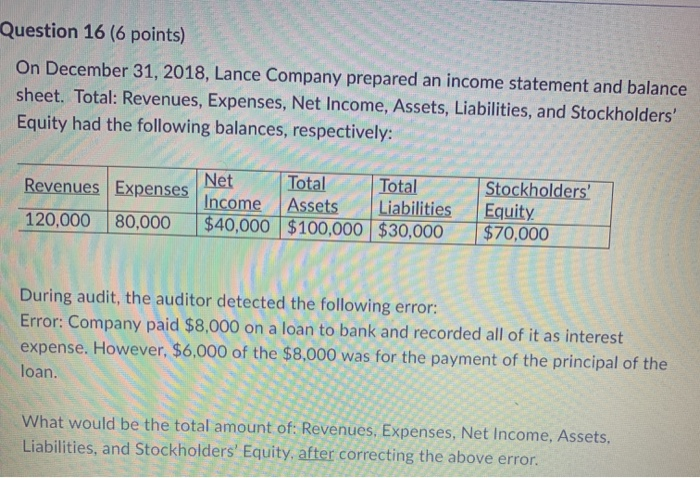

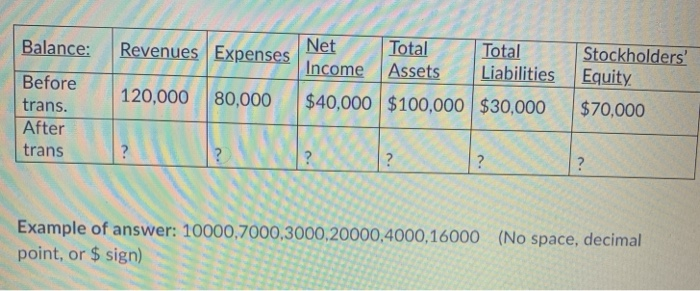

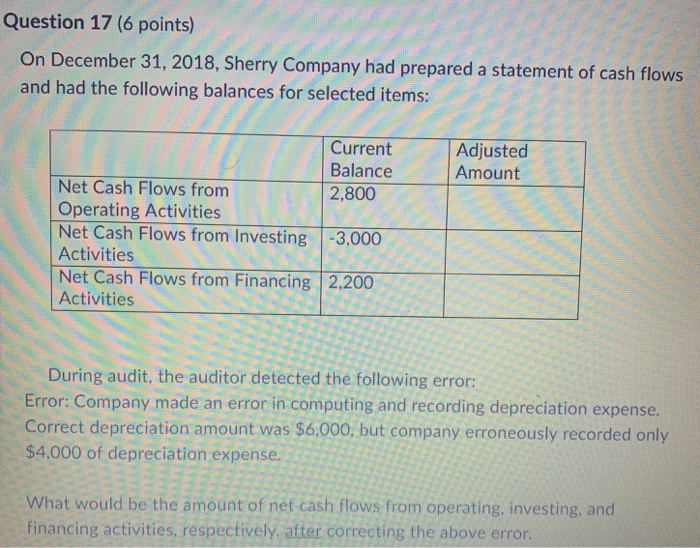

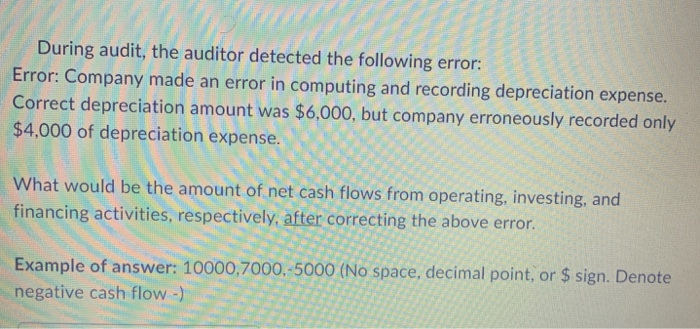

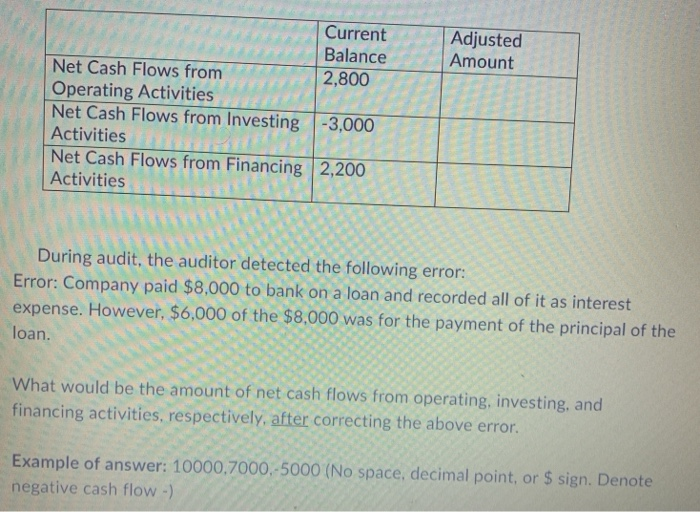

Question 16 (6 points) On December 31, 2018, Lance Company prepared an income statement and balance sheet. Total: Revenues, Expenses, Net Income, Assets, Liabilities, and Stockholders' Equity had the following balances, respectively: Revenues Expenses Net Total Total Income Assets Liabilities $40,000 $100,000 $30,000 120,000 80,000 Stockholders Equity $70,000 During audit, the auditor detected the following error: Error: Company paid $8,000 on a loan to bank and recorded all of it as interest expense. However, $6,000 of the $8,000 was for the payment of the principal of the loan. What would be the total amount of: Revenues. Expenses, Net Income, Assets, Liabilities, and Stockholders' Equity, after correcting the above error. Balance: Revenues Expenses Net Total Total Income Assets Liabilities $40,000 $100,000 $30,000 Stockholders' Equity 120,000 80,000 Before trans. After trans $70,000 ? ? ? ? ? Example of answer: 10000,7000,3000,20000,4000,16000 (No space, decimal point, or $ sign) Question 17 (6 points) On December 31, 2018, Sherry Company had prepared a statement of cash flows and had the following balances for selected items: Adjusted Amount Current Balance Net Cash Flows from 2,800 Operating Activities Net Cash Flows from Investing -3,000 Activities Net Cash Flows from Financing 2,200 Activities During audit, the auditor detected the following error: Error: Company made an error in computing and recording depreciation expense. Correct depreciation amount was $6,000, but company erroneously recorded only $4,000 of depreciation expense. What would be the amount of net cash flows from operating, investing, and financing activities, respectively, after correcting the above error. During audit, the auditor detected the following error: Error: Company made an error in computing and recording depreciation expense. Correct depreciation amount was $6,000, but company erroneously recorded only $4,000 of depreciation expense. What would be the amount of net cash flows from operating, investing, and financing activities, respectively, after correcting the above error. Example of answer: 10000,7000,-5000 (No space, decimal point, or $ sign. Denote negative cash flow -) | Adjusted Amount Current Balance Net Cash Flows from 2,800 Operating Activities Net Cash Flows from Investing -3,000 Activities Net Cash Flows from Financing 2,200 Activities During audit, the auditor detected the following error: Error: Company paid $8,000 to bank on a loan and recorded all of it as interest expense. However, $6,000 of the $8,000 was for the payment of the principal of the loan. What would be the amount of net cash flows from operating, investing, and financing activities, respectively, after correcting the above error. Example of answer: 10000,7000.-5000 (No space, decimal point, or $ sign. Denote negative cash flow -)