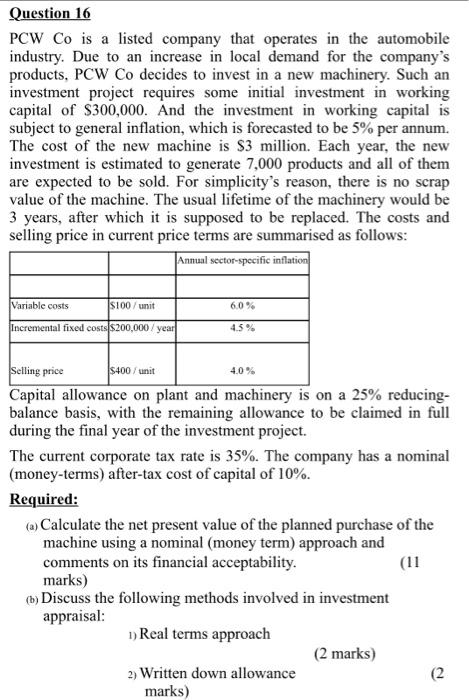

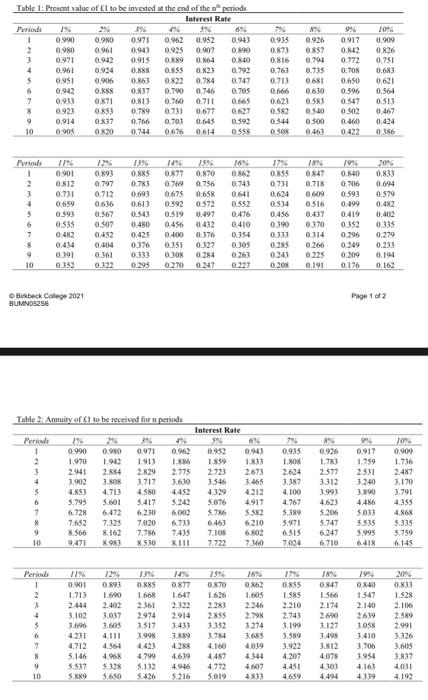

Question 16 PCW Co is a listed company that operates in the automobile industry. Due to an increase in local demand for the company's products, PCW Co decides to invest in a new machinery. Such an investment project requires some initial investment in working capital of $300,000. And the investment in working capital is subject to general inflation, which is forecasted to be 5% per annum. The cost of the new machine is $3 million. Each year, the new investment is estimated to generate 7,000 products and all of them are expected to be sold. For simplicity's reason, there is no scrap value of the machine. The usual lifetime of the machinery would be 3 years, after which it is supposed to be replaced. The costs and selling price in current price terms are summarised as follows: Annual sector-specific inflation Variable costs S100/unit 60% Incremental fixed costs $200,000/year 4.5% Selling price $400/unit Capital allowance on plant and machinery is on a 25% reducing- balance basis, with the remaining allowance to be claimed in full during the final year of the investment project. The current corporate tax rate is 35%. The company has a nominal (money-terms) after-tax cost of capital of 10%. Required: (a) Calculate the net present value of the planned purchase of the machine using a nominal (money term) approach and comments on its financial acceptability. marks) (b) Discuss the following methods involved in investment appraisal: 1) Real terms approach (2 marks) 2) Written down allowance (2 marks) Table 1: Present value of 1 to be invested at the end of the periods Interest Rate Periods 393 69 1 0.990 0.980 0.971 0.962 0.952 0.943 2 0.980 0.961 0.943 0.925 0.907 0.890 3 0.971 0.942 0.915 0.889 0.864 0.840 4 0.961 0.924 O.RS ORSS 0.823 0.792 5 0.951 0.906 0.863 0822 0.784 0747 6 0,942 O.RS 0.837 0.790 0.746 0.705 7 0.933 0.871 0.813 0.760 0.711 0.665 8 0.921 OS 0.789 0731 0.677 0.627 0.914 0.837 0.766 0.703 0.645 0.392 10 0905 0820 0.744 0676 0.915 0.873 0,816 0.763 0.713 19 0.926 0857 0.794 0.735 06RI 0.630 OSR 0540 0.500 0461 99 0.917 0.842 0.772 0,70N 0.650 0.596 0547 0502 0.460 0432 JOS 0.909 0826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0386 0.666 0.623 0.582 0.544 OSOS Periods 1 2 3 4 5 6 7 3 19 0.901 0.812 0.731 0.659 0.593 0.535 13 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0376 0.333 0.295 1496 0.877 0.769 0.675 0.592 0519 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0322 25% 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 16% 0.862 0.741 0.641 0.552 0.476 0.410 0354 0305 0.263 0.227 17% 0.855 0.731 0.624 0.534 0.456 0.390 0.333 0285 0.241 0.205 18% 0847 0.718 0.609 0516 0.437 0370 0314 0266 0.225 0.191 1994 0.840 0.706 0.593 