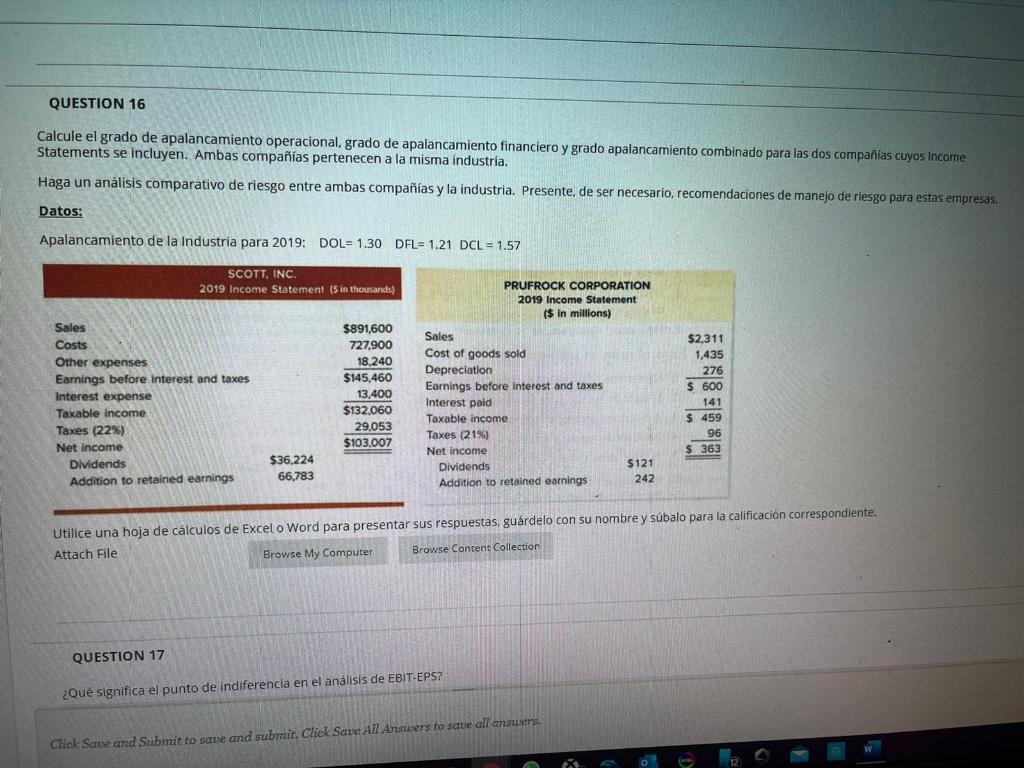

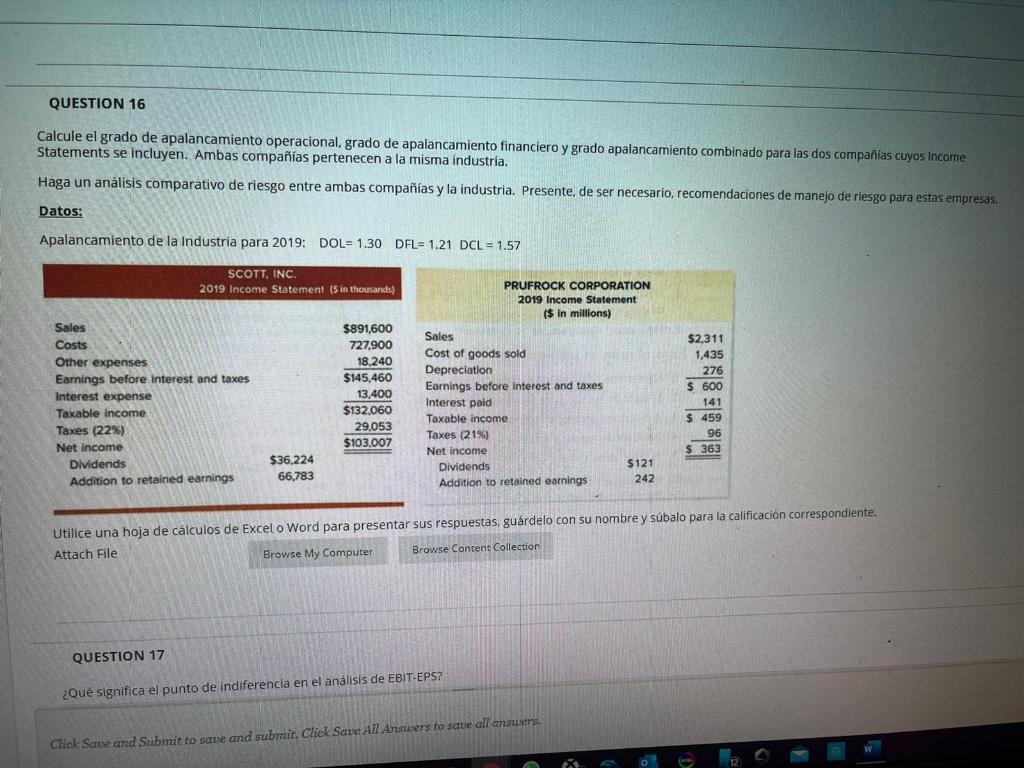

QUESTION 16 Calcule el grado de apalancamiento operacional, grado de apalancamiento financiero y grado apalancamiento combinado para las dos compaas cuyos Income Statements se incluyen. Ambas compaas pertenecen a la misma industria. Haga un anlisis comparativo de riesgo entre ambas compaas y la industria. Presente de ser necesario, recomendaciones de manejo de riesgo para estas empresas. Datos: Apalancamiento de la Industria para 2019: DOL= 1.30 DFL= 1.21 DCL = 1.57 SCOTT, INC 2019 Income Statement (s in thousands) PRUFROCK CORPORATION 2019 Income Statement ($ in millions) Sales Costs Other expenses Earnings before interest and taxes Interest expense Taxable income Taxes (22%) Net Income Dividends Addition to retained earnings $891,600 727,900 18,240 $145,460 13,400 $132.060 29.053 $103.007 Sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes (219) Net Income Dividends Addition to retained earnings $2,311 1,435 276 $ 600 141 $ 459 96 $363 $36,224 $121 66,783 242 Utilice una hoja de clculos de Excel o Word para presentar sus respuestas, guardelo con su nombre y sbalo para la calificacin correspondiente. Attach File Browse My Computer Browse Content Collection QUESTION 17 Qu significa el punto de indiferencia en el anlisis de EBIT-EPS? Click Save and Submit to save and submit. Click