question 1-5 help please

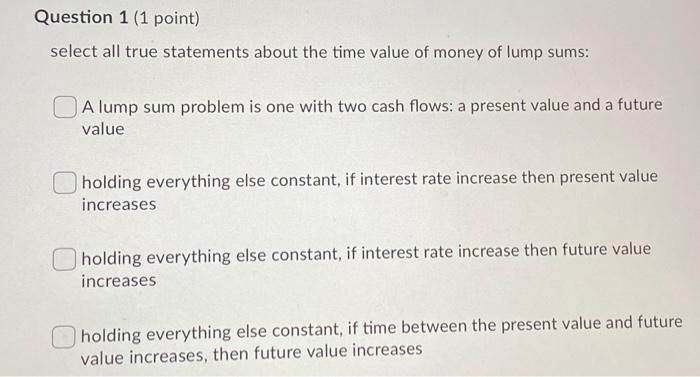

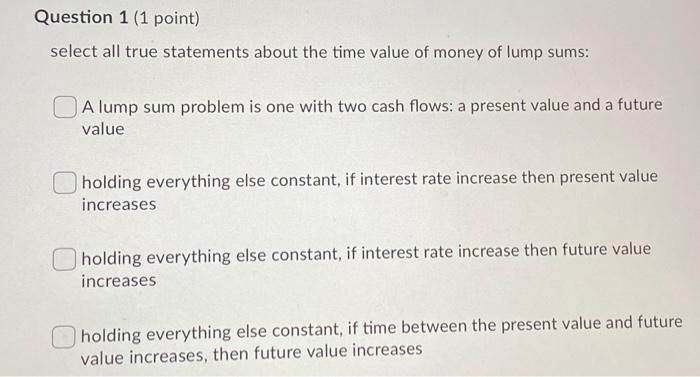

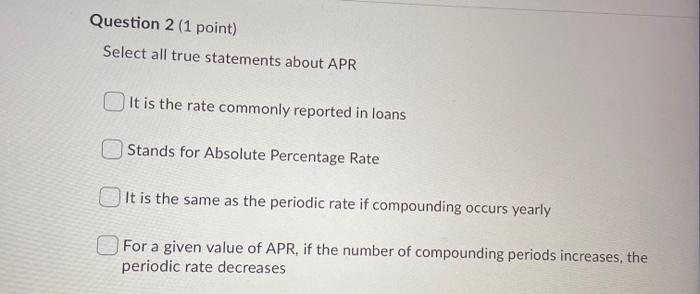

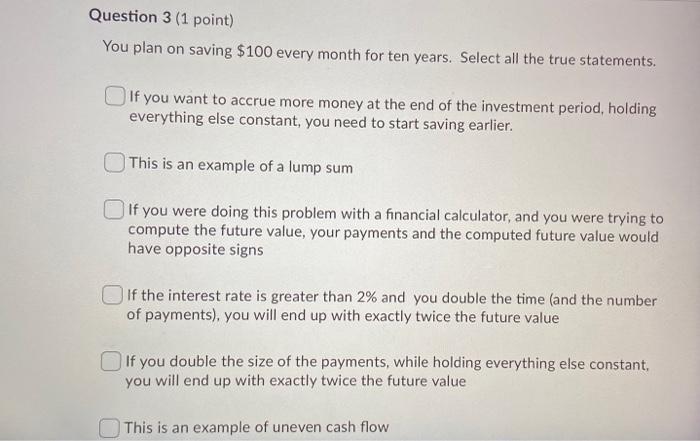

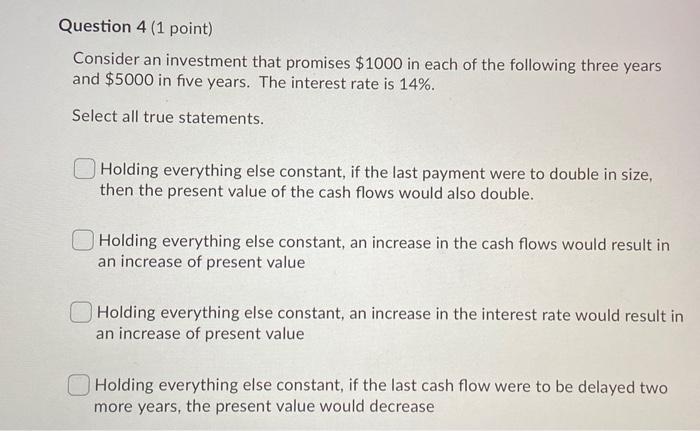

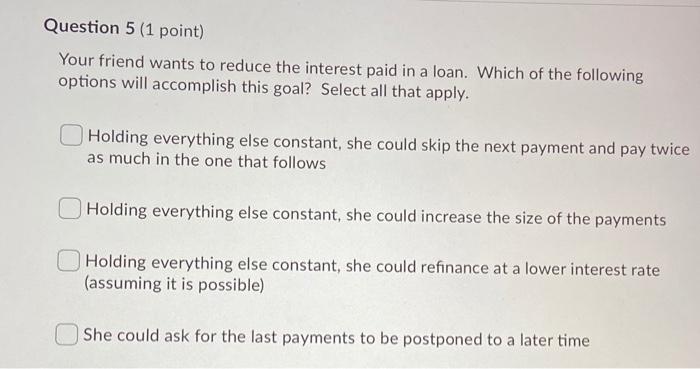

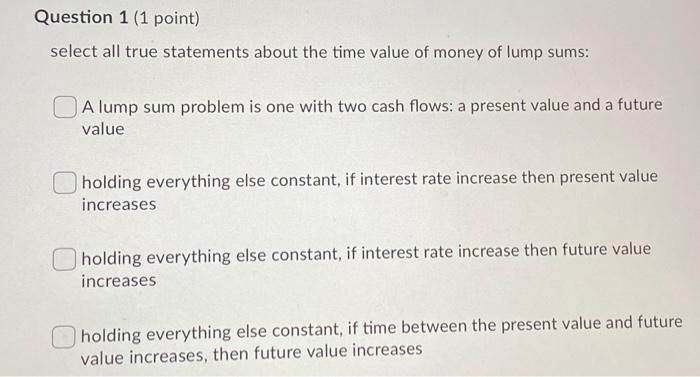

Question 1 (1 point) select all true statements about the time value of money of lump sums: A lump sum problem is one with two cash flows: a present value and a future value holding everything else constant, if interest rate increase then present value increases holding everything else constant, if interest rate increase then future value increases holding everything else constant, if time between the present value and future value increases, then future value increases Question 2 (1 point) Select all true statements about APR It is the rate commonly reported in loans Stands for Absolute Percentage Rate It is the same as the periodic rate if compounding occurs yearly For a given value of APR, if the number of compounding periods increases, the periodic rate decreases Question 3 (1 point) You plan on saving $100 every month for ten years. Select all the true statements. If you want to accrue more money at the end of the investment period, holding everything else constant, you need to start saving earlier. This is an example of a lump sum | If you were doing this problem with a financial calculator, and you were trying to compute the future value, your payments and the computed future value would have opposite signs | If the interest rate is greater than 2% and you double the time (and the number of payments), you will end up with exactly twice the future value If you double the size of the payments, while holding everything else constant, you will end up with exactly twice the future value This is an example of uneven cash flow Question 4 (1 point) Consider an investment that promises $1000 in each of the following three years and $5000 in five years. The interest rate is 14%. Select all true statements. Holding everything else constant, if the last payment were to double in size, then the present value of the cash flows would also double. Holding everything else constant, an increase in the cash flows would result in an increase of present value Holding everything else constant, an increase in the interest rate would result in an increase of present value Holding everything else constant, if the last cash flow were to be delayed two more years, the present value would decrease Question 5 (1 point) Your friend wants to reduce the interest paid in a loan. Which of the following options will accomplish this goal? Select all that apply. Holding everything else constant, she could skip the next payment and pay twice as much in the one that follows Holding everything else constant, she could increase the size of the payments Holding everything else constant, she could refinance at a lower interest rate (assuming it is possible) She could ask for the last payments to be postponed to a later time