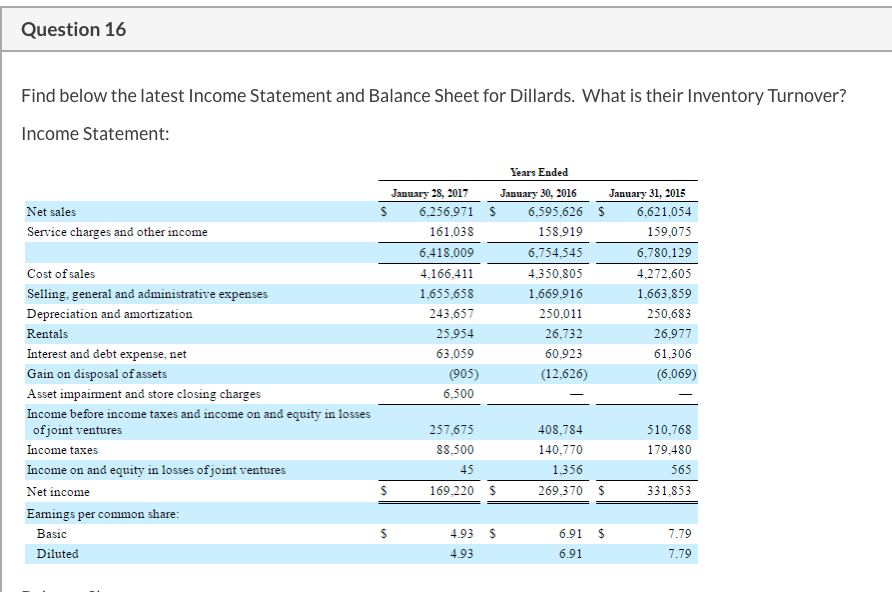

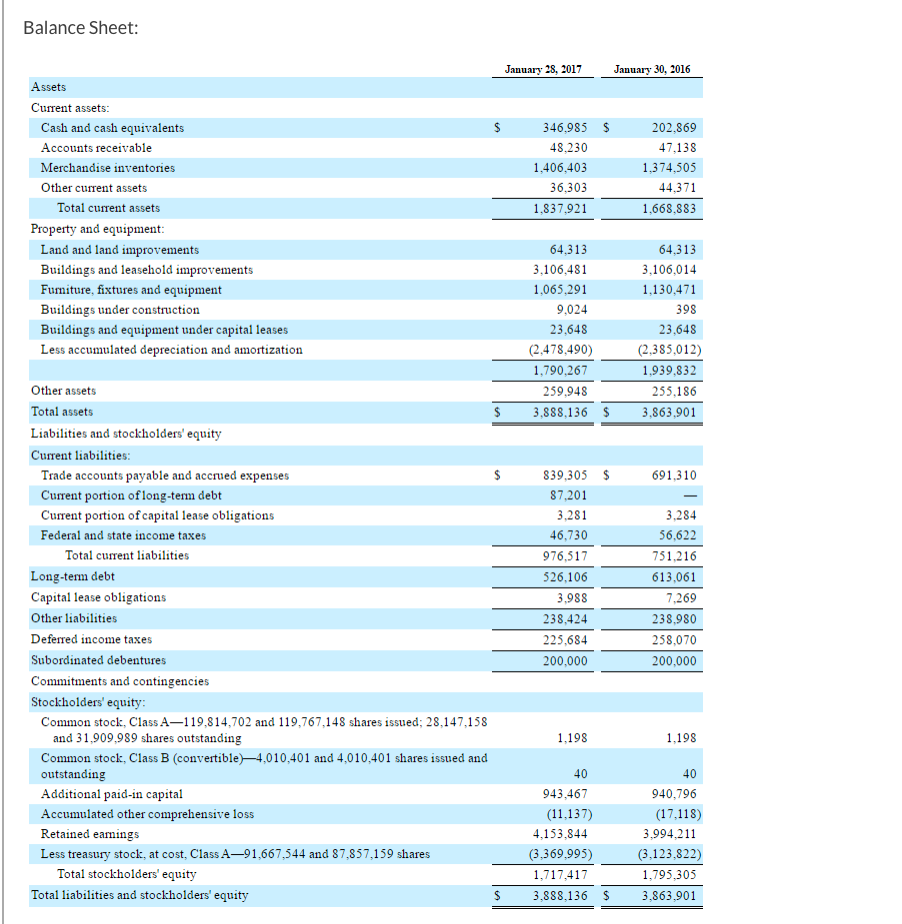

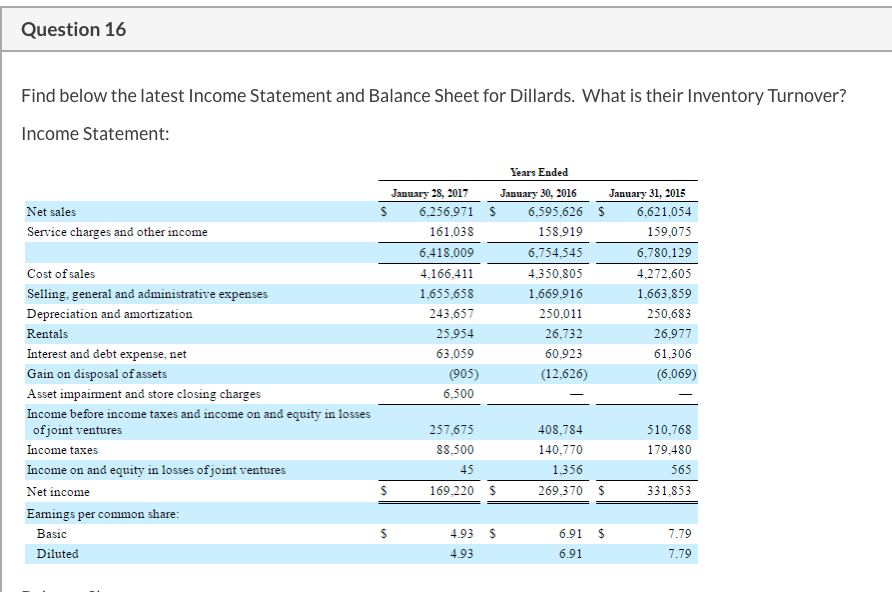

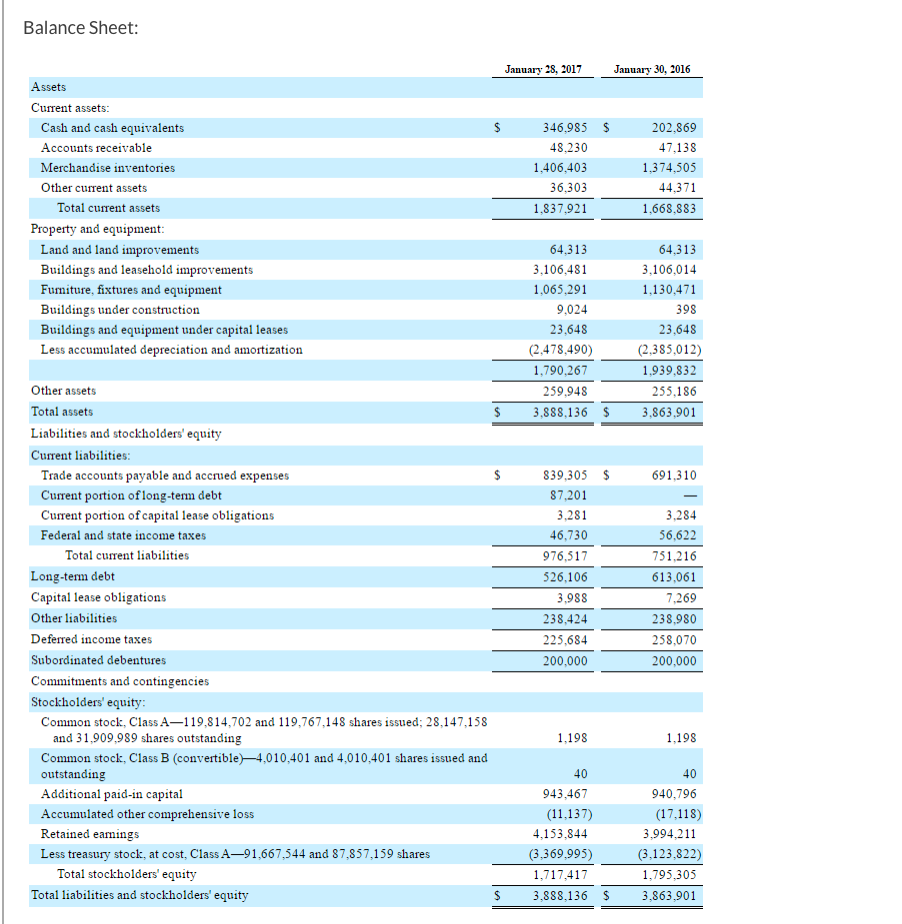

Question 16 Find below the latest Income Statement and Balance Sheet for Dillards. What is their Inventory Turnover? Income Statement: Net sales Service charges and other income Years Ended January 28, 2017 January 30, 2016 $ 6.256,971 S 6,595,626 161,038 158,919 6,418,009 6 ,754,545 4,166,411 4.350,805 1.655,658 1,669.916 243.657 250,011 25,954 26,732 63,059 60.923 (905) (12.626) 6,500 January 31, 2015 $ 6,621,054 159,075 6,780,129 4,272,605 1,663,859 250,683 26,977 61,306 (6.069) Cost of sales Selling, general and administrative expenses Depreciation and amortization Rentals Interest and debt expense.net Gain on disposal of assets Asset impairment and store closing charges Income before income taxes and income on and equity in losses of joint ventures Income taxes Income on and equity in losses of joint ventures Net income Earnings