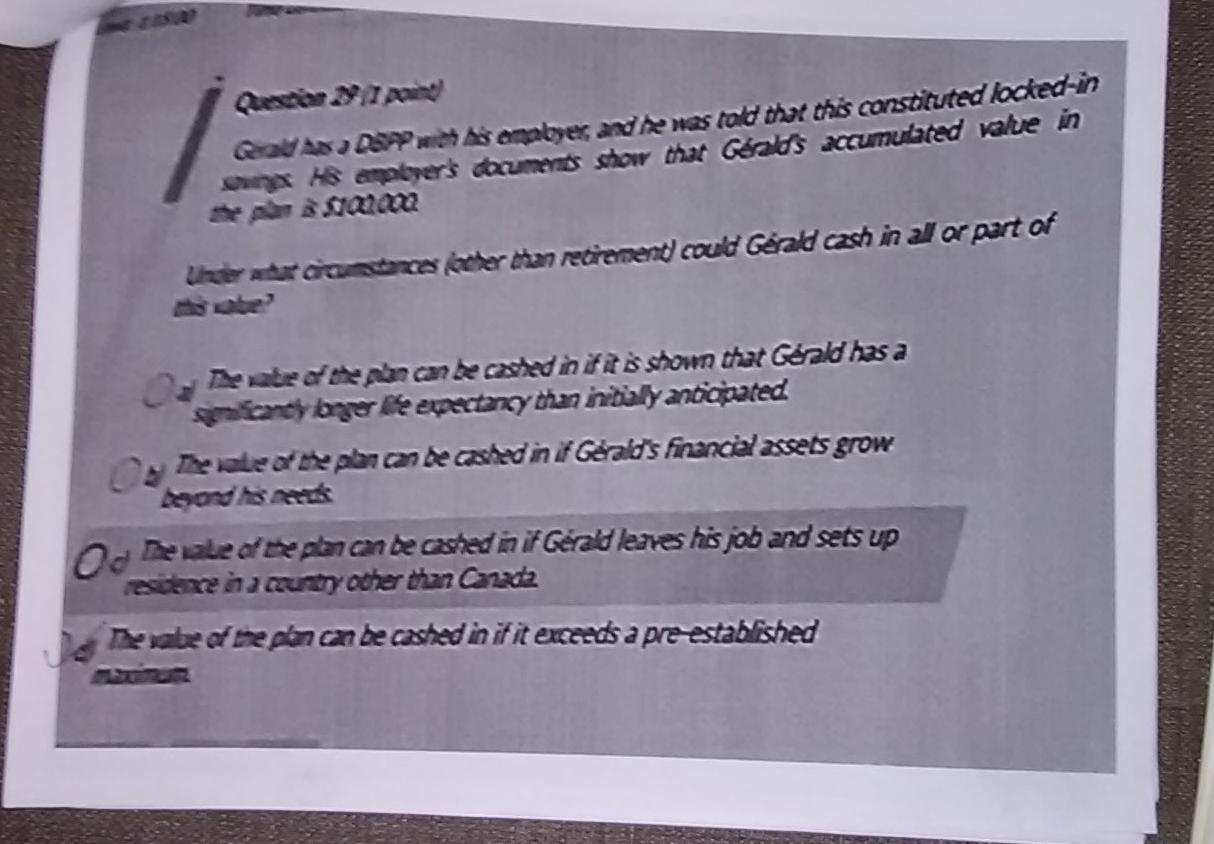

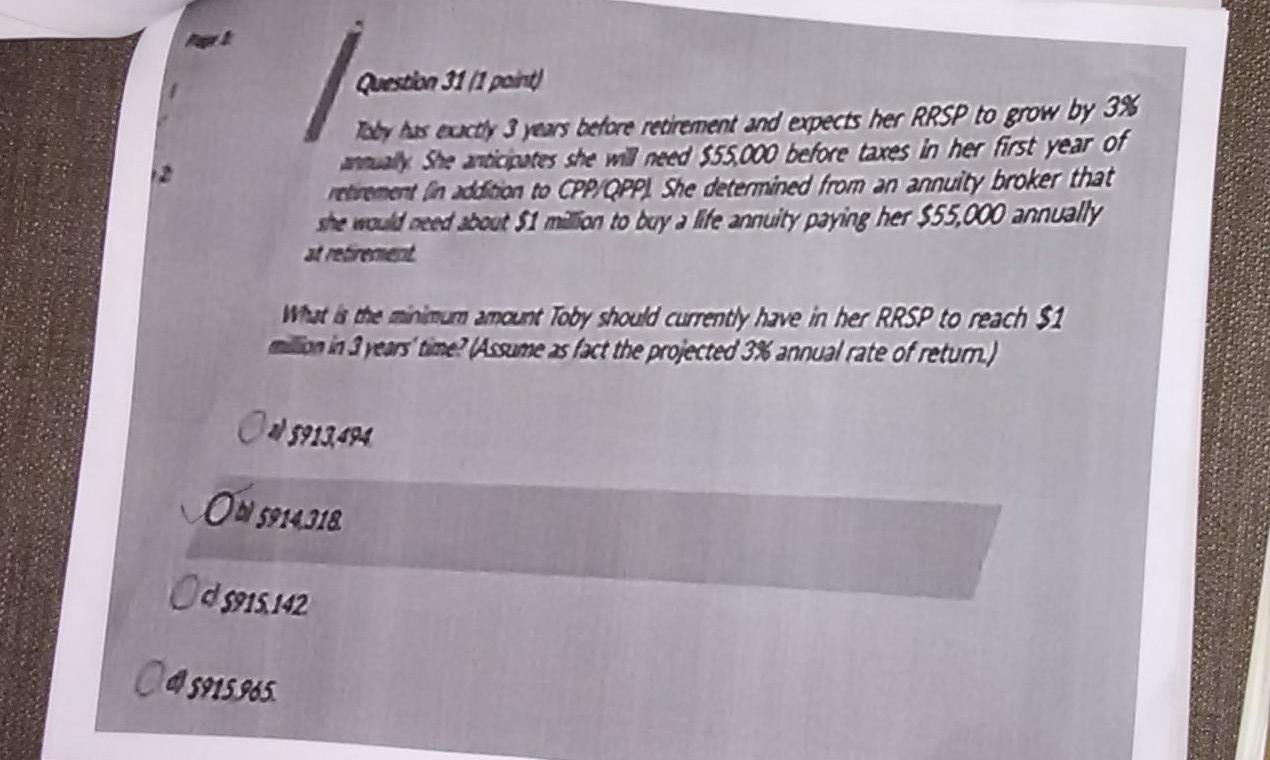

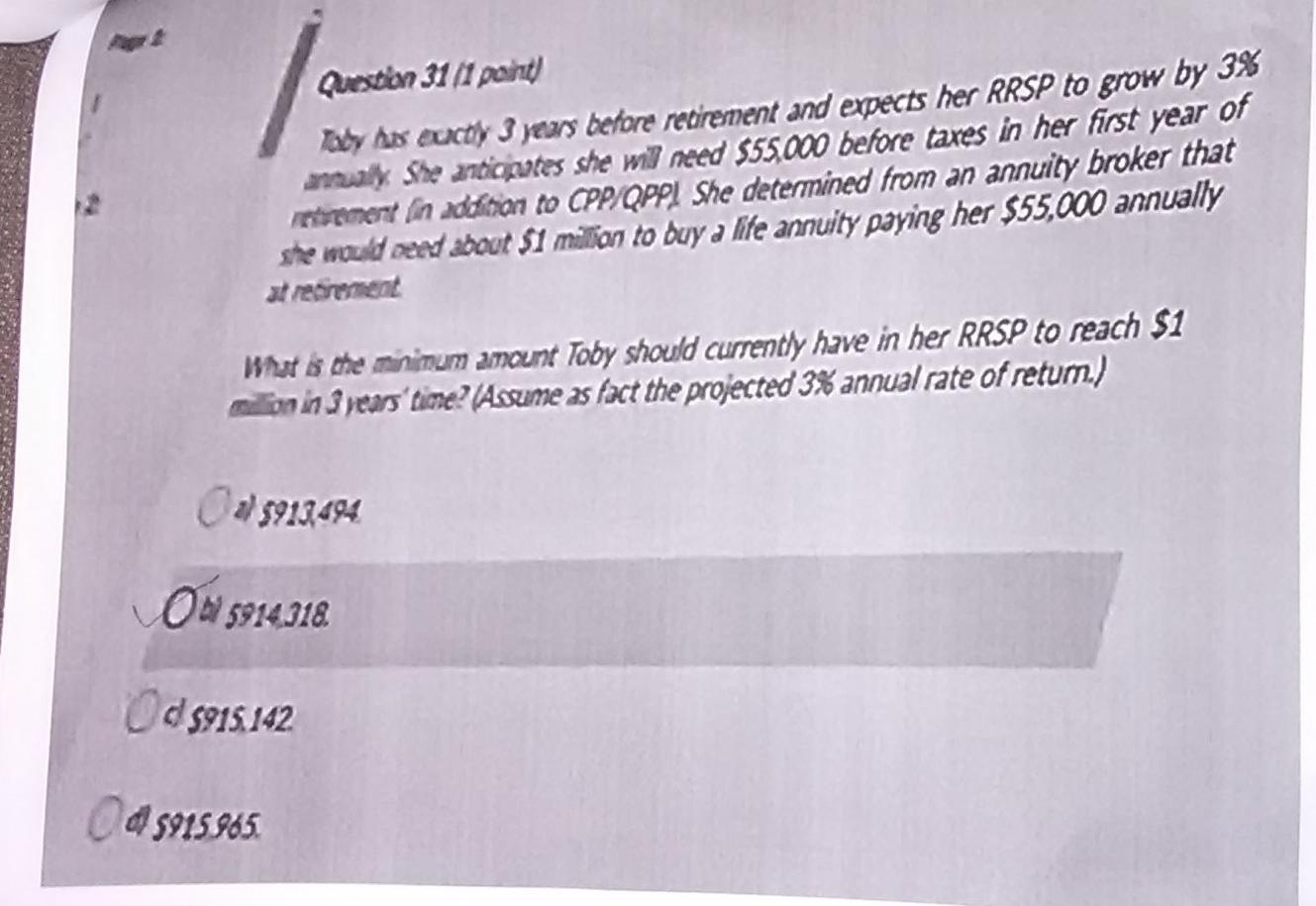

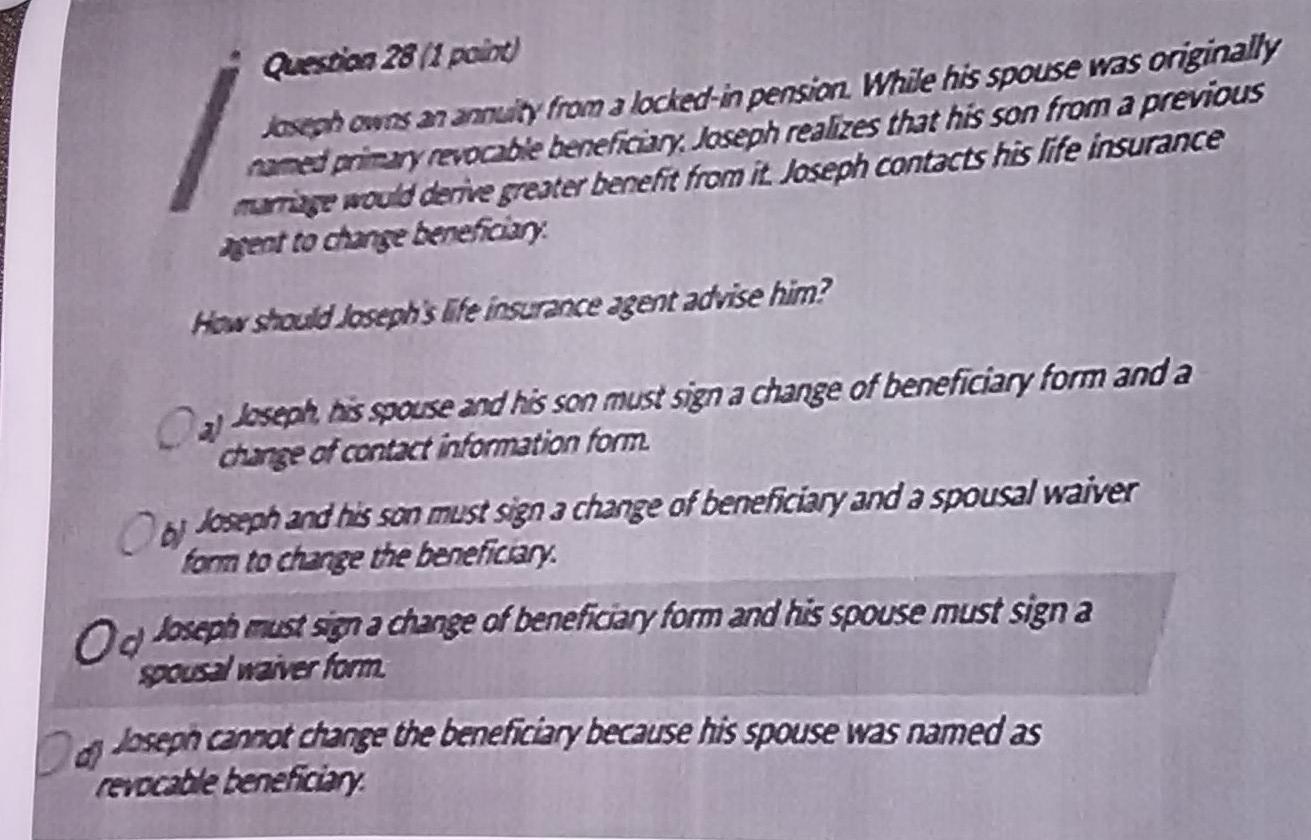

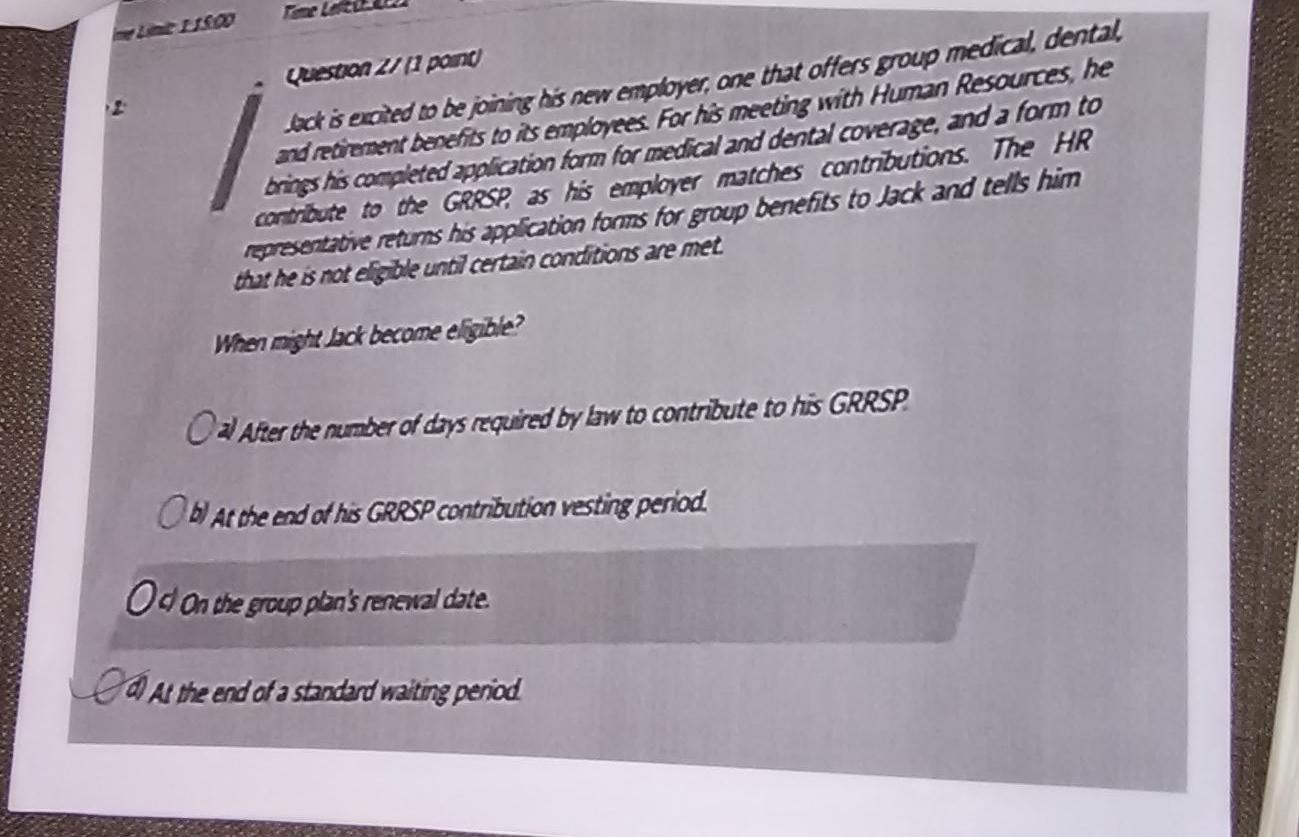

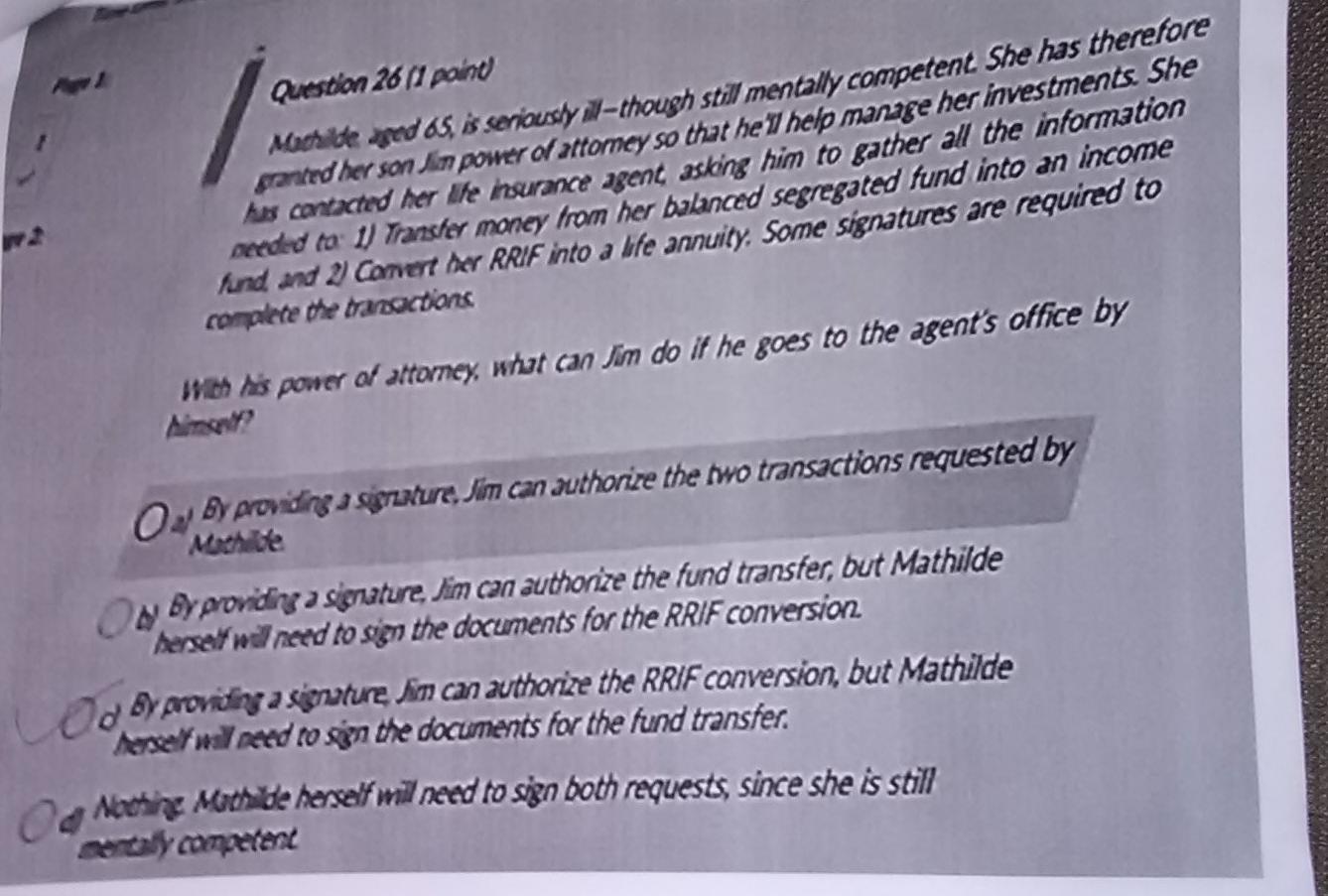

Question 13 (point Al her We ha acumulared stocks bonds and guaranteed investment certificates. Nor one year from retirement she would like a portfolio that is easier to manage she would like to have a single product (preferably a segregated fund, for the peace of mind provided by the maturity and death benefit guarantees that would reflect the widest possible range of investment categories. Which one of the following segregated funds would suit lill? Agroveten tend An industry-specific fund d An index fund d Afund of funds Question 33 (1 point Mariel owns a daycare that employs eight staff members Recently, while reviewing the