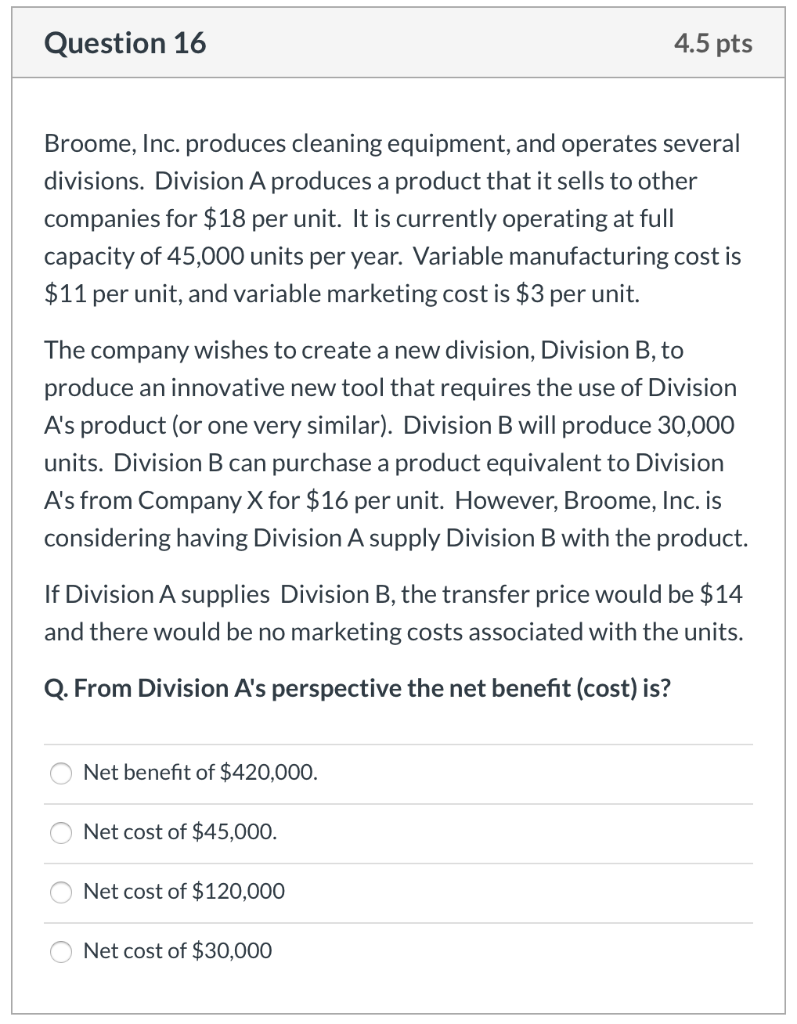

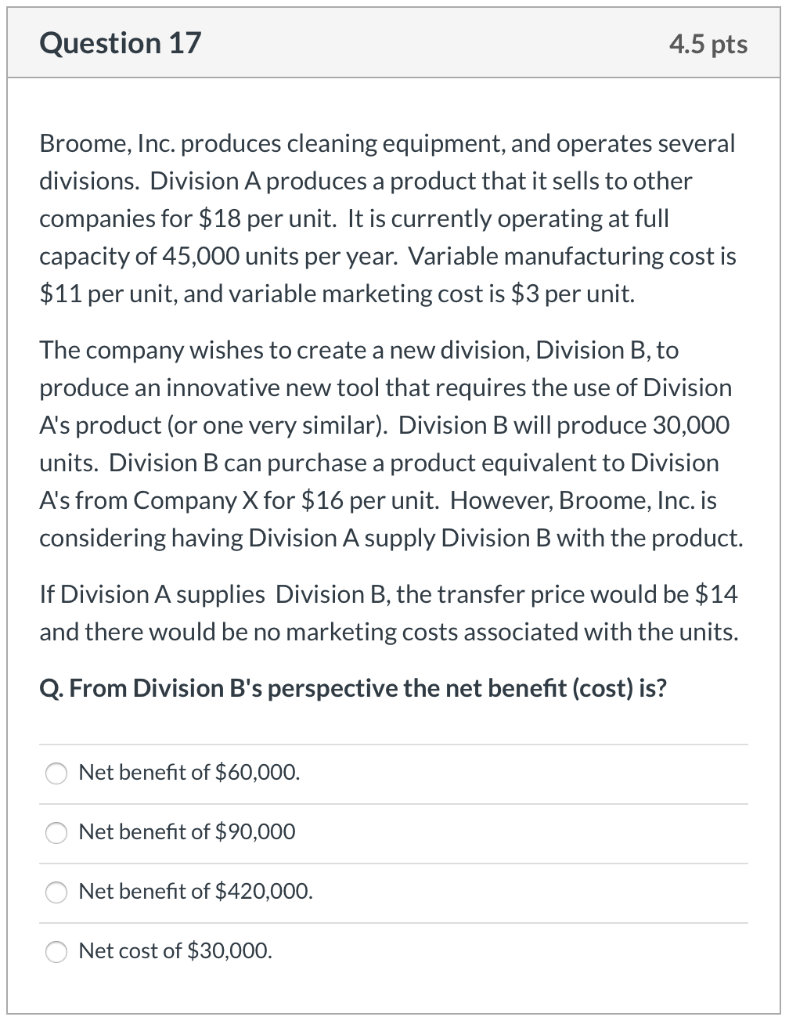

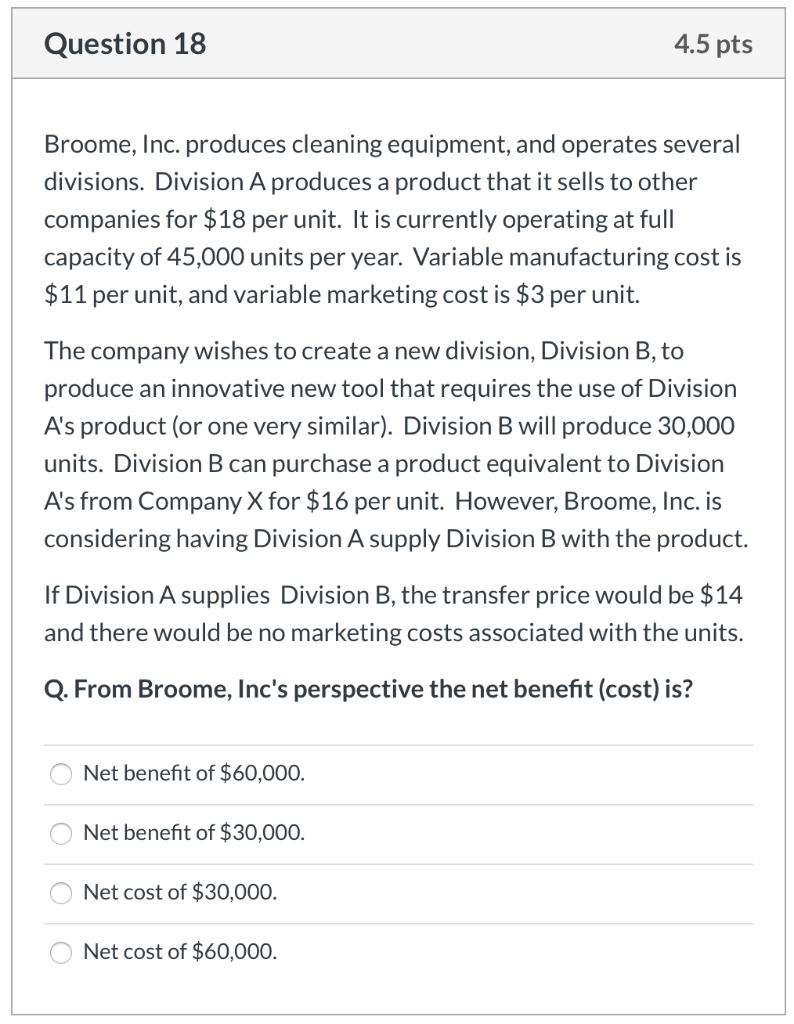

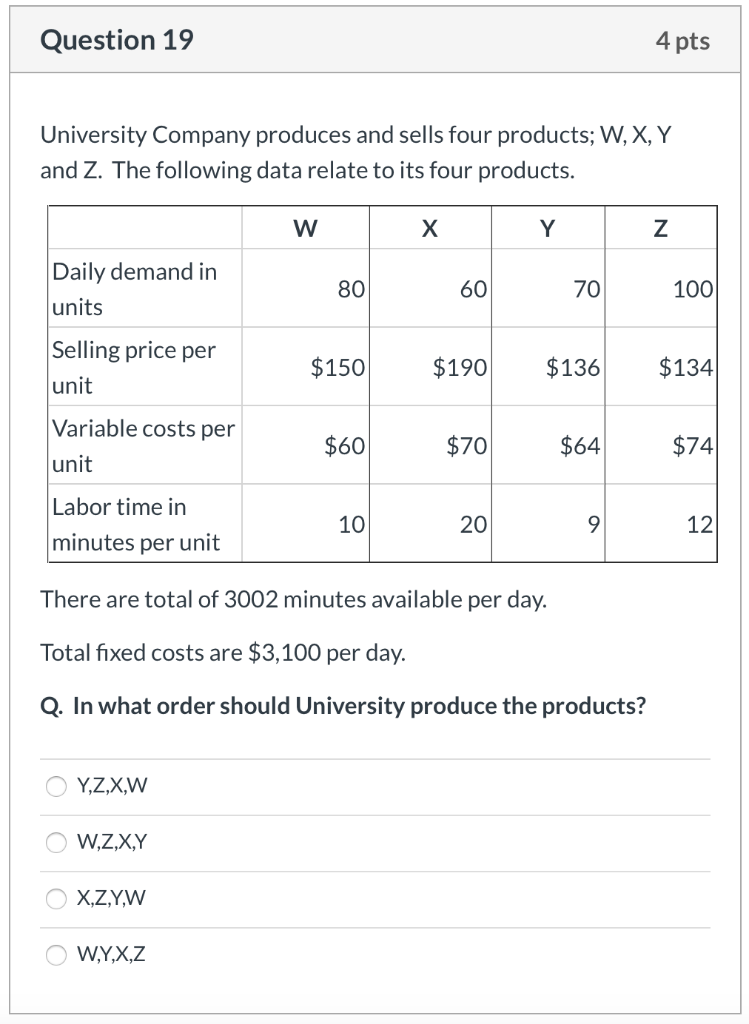

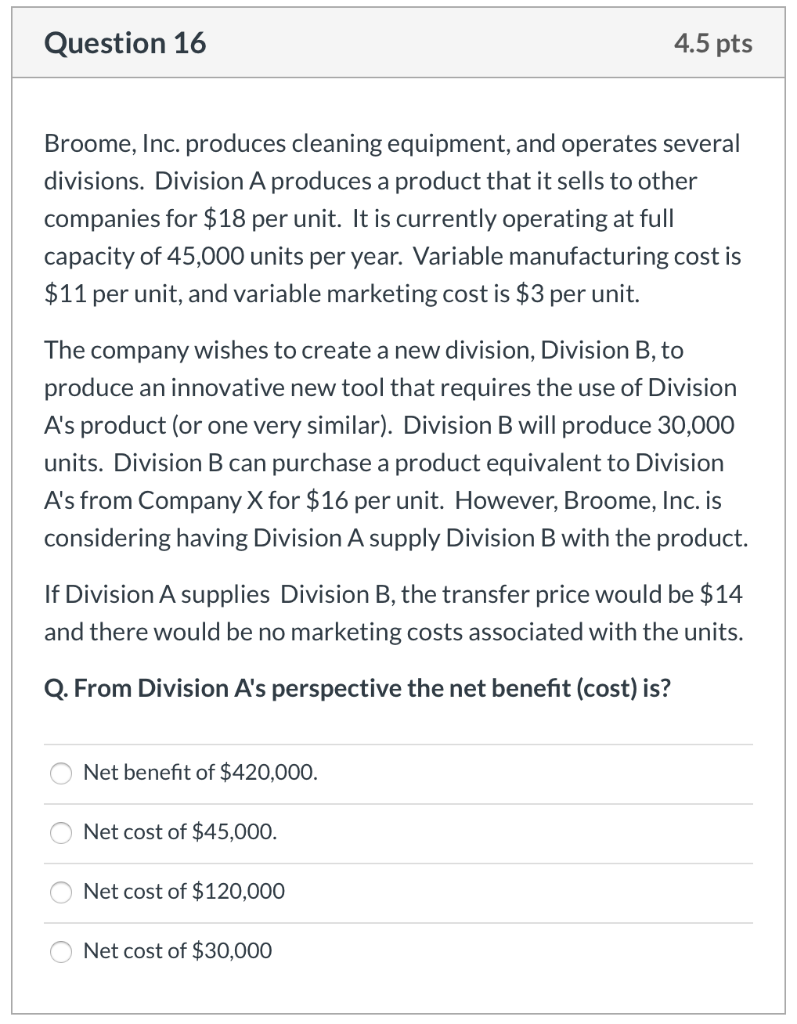

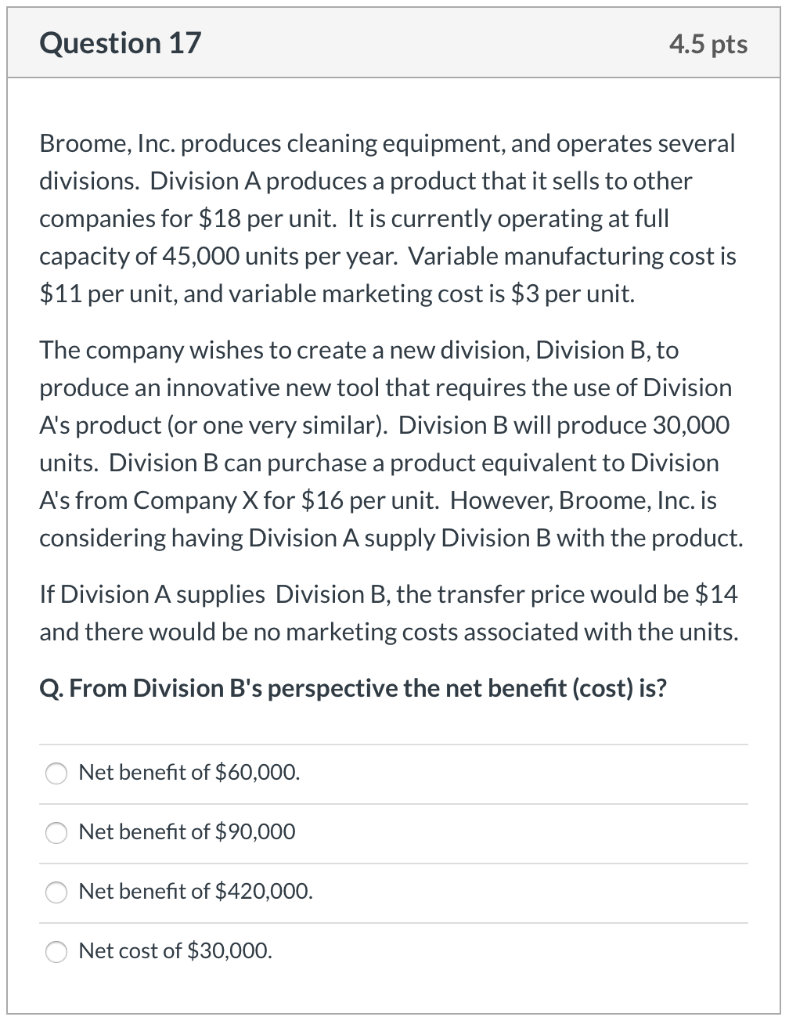

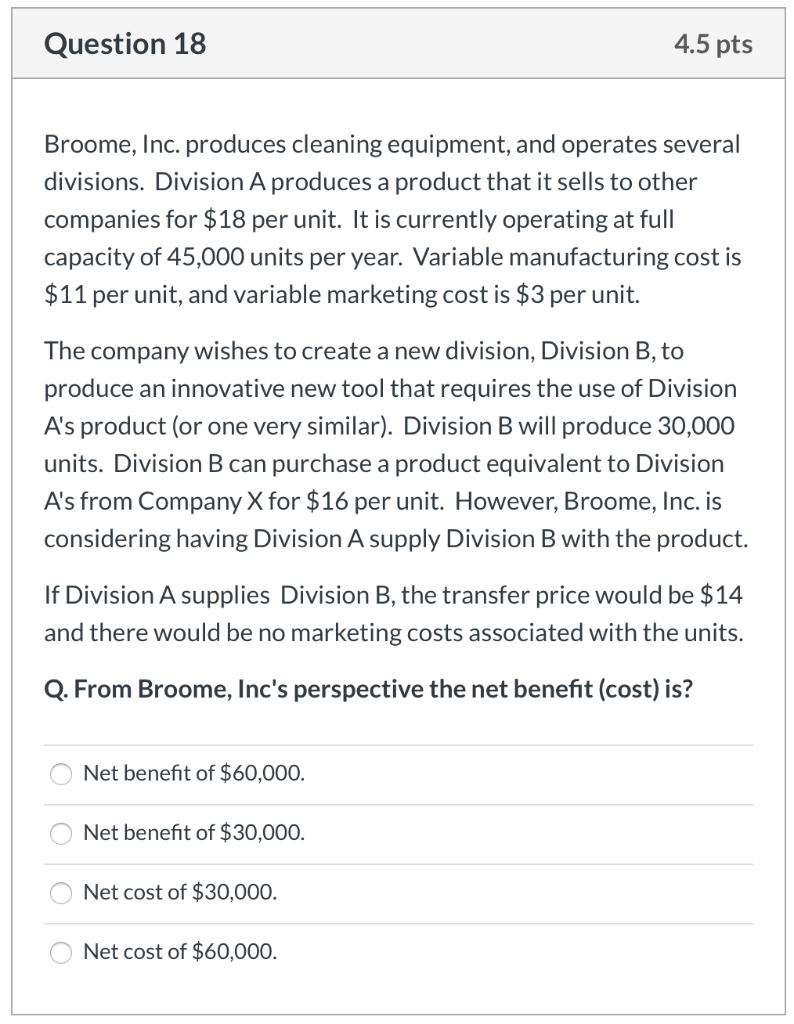

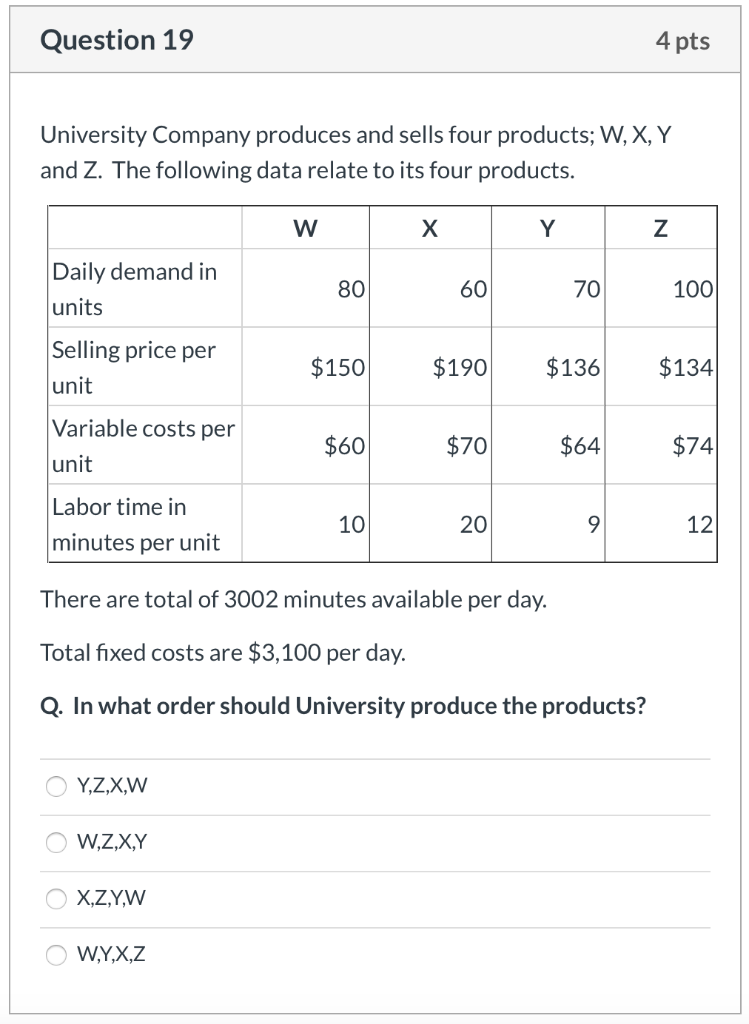

Question 16 4.5pts Broome, Inc. produces cleaning equipment, and operates several divisions. Division A produces a product that it sells to other companies for $18 per unit. It is currently operating at full capacity of 45,000 units per year. Variable manufacturing cost is $11 per unit, and variable