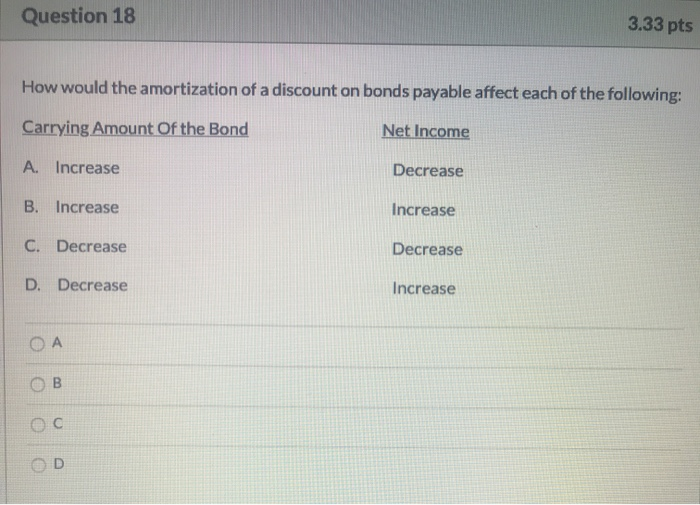

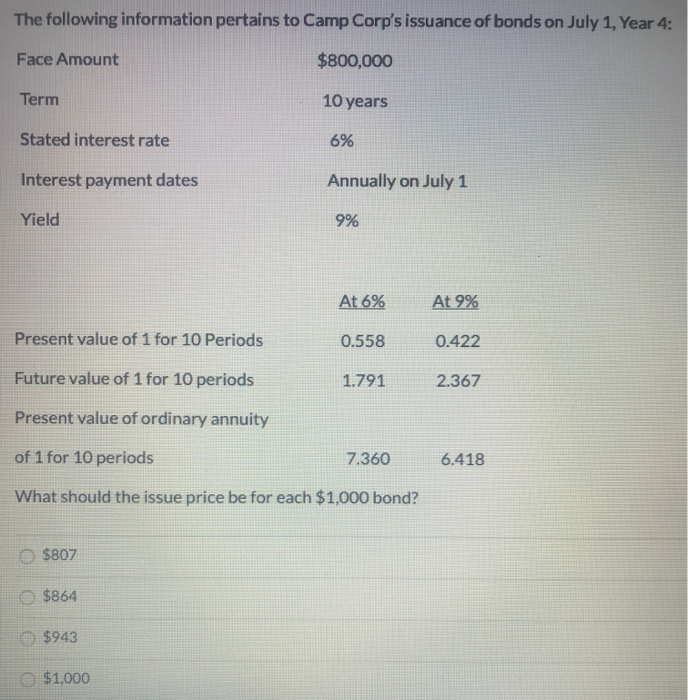

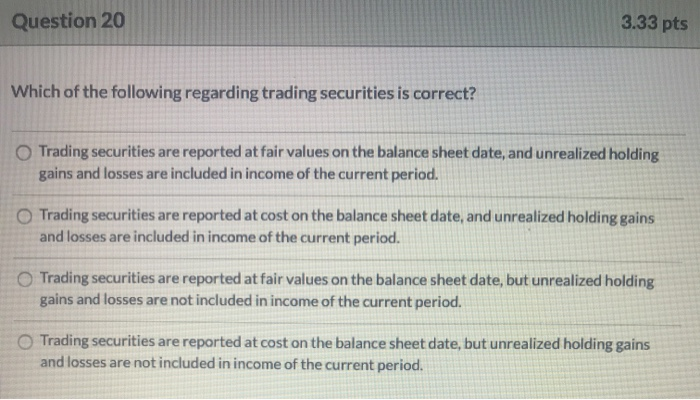

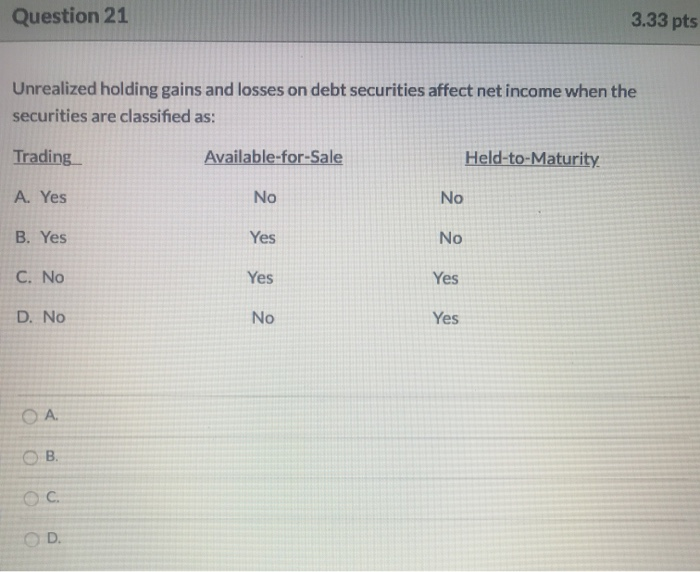

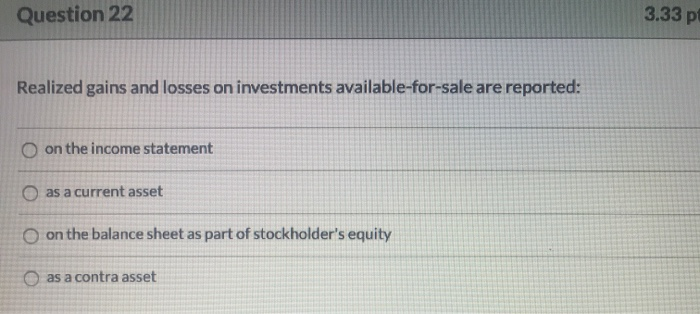

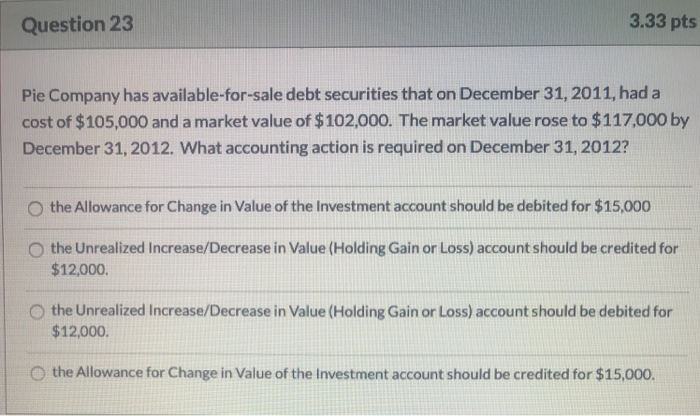

Question 18 3.33 pts How would the amortization of a discount on bonds payable affect each of the following: Carrying Amount of the Bond Net Income A. Increase Decrease B. Increase Increase C. Decrease Decrease D. Decrease Increase OB The following information pertains to Camp Corp's issuance of bonds on July 1, Year 4: Face Amount $800,000 10 years Term 6% Stated interest rate Interest payment dates Annually on July 1 Yield 9% At 6% At 9% Present value of 1 for 10 Periods 0.558 0.422 2.367 Future value of 1 for 10 periods 1.791 Present value of ordinary annuity 6.418 of 1 for 10 periods 7.360 What should the issue price be for each $1,000 bond? $807 $864 $943 $1,000 Question 20 3.33 pts Which of the following regarding trading securities is correct? Trading securities are reported at fair values on the balance sheet date, and unrealized holding gains and losses are included in income of the current period. Trading securities are reported at cost on the balance sheet date, and unrealized holding gains and losses are included in income of the current period. Trading securities are reported at fair values on the balance sheet date, but unrealized holding gains and losses are not included in income of the current period. Trading securities are reported at cost on the balance sheet date, but unrealized holding gains and losses are not included in income of the current period. Question 21 3.33 pts Unrealized holding gains and losses on debt securities affect net income when the securities are classified as: Trading Available-for-Sale Held-to-Maturity A. Yes No No Yes No B. Yes C. No Yes D. No No O O O U O Question 22 3.33 pt Realized gains and losses on investments available-for-sale are reported: O on the income statement as a current asset O on the balance sheet as part of stockholder's equity O as a contra asset Question 23 3.33 pts Pie Company has available-for-sale debt securities that on December 31, 2011, had a cost of $ 105,000 and a market value of $ 102,000. The market value rose to $117,000 by December 31, 2012. What accounting action is required on December 31, 2012? the Allowance for Change in Value of the Investment account should be debited for $15,000 the Unrealized Increase/Decrease in Value (Holding Gain or Loss) account should be credited for $12,000. the Unrealized Increase/Decrease in Value (Holding Gain or Loss) account should be debited for $12,000. the Allowance for Change in Value of the Investment account should be credited for $15,000