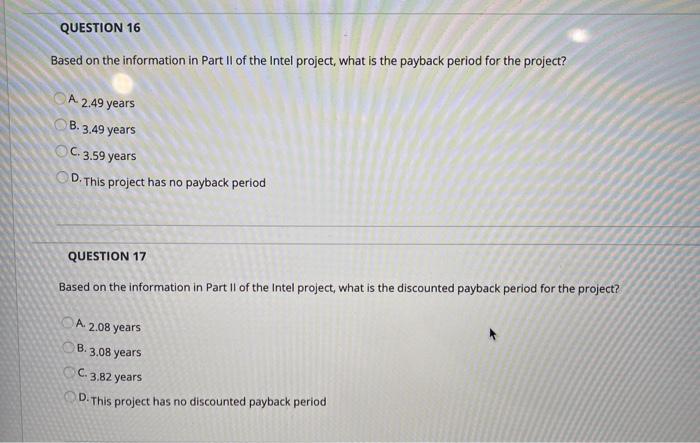

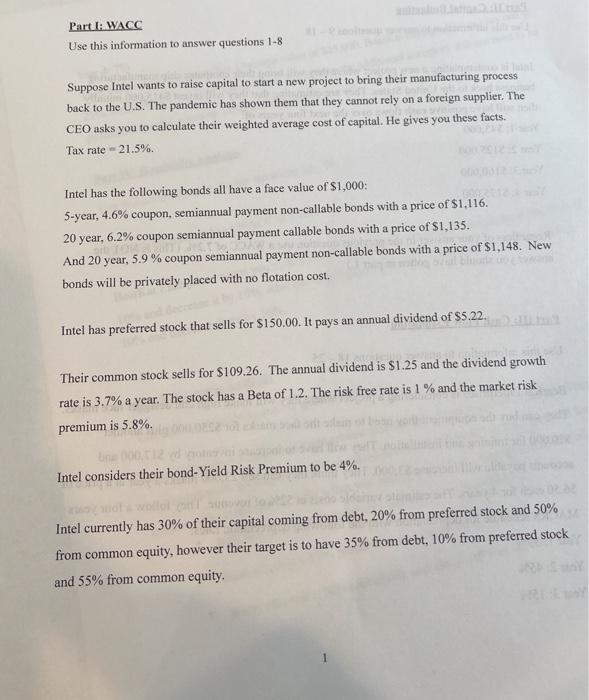

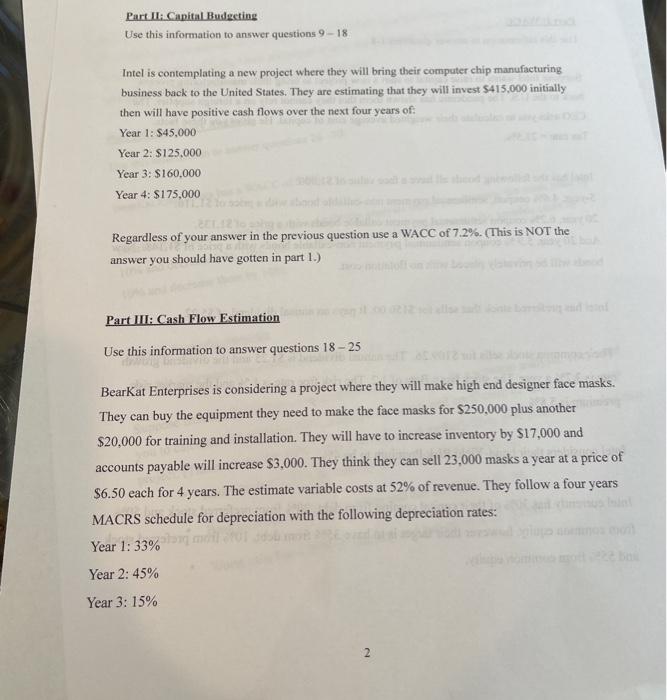

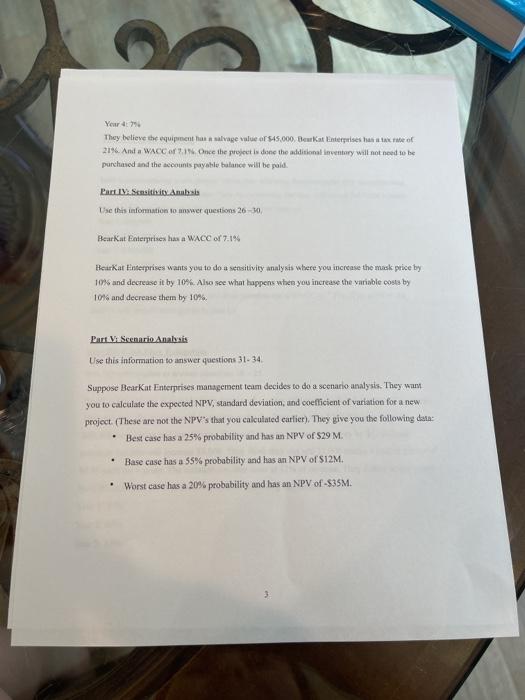

QUESTION 16 Based on the information in Part II of the Intel project, what is the payback period for the project? CA 2.49 years B. 3.49 years C. 3.59 years D. This project has no payback period QUESTION 17 Based on the information in Part II of the Intel project, what is the discounted payback period for the project? A 2.08 years B.3.08 years C. 3.82 years D. This project has no discounted payback period Part I: WACC Use this information to answer questions 1-8 Suppose Intel wants to raise capital to start a new project to bring their manufacturing process back to the U.S. The pandemic has shown them that they cannot rely on a foreign supplier. The CEO asks you to calculate their weighted average cost of capital. He gives you these facts. Tax rate - 21.5%. Intel has the following bonds all have a face value of $1,000: 5-year, 4.6% coupon, semiannual payment non-callable bonds with a price of $1.116. 20 year, 6.2% coupon semiannual | payment callable bonds with a price of $1,135. And 20 year, 5.9 % coupon semiannual payment non-callable bonds with a price of $1,148. New bonds will be privately placed with no flotation cost, Intel has preferred stock that sells for $150.00. It pays an annual dividend of $5.22. Their common stock sells for $109.26. The annual dividend is $1.25 and the dividend growth rate is 3.7% a year. The stock has a Beta of 1.2. The risk free rate is 1 % and the market risk premium is 5.8%. Intel considers their bond-Yield Risk Premium to be 4%. Intel currently has 30% of their capital coming from debt, 20% from preferred stock and 50% from common equity, however their target is to have 35% from debt, 10% from preferred stock and 55% from common equity. Part II: Capital Budgeting Use this information to answer questions 9 - 18 Intel is contemplating a new project where they will bring their computer chip manufacturing business back to the United