marketing cost is $3 per unit. The company wishes to create a new division, Division B, to produce an innovative new tool that requires the use of Division A's product (or one very similar). Division B will produce 30,000 units. Division B can purchase a product equivalent to Divi n A's from Company X for $16 per unit. However, Broome, Inc. is considering having Division A supply Division B with the product. If Division A supplies Division B, the transfer price would be $14 and there would be no marketing costs associated with the units. Q. From Division A's perspective the net benefit (cost) is? Net benefit of $420,000. Net cost of $45,000. Net cost of $120,000 Net cost of $30,000 Question 17 4.5 pts Broome, Inc. produces cleaning equipment, and operates several divisions. Division A produces a product that it sells to other companies for $18 per unit. It is currently operating at full capacity of 45,000 units per year. Variable manufacturing cost is $11 per unit, and variable marketing cost is $3 per unit. The company wishes to create a new division, Division B, to produce an innovative new tool that requires the use of Division A's product (or one very similar). Division B will produce 30,000 C units. Division B can purchase a product equivalent Divisio A's from Company X for $16 per unit. However, Broome, Inc. is considering having Division A supply Division B with the product. If Division A supplies Division B, the transfer price would be $14 and there would be no marketing costs associated with the units. Q. From Division B's perspective the net benefit (cost) is? Net benefit of $60,000. Net benefit of $90,000 Net benefit of $420,000. Net cost of $30,000. Question 18 4.5 pts Broome, Inc. produces cleaning equipment, and operates several divisions. Division A produces a product that it sells to other companies for $18 per unit. It is currently operating at full capacity of 45,000 units per year. Variable manufacturing cost is $11 per unit, and variable marketing cost is $3 per unit. The company wishes to create a new division, Division B, to produce an innovative new tool that requires the use of Division A's product (or one very similar). Division B will produce 30,000 units. Division B can purchase a product equivalent to Division A's from Company X for $16 per unit. However, Broome, Inc. is considering having Division A supply Division B with the product. If Division A supplies Division B, the transfer price would be $14 and there would be no marketing costs associated with the units. Q. From Broome, Inc's perspective the net benefit (cost) is? Net benefit of $60,000. Net benefit of $30,000. Net cost of $30,000. Net cost of $60,000. OOO|0 Question 19 4 pts University Company produces and sells four products; W, X, Y and Z. The following data relate to its four products. W X Y Daily demand in 80 60 70 100 units |Selling price per $190 $136 $134 $150 unit Variable costs per $74 $60 $70 $64 unit Labor time in 10 12 9 minutes per unit There are total of 3002 minutes available per day. Total fixed costs are $3,100 per day. Q. In what order should University produce the products? Y,Z,X,W W,Z,X,Y X,Z,Y,W WYX,Z 20 OOOO