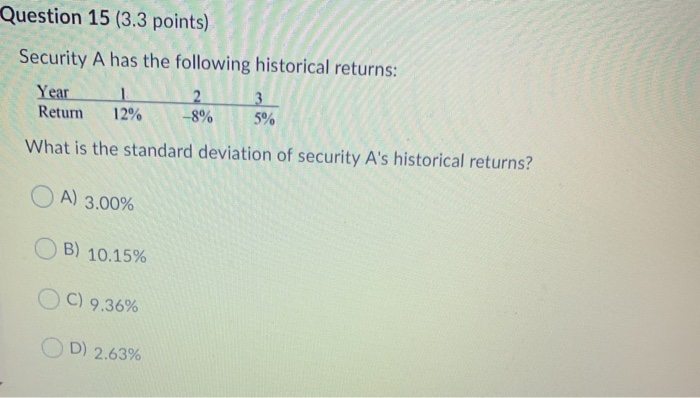

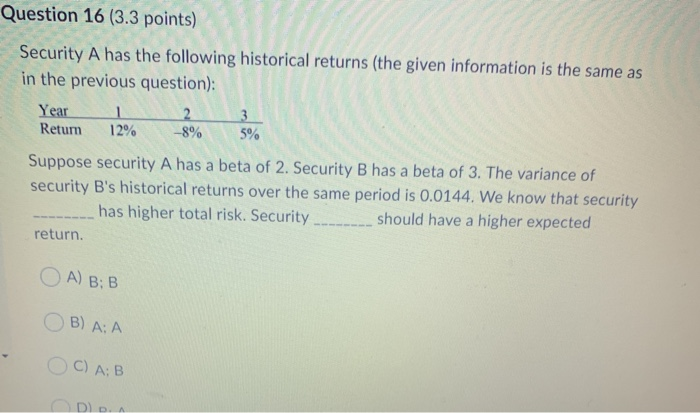

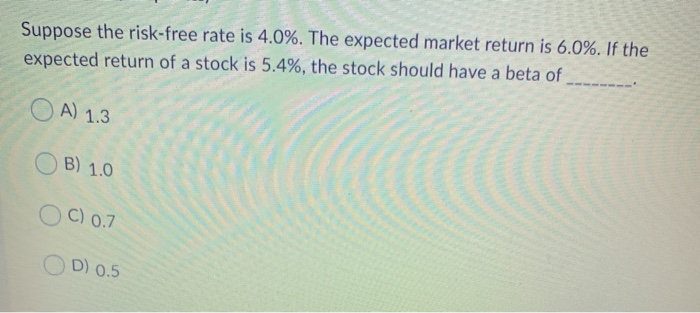

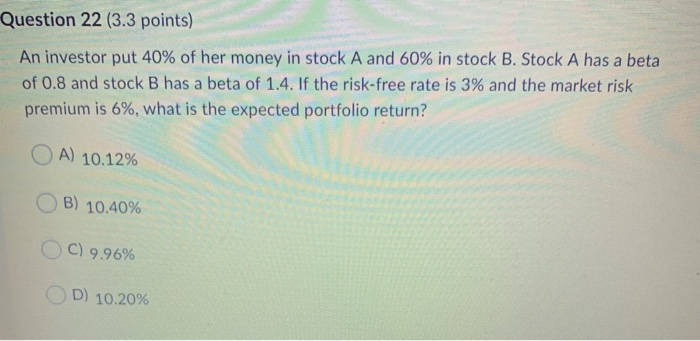

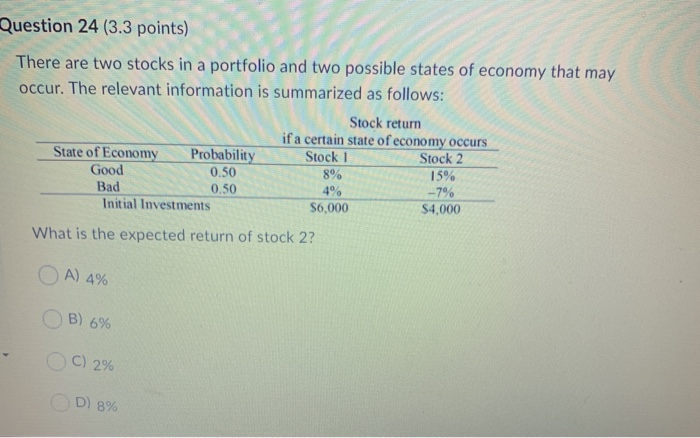

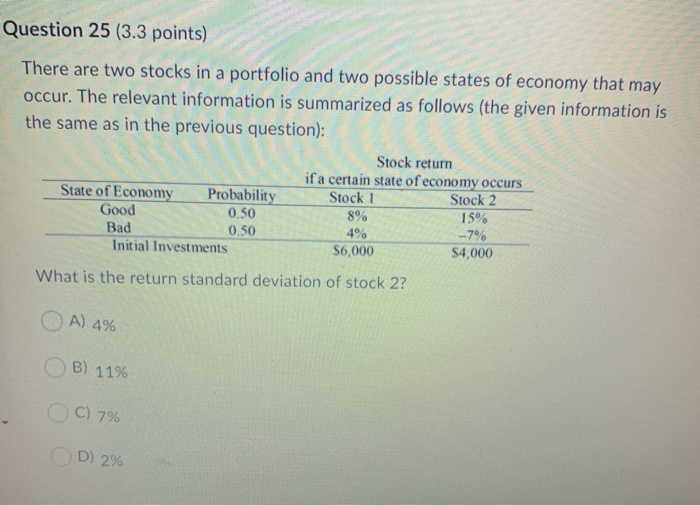

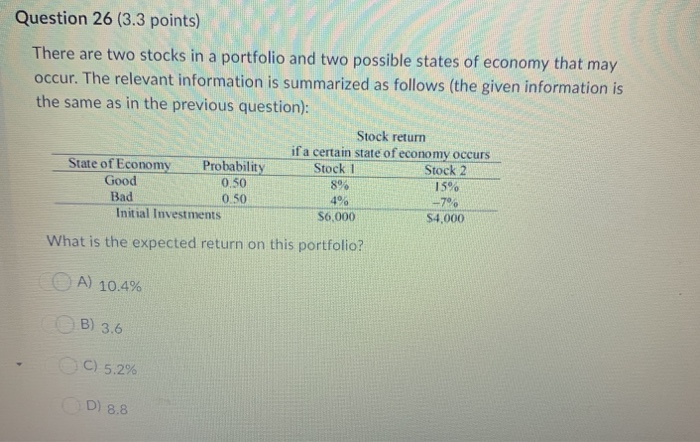

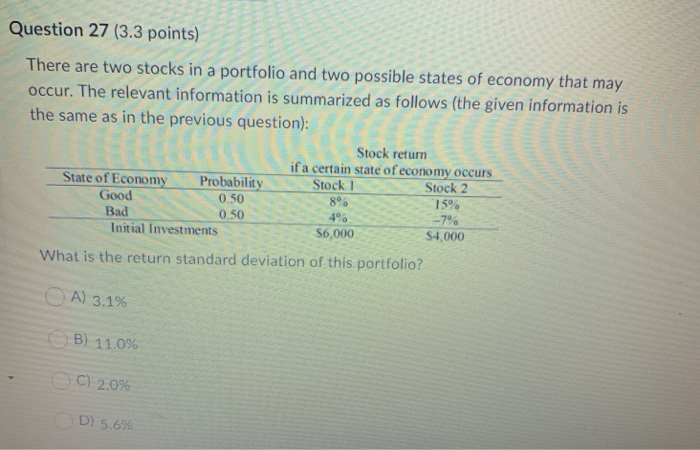

Question 15 (3.3 points) Security A has the following historical returns: Year Return 12% -8% What is the standard deviation of security A's historical returns? OA) 3.00% OB) 10.15% OC) 9.36% OD) 2.63% Question 16 (3.3 points) Security A has the following historical returns (the given information is the same as in the previous question): Year 1 2 3 Retum 12% -8% 5% Suppose security A has a beta of 2. Security B has a beta of 3. The variance of security B's historical returns over the same period is 0.0144. We know that security ____ has higher total risk. Security should have a higher expected return O A) B: B O B) A: A OC) A: B Suppose the risk-free rate is 4.0%. The expected market return is 6.0%. If the expected return of a stock is 5.4%, the stock should have a beta of O A) 1.3 OB) 1.0 OC) 0.7 OD) 0.5 Question 22 (3.3 points) An investor put 40% of her money in stock A and 60% in stock B. Stock A has a beta of 0.8 and stock B has a beta of 1.4. If the risk-free rate is 3% and the market risk premium is 6%, what is the expected portfolio return? OA) 10.12% OB) 10.40% OC) 9.96% OD 10.20% Question 24 (3.3 points) There are two stocks in a portfolio and two possible states of economy that may occur. The relevant information is summarized as follows: Stock return if a