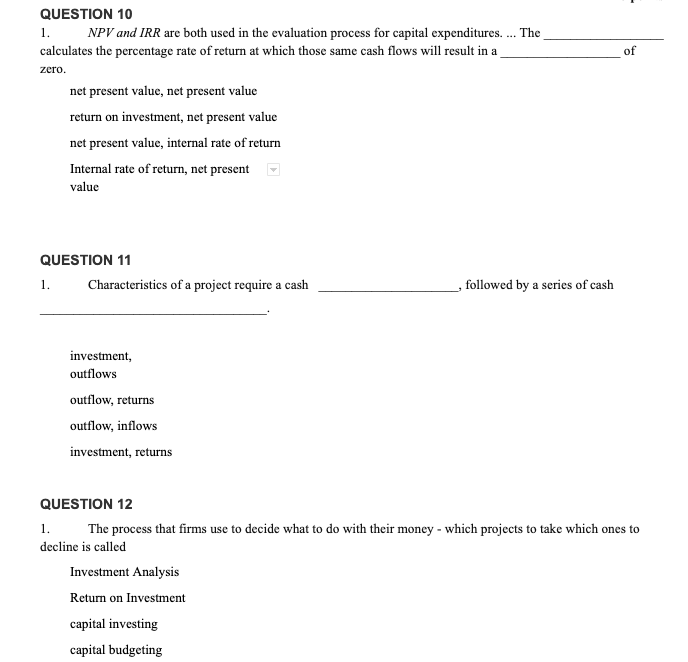

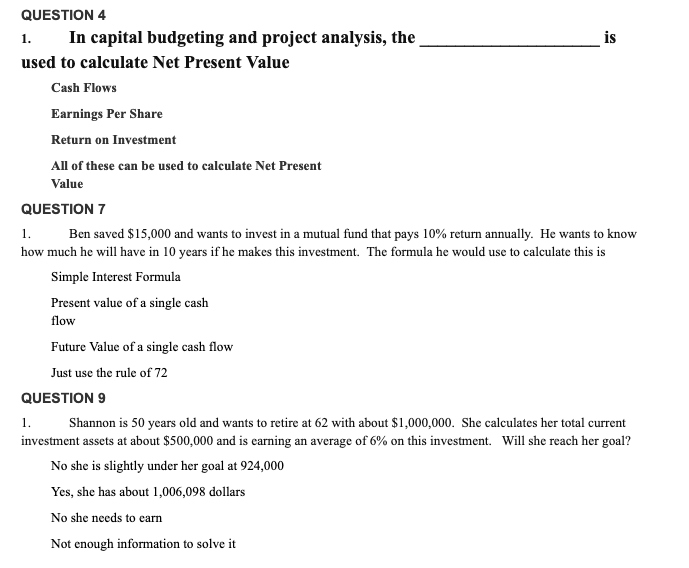

QUESTION 16 1. Clara bought a one-family home in Park Slope in 2002 for $900,000. In 2020, she sold the home for 1.4 million dollars. Clara's return on investment (ROI) is 5% 55.5% 500,00 0 555% 3 points QUESTION 17 1. Dina is 30 years old and wants to retire in Florida at age 55. She estimates that a condo in Florida will cost around $300,000 when she turns 55. She has already saved $45,000. If she invests the money in a bond that pays 8% return every year, will she reach her goal? No, she will need to invest that money for 45 years to reach her goal No, she needs to have saved 53,805.37 Yes, she will have 308,181 Yes, she will have 333,000 QUESTION 25 The Dividend Discount Model is one of the best valuation tools for analyzing a stock because: It is not a good tool since it is difficult to find the dividend growth rates It is the most popular method to value stocks of any company It can easily value a company's stock for any company that pays dividends It is not one of the best valuation tools since not all stocks pay dividends and few consistently grow their dividends. 1. QUESTION 10 1. NPV and IRR are both used in the evaluation process for capital expenditures.... The calculates the percentage rate of return at which those same cash flows will result in a of zero. net present value, net present value return on investment, net present value net present value, internal rate of return Internal rate of return, net present value QUESTION 11 1. Characteristics of a project require a cash followed by a series of cash investment, outflows outflow, returns outflow, inflows investment, returns QUESTION 12 1. The process that firms use to decide what to do with their money - which projects to take which ones to decline is called Investment Analysis Return on Investment capital investing capital budgeting QUESTION 4 1. In capital budgeting and project analysis, the is used to calculate Net Present Value Cash Flows Earnings Per Share Return on Investment All of these can be used to calculate Net Present Value QUESTION 7 1. Ben saved $15,000 and wants to invest in a mutual fund that pays 10% return annually. He wants to know how much he will have in 10 years if he makes this investment. The formula he would use to calculate this is Simple Interest Formula Present value of a single cash flow Future Value of a single cash flow Just use the rule of 72 QUESTION 9 1. Shannon is 50 years old and wants to retire at 62 with about $1,000,000. She calculates her total current investment assets at about $500,000 and is earning an average of 6% on this investment. Will she reach her goal? No she is slightly under her goal at 924,000 Yes, she has about 1,006,098 dollars No she needs to earn Not enough information to solve it