daycare's health benefits plan with her group insurance agent Mariel inquired about putting a savings plan in place for her employees. Although the daycare is not that it is important for her young staff to have the opportunity to develop the habit of saving for retirement Which one of the following group plans would be most appropriate for Mariel's daycare? Os) A OBPP DA GRRSP Od A DCPP OD ADPSP. Qa A2DP AS enabyer and se was told that this constituted locked-in 18 opbrer's dauments show thar Geralds accumulated value in sa alla Uzonderes her than retirement could Gerald cash in al or part of Date de parcare castedintas shown that Gerald has a ny byer le expertency than initialy antionated Date of Panca de casted in it Gerald's financial assets grow House Deale te plan can be casted init Gerald lenes his job and sets up excutycoher than Canada Je Deate te plan can be casked in if it exceeds a pre-established Question 31 (1 part) Day As eucy 3 years before retirement and expects her RRSP to grow by 3% may ske antiarutes she will need $55.000 before taxes in her first year of retirement in addition to CPP/OPP! She determined from an annuity broker that she would read about $1 milion to bay a lite annuity paying her $55,000 annually What is the animum amount Toby should currently have in her RRSP to reach $1 sion in 3 years time? (Assume as fact the projected 3% annual rate of retum.) 85913.494 ON 5914.318 Od 8915142 Ca 5915965 Question 31 point by ho eucy 3 years before retirement and expects her RRSP to grow by 3% willy She antiquates she will need $55.000 before taxes in her first year of mrtement in addition to CPP/OPPI She determined from an annuity broker that she would send about $1 milion to buy a lite annuity paying her $55,000 annually What is the monimum