0,499 0.419 0352 0.296 0.249 0.209 0.176 20% 0.833 0.694 0.579 0.482 0.402 0,335 0.279 0.233 0.194 0.162 0.454 0.391 0.352 0.400 0351 0 308 0210 10 Birkbeck College 2021 BUMNO5256 Page 1 of 2 Table 2: Annuity of 1 to be received for periods 942 95 VIT 0.935 1.80 2.624 3.387 34 0.950 1.942 2.884 3.80 4.713 5.601 6.472 7125 0.909 1.736 2.487 3.170 1 2 3 4 5 6 7 8 9 10 0.990 1.970 2.941 3.902 4853 5.795 6.728 7.652 8.566 9.471 + 0.42 1.836 2.775 3.610 4.452 5.242 6.002 6.733 7.435 8111 0.971 1.913 2.829 3.717 4.580 5.417 6.230 7.020 7.786 X 50 3.791 Interest Rate 64 0.952 0.943 1.833 2.673 3.546 3.465 4.329 4.212 5.076 4.917 5.786 S.582 6.463 6.210 7.108 602 7.222 70 92 0.917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.995 6.41 1.71 2577 3312 3.993 4.623 5.206 5.747 6247 6.710 4.767 5.389 5.971 6.515 7.024 4355 4.86 5.335 5.759 6.145 89 MI Periods 1 2 3 4 $ 0.901 1.713 2.444 3.102 0.893 1.6790 2.402 3.037 3.605 14 0.877 1647 2322 19% 0.870 1.626 2.23 2855 1996 O-40 1.547 2.140 1.394 0.885 1.668 2361 2.974 3.517 3.998 4.423 4.799 5.132 $426 3.433 0262 1.60s 2.346 2.798 1.274 3.65 4039 4344 4.807 4833 19% 0855 1.585 2.210 2.743 3.199 3.589 3.922 4.207 4.451 4659 18 0847 1566 2.174 2.690 3.127 3.49 3812 4.07 4301 4.494 20% 0.833 1.528 2.100 2.589 2.991 3.326 3.605 3.837 4.031 3.784 7 % 9 10 4231 4.712 5.146 5.537 SRRO 4.564 4.968 5328 $ 650 3. OSN 3410 3.706 3.954 4.163 4 119 4.288 4.619 4946 $ 216 4.487 4.772 5019 Question 16 PCW Co is a listed company that operates in the automobile industry. Due to an increase in local demand for the company's products, PCW Co decides to invest in a new machinery. Such an investment project requires some initial investment in working capital of $300,000. And the investment in working capital is subject to general inflation, which is forecasted to be 5% per annum. The cost of the new machine is $3 million. Each year, the new investment is estimated to generate 7,000 products and all of them are expected to be sold. For simplicity's reason, there is no scrap value of the machine. The usual lifetime of the machinery would be 3 years, after which it is supposed to be replaced. The costs and selling price in current price terms are summarised as follows: Annual sector-specific inflation Variable costs S100/unit 60% Incremental fixed costs $200,000/year 4.5% Selling price $400/unit Capital allowance on plant and machinery is on a 25% reducing- balance basis, with the remaining allowance to be claimed in full during the final year of the investment project. The current corporate tax rate is 35%. The company has a nominal (money-terms) after-tax cost of capital of 10%. Required: (a) Calculate the net present value of the planned purchase of the machine using a nominal (money term) approach and comments on its financial