Save All Answers to save all answers 12 QUESTION 16 Calcule el grado de apalancamiento operacional, grado de apalancamiento financiero y grado apalancamiento combinado para las dos compaas cuyos Income Statements se incluyen. Ambas compaas pertenecen a la misma industria. Haga un anlisis comparativo de riesgo entre ambas compaas y la industria. Presente de ser necesario, recomendaciones de manejo de riesgo para estas empresas. Datos: Apalancamiento de la Industria para 2019: DOL= 1.30 DFL= 1.21 DCL = 1.57 SCOTT, INC 2019 Income Statement (s in thousands) PRUFROCK CORPORATION 2019 Income Statement ($ in millions) Sales Costs Other expenses Earnings before interest and taxes Interest expense Taxable income Taxes (22%) Net Income Dividends Addition to retained earnings $891,600 727,900 18,240 $145,460 13,400 $132.060 29.053 $103.007 Sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes (219) Net Income Dividends Addition to retained earnings $2,311 1,435 276 $ 600 141 $ 459 96 $363 $36,224 $121 66,783 242 Utilice una hoja de clculos de Excel o Word para presentar sus respuestas, guardelo con su nombre y sbalo para la calificacin correspondiente. Attach File Browse My Computer Browse Content Collection QUESTION 17 Qu significa el punto de indiferencia en el anlisis de EBIT-EPS? Click Save and Submit to save and submit. Click Save All Answers to save all answers 12