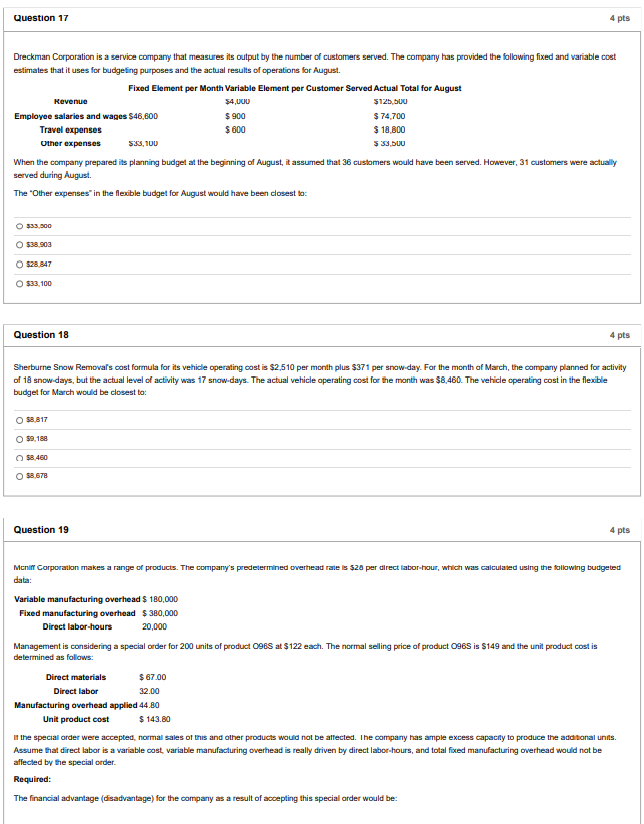

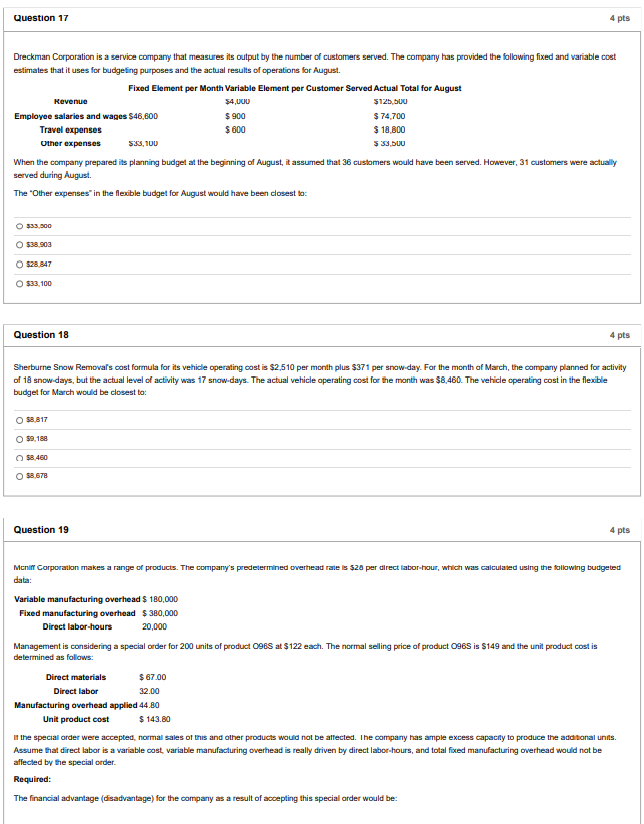

Question 17 4 pts Dreckman Corporation is a service company that measures is output by the number of customers served. The company has provided the following fixed and variable cost estimates that it uses for budgeting purposes and the actual results of operations for August Fixed Element per Month Variable Element per Customer Served Actual Total for August Revenue $4,000 $125,00 Employee salaries and wages $46,600 $ 900 $ 74,700 Travel expenses $ 600 $18.800 Other expenses $3,100 $ 33,DUU When the company prepared its planning budget at the beginning of August, it assumed that 36 customers would have been served. However, 31 customers were actually served during August The Other expenses in the flexible budget for August would have been closest to: O $33.500 O $38.903 $28MY O $33.100 Question 18 4 pts Sherburne Snow Removals cost formula for its vehicle operating cost is $2,510 per month plus $371 per snow-day. For the month of March, the company planned for activity of 18 snow-days, but the actual level of activity was 17 snow-days. The actual vehicle operating cost for the month was $8.480. The vehicle operating cost in the flexible budget for March would be closest to: O $8.817 59.18 $8.460 $8.678 Question 19 4 pts Mcnil Corporation makes a range of products. The company's predetermined overhead rate is $28 per direct labor-hour, which was calculated using the following budgeted data: Variable manufacturing overhead $ 180,000 Fixed manufacturing overhead $380,000 Direct labor-hours 20,000 Management is considering a special order for 200 units of product 0988 at $122 each. The normal selling price of product 096S is $149 and the unit product cost is determined as follows: Direct materials $67.00 Direct labor 32.00 Manufacturing overhead applied 44.80 Unit product cost $143.80 It the special order were accepted, normal sales of this and other products would not be affected. The company has ample excess capacity to produce the additional units. Assume that direct labor is a variable cost, variable manufacturing overhead is really driven by direct labor-hours, and total fixed manufacturing overhead would not be affected by the special order. Required: The financial advantage (disadvantage) for the company as a result of accepting this special order would be