acceptability. marks) (b) Discuss the following methods involved in investment appraisal: 1) Real terms approach (2 marks) 2) Written down allowance (2 marks) Table 1: Present value of 1 to be invested at the end of the periods Interest Rate Periods 393 69 1 0.990 0.980 0.971 0.962 0.952 0.943 2 0.980 0.961 0.943 0.925 0.907 0.890 3 0.971 0.942 0.915 0.889 0.864 0.840 4 0.961 0.924 O.RS ORSS 0.823 0.792 5 0.951 0.906 0.863 0822 0.784 0747 6 0,942 O.RS 0.837 0.790 0.746 0.705 7 0.933 0.871 0.813 0.760 0.711 0.665 8 0.921 OS 0.789 0731 0.677 0.627 0.914 0.837 0.766 0.703 0.645 0.392 10 0905 0820 0.744 0676 0.915 0.873 0,816 0.763 0.713 19 0.926 0857 0.794 0.735 06RI 0.630 OSR 0540 0.500 0461 99 0.917 0.842 0.772 0,70N 0.650 0.596 0547 0502 0.460 0432 JOS 0.909 0826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0386 0.666 0.623 0.582 0.544 OSOS Periods 1 2 3 4 5 6 7 3 19 0.901 0.812 0.731 0.659 0.593 0.535 13 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0376 0.333 0.295 1496 0.877 0.769 0.675 0.592 0519 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0322 25% 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 16% 0.862 0.741 0.641 0.552 0.476 0.410 0354 0305 0.263 0.227 17% 0.855 0.731 0.624 0.534 0.456 0.390 0.333 0285 0.241 0.205 18% 0847 0.718 0.609 0516 0.437 0370 0314 0266 0.225 0.191 1994 0.840 0.706 0.593 0,499 0.419 0352 0.296 0.249 0.209 0.176 20% 0.833 0.694 0.579 0.482 0.402 0,335 0.279 0.233 0.194 0.162 0.454 0.391 0.352 0.400 0351 0 308 0210 10 Birkbeck College 2021 BUMNO5256 Page 1 of 2 Table 2: Annuity of 1 to be received for periods 942 95 VIT 0.935 1.80 2.624 3.387 34 0.950 1.942 2.884 3.80 4.713 5.601 6.472 7125 0.909 1.736 2.487 3.170 1 2 3 4 5 6 7 8 9 10 0.990 1.970 2.941 3.902 4853 5.795 6.728 7.652 8.566 9.471 + 0.42 1.836 2.775 3.610 4.452 5.242 6.002 6.733 7.435 8111 0.971 1.913 2.829 3.717 4.580 5.417 6.230 7.020 7.786 X 50 3.791 Interest Rate 64 0.952 0.943 1.833 2.673 3.546 3.465 4.329 4.212 5.076 4.917 5.786 S.582 6.463 6.210 7.108 602 7.222 70 92 0.917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.995 6.41 1.71 2577 3312 3.993 4.623 5.206 5.747 6247 6.710 4.767 5.389 5.971 6.515 7.024 4355 4.86 5.335 5.759 6.145 89 MI Periods 1 2 3 4 $ 0.901 1.713 2.444 3.102 0.893 1.6790 2.402 3.037 3.605 14 0.877 1647 2322 19% 0.870 1.626 2.23 2855 1996 O-40 1.547 2.140 1.394 0.885 1.668 2361 2.974 3.517 3.998 4.423 4.799 5.132 $426 3.433 0262 1.60s 2.346 2.798 1.274 3.65 4039 4344 4.807 4833 19% 0855 1.585 2.210 2.743 3.199 3.589 3.922 4.207 4.451 4659 18 0847 1566 2.174 2.690 3.127 3.49 3812 4.07 4301 4.494 20% 0.833 1.528 2.100 2.589 2.991 3.326 3.605 3.837 4.031 3.784 7 % 9 10 4231 4.712 5.146 5.537 SRRO 4.564 4.968 5328 $ 650 3. OSN 3410 3.706 3.954 4.163 4 119 4.288 4.619 4946 $ 216 4.487 4.772 5019