per common share: Basic Diluted 257,675 88,500 408,784 140.770 1.356 269,370 $ 510,768 179,480 565 331,853 45 $ 169,220 $ $ 4.93 $ 4.93 6.91 $ 6.91 7.79 7.79 Balance Sheet: January 28, 2017 January 30, 2016 $ 346,985 $ 48,230 1,406,403 36,303 1,837,921 202,869 47,138 1,374,505 44.371 1.668.883 Assets Current assets: Cash and cash equivalents Accounts receivable Merchandise inventories Other current assets Total current assets Property and equipment: Land and land improvements Buildings and leasehold improvements Furniture, fixtures and equipment Buildings under construction Buildings and equipment under capital leases Less accumulated depreciation and amortization 64,313 3.106,481 1,065.291 9,024 23.648 (2.478,490) 1,790,267 259,948 3.888.136 64,313 3,106,014 1,130,471 398 23,648 (2.385,012) 1.939,832 255,186 3.863,901 $ 691,310 Other assets Total assets $ Liabilities and stockholders' equity Current liabilities: Trade accounts payable and accrued expenses $ Current portion of long-term debt Current portion of capital lease obligations Federal and state income taxes Total current liabilities Long-term debt Capital lease obligations Other liabilities Deferred income taxes Subordinated debentures Commitments and contingencies Stockholders' equity: Common stock, Class A-119,814,702 and 119,767,148 shares issued; 28,147,158 and 31.909.989 shares outstanding Common stock, Class B (convertible)-4,010,401 and 4,010,401 shares issued and outstanding Additional paid-in capital Accumulated other comprehensive loss Retained earnings Less treasury stock, at cost, Class A-91,667,544 and 87,857,159 shares Total stockholders' equity Total liabilities and stockholders' equity $ 839,305 $ 87,201 3.281 46,730 976,517 526,106 3.988 238,424 225,684 200,000 3.284 56,622 751,216 613,061 7.269 238,980 258,070 200,000 1.198 1,198 40 40 943,467 (11.137) 4.153,844 (3.369.995) 1,717,417 3,888,136 940,796 (17,118) 3,994,211 (3.123.822) 1,795,305 3.863,901 $ About 3 turns About 4 turns About 5 turns O About 6 turns