amount Toby should currently have in her RRSP to reach $1 milion in 3 years' time? (Assume as fact the projected 3% annual rate of retum.) 88913494 5914.318 Od 5915,142 4 5915965 Questas 28/1 point loveshows 27 amwity from a locked-in pension. While his spouse was originally med prizny revocabile beneficiary, Joseph realizes that his son from a previous murat would derie greater benefit from it Joseph contacts his life insurance Beat to change beneficiary How should Joseph's life insurance agent advise him? al losephns pouse and his son must sign a change of beneficiary form and a change of contact information form by Joseph and his son must sign a change of beneficiary and a spousal waiver form to change the beneficiary. Od Joseph must sign a change of beneficiary form and his spouse must sign a Sousa/waver form sepn cannot change the beneficiary because his spouse was named as revocable beneficiary question 11 pone bct is excited to be joining to's new employer, one that offers group medical, dental and retirement benefits to its employees. For his meeting with Human Resources, he contribute to the GRESP. as lois employer matches contributions. The HR brings his completed application form for medical and dental coverage, and a form to representative returns his application forms for group benefits to Jack and tells hin that he is not ele bile unti certain conditions are met When might back become eligible? Od After the number of days required by law to contribute to his GRRSP. b! At the end at hos GreSP contribution vesting period. Od on the group plan's renewal date At the end of a standard waiting period Question 26 (1 point Mochibe and OS , is seriously ill-though still mentally competent . She has therefore granted her son Jin power of attomey so that he'll help manage her investments. She has contacted her life insurance agent asking him to gather all the information Deeded to 1) Transfer money from her balanced segregated fund into an income hand and 2 Carvert der RRIF into a life annuity. Some signatures are required to comalete the transactions is his power of attorney, what can Jim do if he goes to the agent's office by 04 By providing a sprzature, Jim can authorize the tvo transactions requested by By providing a signature, Jim can authorize the fund transfer, but Mathilde Persewd need to sign the documents for the RRIF conversion Od by providing a sienature, Jim can authorize the RRIF conversion, but Mathilde herself wiped to sign the documents for the fund transfer. Alecting Machide herself will need to sign both requests, since she is still cely camere

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started