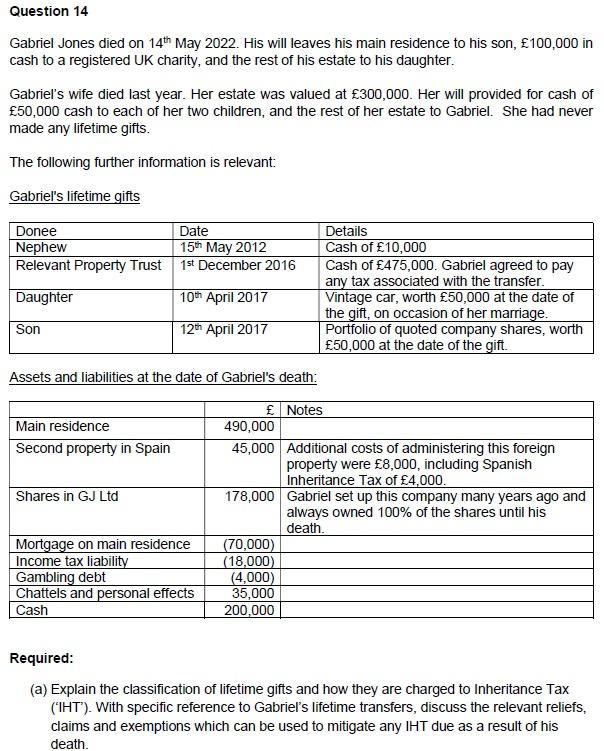

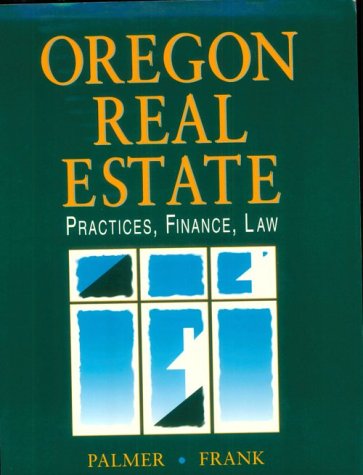

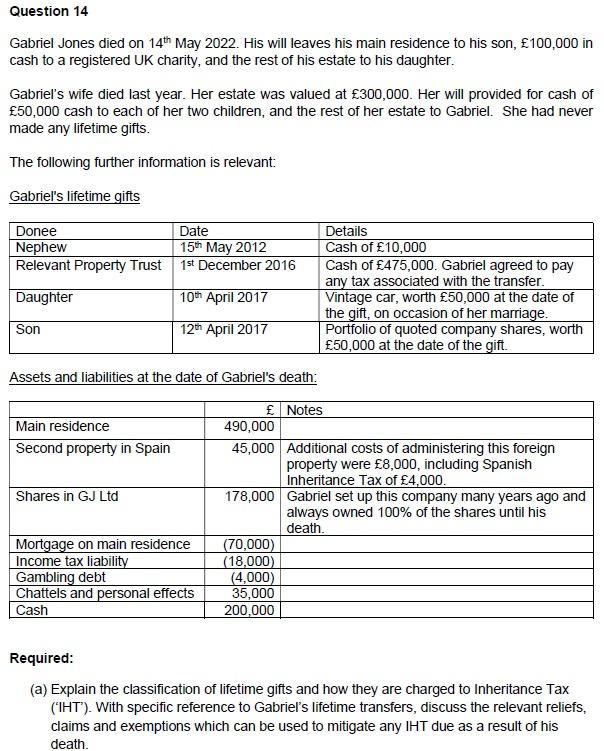

Question 14 Gabriel Jones died on 14th May 2022. His will leaves his main residence to his son, 100,000 in cash to a registered UK charity, and the rest of his estate to his daughter. Gabriel's wife died last year. Her estate was valued at 300,000. Her will provided for cash of 50,000 cash to each of her two children, and the rest of her estate to Gabriel. She had never made any lifetime gifts. The following further information is relevant: Gabriel's lifetime gifts Donee Nephew Relevant Property Trust Date 15th May 2012 1st December 2016 Daughter Details Cash of 10,000 Cash of 475,000. Gabriel agreed to pay any tax associated with the transfer. Vintage car, worth 50,000 at the date of the gift, on occasion of her marriage. Portfolio of quoted company shares, worth 50,000 at the date of the gift. 10th April 2017 Son 12th April 2017 Assets and liabilities at the date of Gabriel's death: Main residence Second property in Spain Shares in GJ Ltd Notes 490,000 45,000 Additional costs of administering this foreign property were 8,000, including Spanish Inheritance Tax of 4,000. 178,000 Gabriel set up this company many years ago and always owned 100% of the shares until his death. (70,000) (18,000) (4,000) 35,000 200,000 Mortgage on main residence Income tax liability Gambling debt Chattels and personal effects Cash Required: (a) Explain the classification of lifetime gifts and how they are charged to Inheritance Tax (IHT'). With specific reference to Gabriel's lifetime transfers, discuss the relevant reliefs, claims and exemptions which can be used to mitigate any IHT due as a result of his death. (b) Show the IHT due on each of Gabriel's lifetime gifts as a result of his death. State who is responsible for paying the tax and the date by which it should be paid. (29 marks) (c) Calculate the IHT due on Gabriel's death estate. Explain any reliefs or deductions that are available. State who is responsible for paying the IHT to the HMRC and the date by which it should be paid. (40 marks) (Total 100 marks) Question 14 Gabriel Jones died on 14th May 2022. His will leaves his main residence to his son, 100,000 in cash to a registered UK charity, and the rest of his estate to his daughter. Gabriel's wife died last year. Her estate was valued at 300,000. Her will provided for cash of 50,000 cash to each of her two children, and the rest of her estate to Gabriel. She had never made any lifetime gifts. The following further information is relevant: Gabriel's lifetime gifts Donee Nephew Relevant Property Trust Date 15th May 2012 1st December 2016 Daughter Details Cash of 10,000 Cash of 475,000. Gabriel agreed to pay any tax associated with the transfer. Vintage car, worth 50,000 at the date of the gift, on occasion of her marriage. Portfolio of quoted company shares, worth 50,000 at the date of the gift. 10th April 2017 Son 12th April 2017 Assets and liabilities at the date of Gabriel's death: Main residence Second property in Spain Shares in GJ Ltd Notes 490,000 45,000 Additional costs of administering this foreign property were 8,000, including Spanish Inheritance Tax of 4,000. 178,000 Gabriel set up this company many years ago and always owned 100% of the shares until his death. (70,000) (18,000) (4,000) 35,000 200,000 Mortgage on main residence Income tax liability Gambling debt Chattels and personal effects Cash Required: (a) Explain the classification of lifetime gifts and how they are charged to Inheritance Tax (IHT'). With specific reference to Gabriel's lifetime transfers, discuss the relevant reliefs, claims and exemptions which can be used to mitigate any IHT due as a result of his death. (b) Show the IHT due on each of Gabriel's lifetime gifts as a result of his death. State who is responsible for paying the tax and the date by which it should be paid. (29 marks) (c) Calculate the IHT due on Gabriel's death estate. Explain any reliefs or deductions that are available. State who is responsible for paying the IHT to the HMRC and the date by which it should be paid. (40 marks) (Total 100 marks)