States. They are estimating that they will invest $415,000 initially then will have positive cash flows over the next four years of: Year 1: $45.000 Year 2: $125.000 Year 3: $160,000 Year 4: $175,000 Regardless of your answer in the previous question use a WACC of 7.2%. (This is NOT the answer you should have gotten in part 1.) Part III: Cash Flow Estimation Use this information to answer questions 18 - 25 BearKat Enterprises is considering a project where they will make high end designer face masks. They can buy the equipment they need to make the face masks for $250,000 plus another $20,000 for training and installation. They will have to increase inventory by $17,000 and accounts payable will increase $3.000. They think they can sell 23,000 masks a year at a price of $6.50 each for 4 years. The estimate variable costs at 52% of revenue. They follow a four years MACRS schedule for depreciation with the following depreciation rates: Year 1: 33% Year 2: 45% Year 3: 15% 2 They believe the equipment has a salvage value of $45.000. Beat Enterprises state of 21%. Anita WACC of Once the project is done the additional inventory will not need to be purchased and the accounts payable balance will be paid. Part IV Sensitivity.Ambala Use this information to answer questions 26-30 BearKat Enterprises has a WACC Of 7.1% Berkat Enterprises wants you to do a sensitivity analysis where you increase the musk price by 10% and decrease it by 10%. Also see what happens when you increase the variable costs by 10% and decrease them by 10% Part Vi Scenario Analysis Use this information to answer questions 31-34 Suppose Bearkat Enterprises management team decides to do a scenario analysis. They want you to calculate the expected NPV, standard deviation, and coefficient of variation for a new project. These are not the NPV's that you calculated earlice). They give you the following data: Best case has a 25% probability and has an NPV of S29 M. Base case has a 55% probability and has an NPV of S12M. Worst case has a 20% probability and has an NPV of -S35M. 3