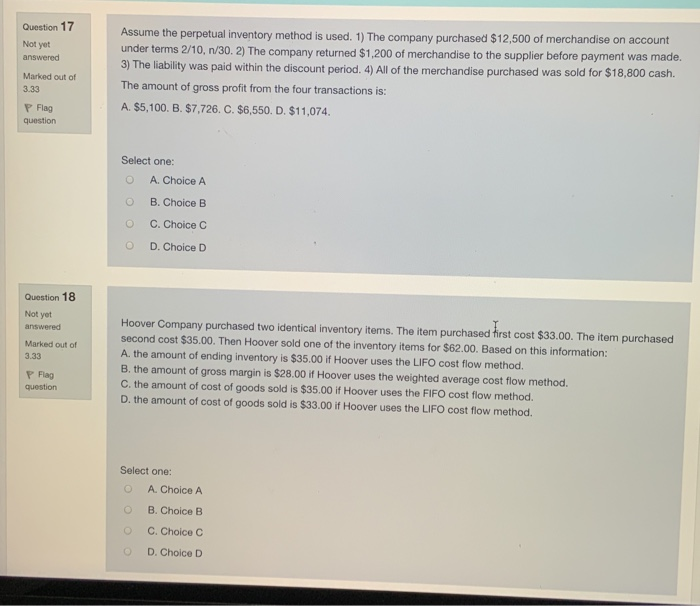

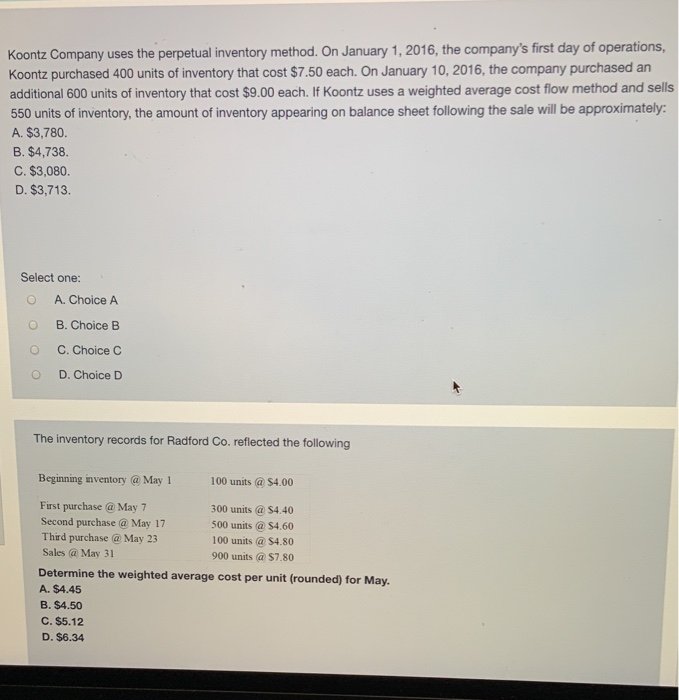

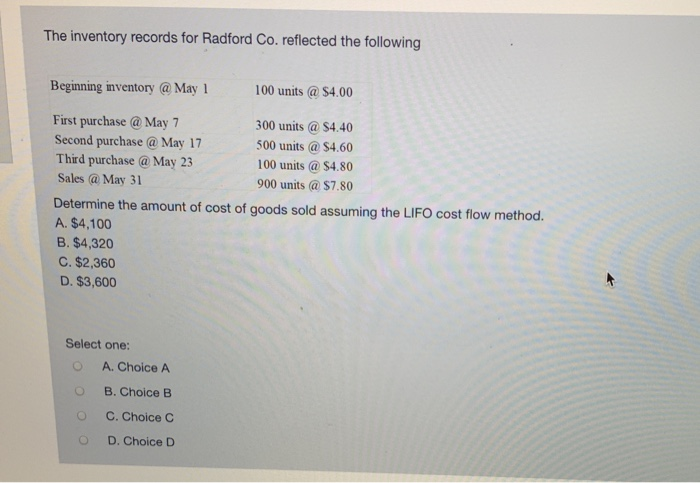

Question 17 Not yet answered Assume the perpetual inventory method is used. 1) The company purchased $12,500 of merchandise on account under terms 2/10, 1/30. 2) The company returned $1,200 of merchandise to the supplier before payment was made. 3) The liability was paid within the discount period. 4) All of the merchandise purchased was sold for $18,800 cash. The amount of gross profit from the four transactions is: A. $5,100. B. $7,726. C. $6,550. D. $11,074. Marked out of 333 P Flag question Select one: O A. Choice A B. Choice B C. Choice D. Choice D Question 18 Not yet answered Marked out of 3.33 Hoover Company purchased two identical inventory items. The item purchased first cost $33.00. The item purchased second cost $35.00. Then Hoover sold one of the inventory items for $62.00. Based on this information: A. the amount of ending inventory is $35.00 if Hoover uses the LIFO cost flow method. B. the amount of gross margin is $28.00 if Hoover uses the weighted average cost flow method. C. the amount of cost of goods sold is $35.00 if Hoover uses the FIFO cost flow method. D. the amount of cost of goods sold is $33.00 if Hoover uses the LIFO cost flow method. P Flag question Select one: A. Choice A B. Choice B C. Choice C D. Choice Koontz Company uses the perpetual inventory method. On January 1, 2016, the company's first day of operations, Koontz purchased 400 units of inventory that cost $7.50 each. On January 10, 2016, the company purchased an additional 600 units of inventory that cost $9.00 each. If Koontz uses a weighted average cost flow method and sells 550 units of inventory, the amount of inventory appearing on balance sheet following the sale will be approximately A. $3,780. B. $4,738. C. $3,080. D. $3,713 Select one: O A. Choice A B. Choice B O C. Choice D. Choice D The inventory records for Radford Co. reflected the following Beginning inventory May 1 100 units @ $4.00 First purchase @ May 7 300 units @ $4.40 Second purchase @ May 17 500 units @ $4.60 Third purchase @ May 23 100 units @ $4.80 Sales @ May 31 900 units @ $7.80 Determine the weighted average cost per unit (rounded) for May. A. $4.45 B. $4.50 C. $5.12 D. $6.34 The inventory records for Radford Co. reflected the following Beginning inventory @ May 1 100 units @ $4.00 First purchase @ May 7 300 units @ $4.40 Second purchase @ May 17 500 units @ $4.60 Third purchase @ May 23 100 units @ $4.80 Sales @ May 31 900 units @ $7.80 Determine the amount of cost of goods sold assuming the LIFO cost flow method. A. $4,100 B. $4,320 C. $2,360 D. $3,600 Select one: O A. Choice A B. Choice B O C. Choice D. Choice D