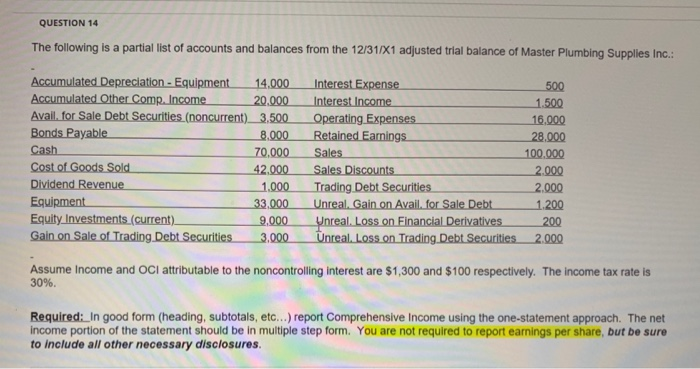

QUESTION 14 The following is a partial list of accounts and balances from the 12/31/X1 adjusted trial balance of Master Plumbing Supplies Inc.: Accumulated Depreciation - Equipment 14.000 Interest Expense 500 Accumulated Other Comp. Income 20.000 Interest Income 1.500 Avail. for Sale Debt Securities (noncurrent) 3.500 Operating Expenses 16.000 Bonds Payable 8.000 Retained Earnings 28.000 Cash 70,000 Sales 100.000 Cost of Goods Sold 42.000 Sales Discounts 2.000 Dividend Revenue 1.000 Trading Debt Securities 2.000 Equipment 33.000 Unreal. Gain on Avail. for Sale Debt 1.200 Equity Investments (current) 9.000 Unreal. Loss on Financial Derivatives 200 Gain on Sale of Trading Debt Securities 3.000 Unreal. Loss on Trading Debt Securities 2.000 Assume Income and OCI attributable to the noncontrolling interest are $1,300 and $100 respectively. The income tax rate is 30%. Required: In good form (heading, subtotals, etc...) report Comprehensive Income using the one-statement approach. The net income portion of the statement should be in multiple step form. You are not required to report earnings per share, but be sure to include all other necessary disclosures. QUESTION 14 The following is a partial list of accounts and balances from the 12/31/X1 adjusted trial balance of Master Plumbing Supplies Inc.: Accumulated Depreciation - Equipment 14.000 Interest Expense 500 Accumulated Other Comp. Income 20.000 Interest Income 1.500 Avail. for Sale Debt Securities (noncurrent) 3.500 Operating Expenses 16.000 Bonds Payable 8.000 Retained Earnings 28.000 Cash 70,000 Sales 100.000 Cost of Goods Sold 42.000 Sales Discounts 2.000 Dividend Revenue 1.000 Trading Debt Securities 2.000 Equipment 33.000 Unreal. Gain on Avail. for Sale Debt 1.200 Equity Investments (current) 9.000 Unreal. Loss on Financial Derivatives 200 Gain on Sale of Trading Debt Securities 3.000 Unreal. Loss on Trading Debt Securities 2.000 Assume Income and OCI attributable to the noncontrolling interest are $1,300 and $100 respectively. The income tax rate is 30%. Required: In good form (heading, subtotals, etc...) report Comprehensive Income using the one-statement approach. The net income portion of the statement should be in multiple step form. You are not required to report earnings per share, but be sure to include all other necessary disclosures