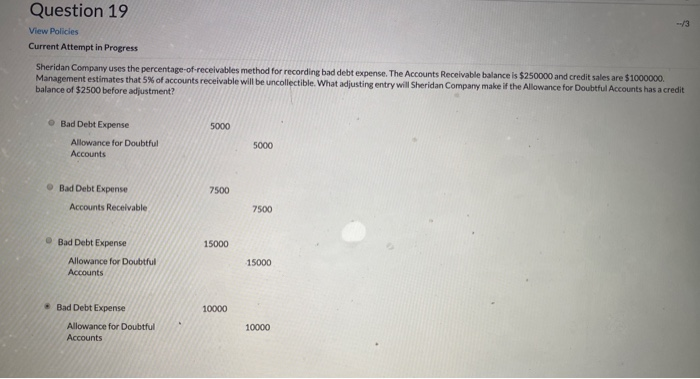

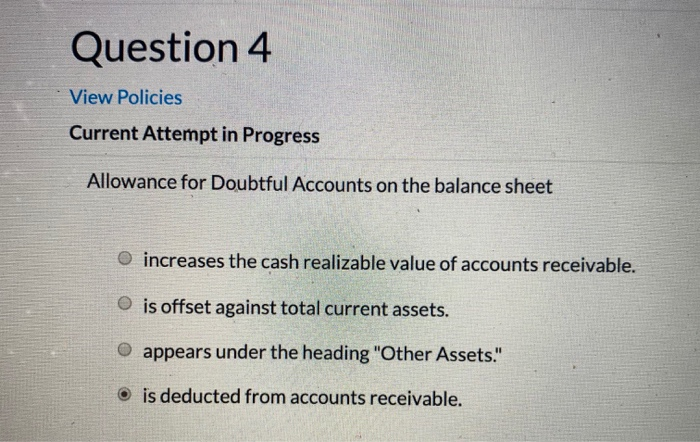

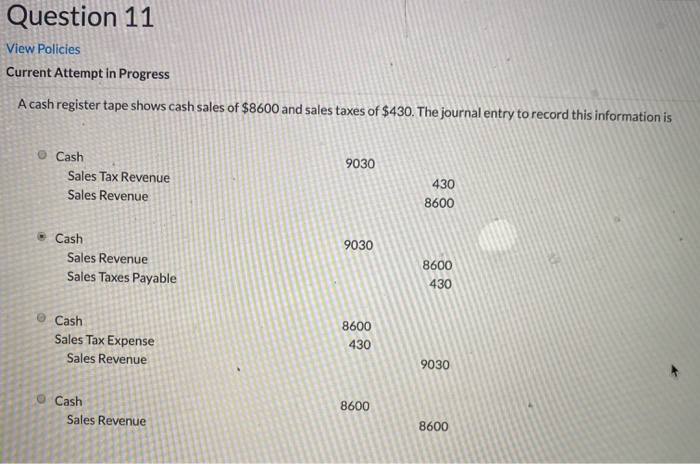

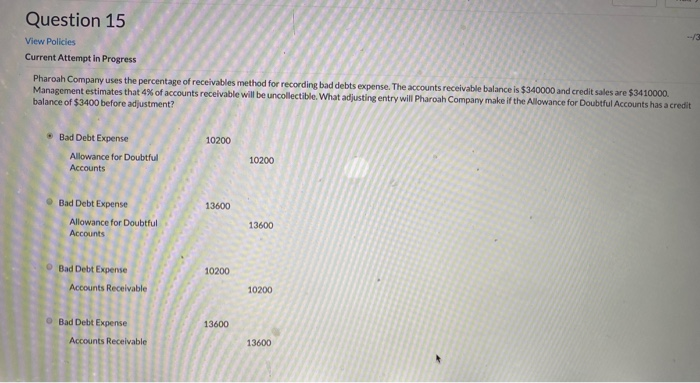

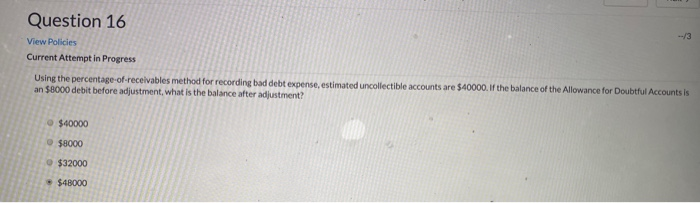

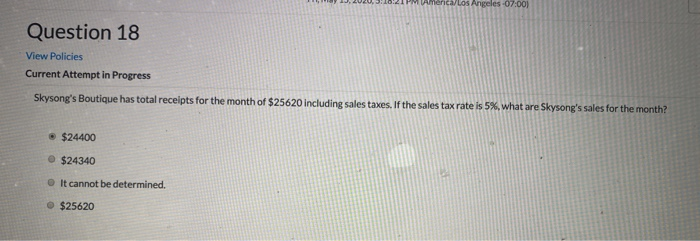

Question 19 --/3 View Policies Current Attempt in Progress Sheridan Company uses the percentage-of-receivables method for recording bad debt expense. The Accounts Receivable balance is $250000 and credit sales are $1000000 Management estimates that 5% of accounts receivable will be uncollectible. What adjusting entry will Sheridan Company make if the Allowance for Doubtful Accounts has a credit balance of $2500 before adjustment? Bad Debt Expense 5000 Allowance for Doubtful Accounts 5000 7500 Bad Debt Expense Accounts Receivable 7500 15000 Bad Debt Expense Allowance for Doubtful Accounts 15000 10000 Bad Debt Expense Allowance for Doubtful Accounts 10000 Question 4 View Policies Current Attempt in Progress Allowance for Doubtful Accounts on the balance sheet increases the cash realizable value of accounts receivable. is offset against total current assets. appears under the heading "Other Assets." is deducted from accounts receivable. Question 11 View Policies Current Attempt in Progress A cash register tape shows cash sales of $8600 and sales taxes of $430. The journal entry to record this information is 9030 O Cash Sales Tax Revenue Sales Revenue 430 8600 9030 Cash Sales Revenue Sales Taxes Payable 8600 430 Cash Sales Tax Expense Sales Revenue 8600 430 9030 Cash Sales Revenue 8600 8600 Question 15 View Policies Current Attempt in Progress Pharoah Company uses the percentage of receivables method for recording bad debts expense. The accounts receivable balance is $340000 and credit sales are $3410000. Management estimates that 4% of accounts receivable will be uncollectible. What adjusting entry will Pharoah Company make if the Allowance for Doubtful Accounts has a credit balance of $3400 before adjustment? 10200 Bad Debt Expense Allowance for Doubtful Accounts 10200 Bad Debt Expense 13600 Allowance for Doubtful Accounts 13600 Bad Debt Expense 10200 Accounts Receivable 10200 Bad Debt Expense 13600 Accounts Receivable 13600 Question 16 --/3 View Policies Current Attempt in Progress Using the percentage-of-receivables method for recording bad debt expense, estimated uncollectible accounts are $40000. If the balance of the Allowance for Doubtful Accounts is an 58000 debit before adjustment, what is the balance after adjustment? $40000 $8000 $32000 $48000 mrica/Los Angeles -07:00) Question 18 View Policies Current Attempt in Progress Skysong's Boutique has total receipts for the month of $25620 including sales taxes. If the sales tax rate is 5%, what are Skysong's sales for the month? $24400 $24340 It cannot be determined. $25620