Question: Question 15 (1 point) Saved An outstanding bond has a carrying value of $872,270, and a face value of $812,000 on January 1 of Year

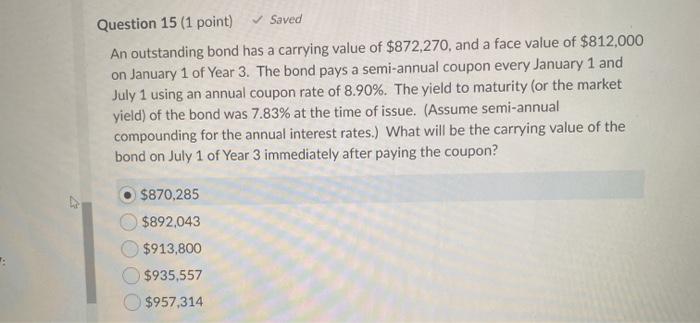

Question 15 (1 point) Saved An outstanding bond has a carrying value of $872,270, and a face value of $812,000 on January 1 of Year 3. The bond pays a semi-annual coupon every January 1 and July 1 using an annual coupon rate of 8.90%. The yield to maturity (or the market yield) of the bond was 7.83% at the time of issue. (Assume semi-annual compounding for the annual interest rates.) What will be the carrying value of the bond on July 1 of Year 3 immediately after paying the coupon? $870,285 $892,043 $913,800 $935,557 $957,314

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts