Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 15 2 pts Johnny and Rebecca are discussing the different types of evidence they plan to collect as part of the audit of

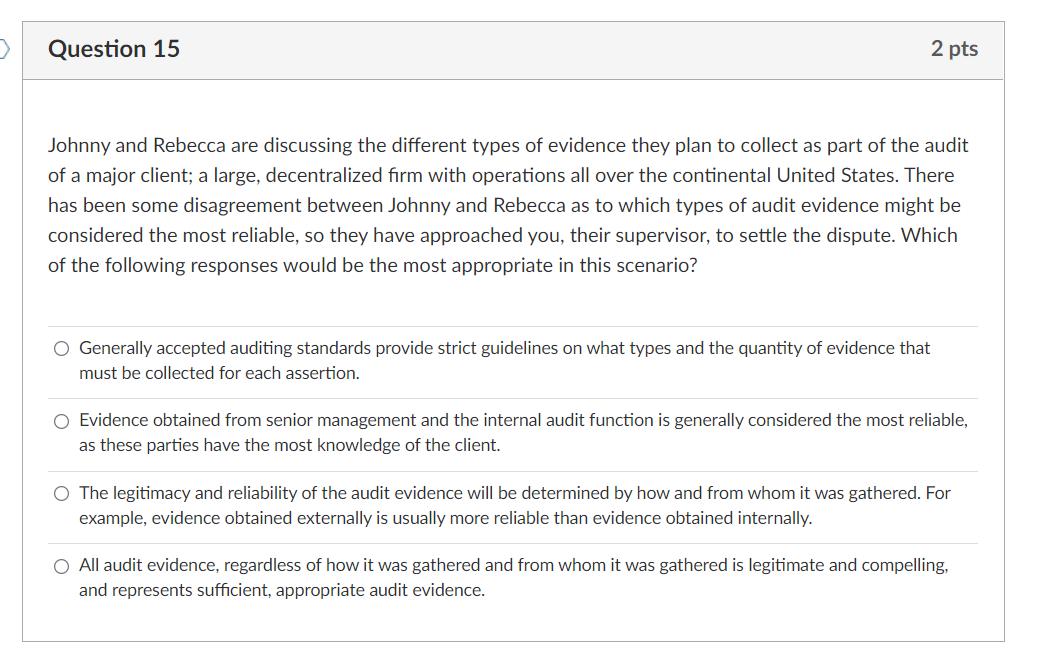

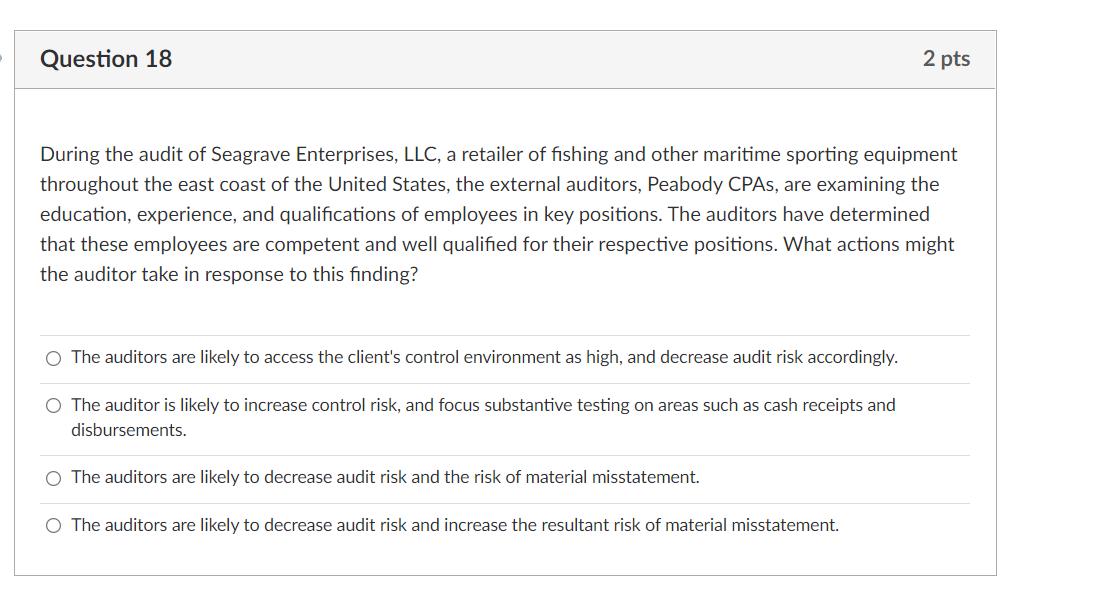

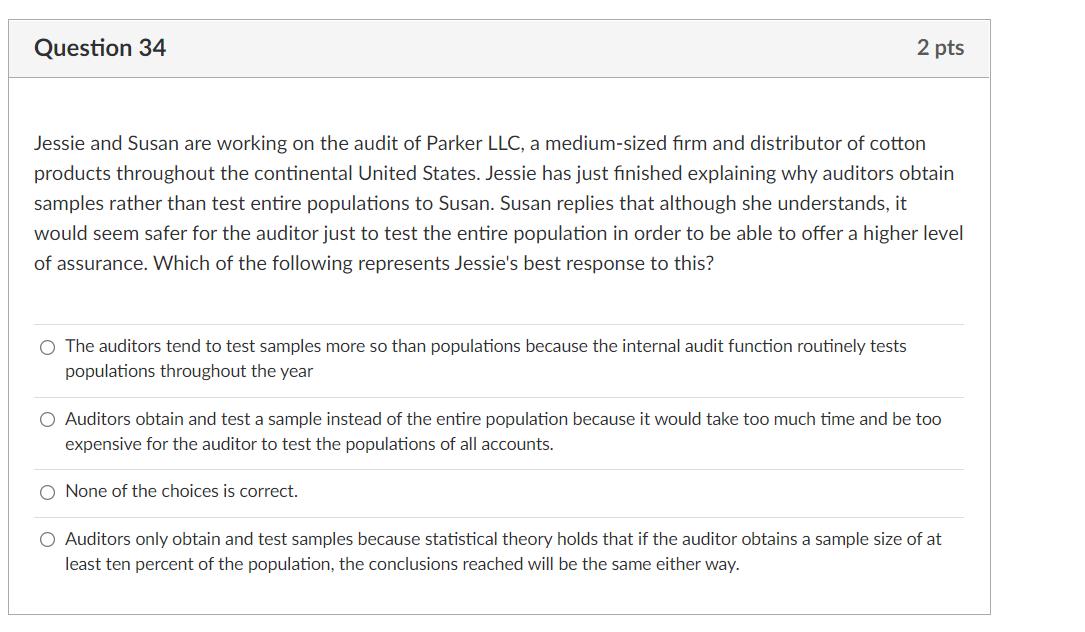

Question 15 2 pts Johnny and Rebecca are discussing the different types of evidence they plan to collect as part of the audit of a major client; a large, decentralized firm with operations all over the continental United States. There has been some disagreement between Johnny and Rebecca as to which types of audit evidence might be considered the most reliable, so they have approached you, their supervisor, to settle the dispute. Which of the following responses would be the most appropriate in this scenario? O Generally accepted auditing standards provide strict guidelines on what types and the quantity of evidence that must be collected for each assertion. O Evidence obtained from senior management and the internal audit function is generally considered the most reliable, as these parties have the most knowledge of the client. O The legitimacy and reliability of the audit evidence will be determined by how and from whom it was gathered. For example, evidence obtained externally is usually more reliable than evidence obtained internally. O All audit evidence, regardless of how it was gathered and from whom it was gathered is legitimate and compelling, and represents sufficient, appropriate audit evidence. Question 18 2 pts During the audit of Seagrave Enterprises, LLC, a retailer of fishing and other maritime sporting equipment throughout the east coast of the United States, the external auditors, Peabody CPAs, are examining the education, experience, and qualifications of employees in key positions. The auditors have determined that these employees are competent and well qualified for their respective positions. What actions might the auditor take in response to this finding? O The auditors are likely to access the client's control environment as high, and decrease audit risk accordingly. O The auditor is likely to increase control risk, and focus substantive testing on areas such as cash receipts and disbursements. O The auditors are likely to decrease audit risk and the risk of material misstatement. O The auditors are likely to decrease audit risk and increase the resultant risk of material misstatement. Question 34 Jessie and Susan are working on the audit of Parker LLC, a medium-sized firm and distributor of cotton products throughout the continental United States. Jessie has just finished explaining why auditors obtain samples rather than test entire populations to Susan. Susan replies that although she understands, it would seem safer for the auditor just to test the entire population in order to be able to offer a higher level of assurance. Which of the following represents Jessie's best response to this? O The auditors tend to test samples more so than populations because the internal audit function routinely tests populations throughout the year 2 pts O Auditors obtain and test a sample instead of the entire population because it would take too much time and be too expensive for the auditor to test the populations of all accounts. None of the choices is correct. O Auditors only obtain and test samples because statistical theory holds that if the auditor obtains a sample size of at least ten percent of the population, the conclusions reached will be the same either way.

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Question 15 Answer Generally accepted a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started