certain state of economy occurs State of Economy Probability Stock Stock 2 Good 0.50 8% 15% 4% -7% Initial Investments S6,000 $4.000 What is the expected return of stock 2? Bad 0.50 O A) 4% OB) 6% OC) 2% OD 8% Question 25 (3.3 points) There are two stocks in a portfolio and two possible states of economy that may occur. The relevant information is summarized as follows (the given information is the same as in the previous question): Stock return if a certain state of economy occurs State of Economy Probability Stock 1 Stock 2 Good 0.50 E8% 15% Bad 0.50 4% -7% Initial Investments $6,000 $4,000 What is the return standard deviation of stock 2? O A) 4% B) 11% C) 7% D) 2% Question 26 (3.3 points) There are two stocks in a portfolio and two possible states of economy that may occur. The relevant information is summarized as follows (the given information is the same as in the previous question): Stock return if a certain state of economy occurs State of Economy Probability Stock 1 Stock 2 Good 0.50 8% 15% Bad 0.50 4 -7% Initial Investments S6,000 $4,000 What is the expected return on this portfolio? C A) 10.4% 0 B) 3.6 C) 5.2% OD) 8.8 Question 27 (3.3 points) There are two stocks in a portfolio and two possible states of economy that may occur. The relevant information is summarized as follows the given information is the same as in the previous question): Stock return if a certain state of economy occurs State of Economy Probability Stock 1 Stock 2 Good 0.50 8% 15% 0.50 -- 7% Initial Investments $6,000 $4,000 Bad What is the return standard deviation of this portfolio? A) 3.1% CB) 11.0% C) 2.0% D) 5.6%