Answered step by step

Verified Expert Solution

Question

1 Approved Answer

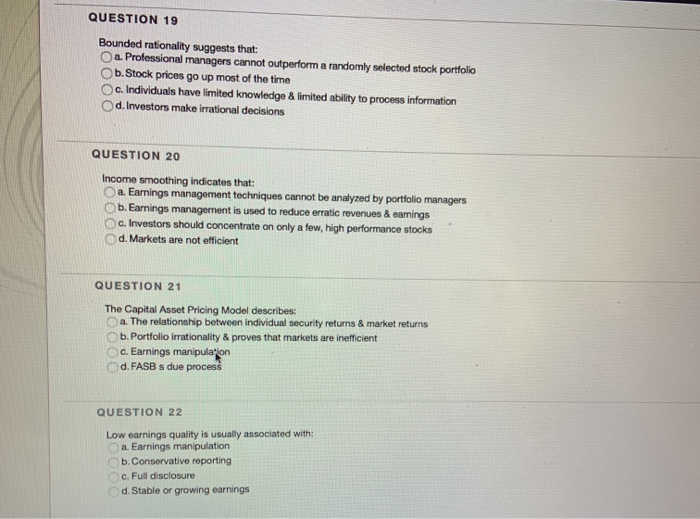

QUESTION 19 Bounded rationality suggests that: a. Professional managers cannot outperform a randomly selected stock portfolio b. Stock prices go up most of the time

QUESTION 19 Bounded rationality suggests that: a. Professional managers cannot outperform a randomly selected stock portfolio b. Stock prices go up most of the time c. Individuals have limited knowledge & limited ability to process information d. Investors make irrational decisions QUESTION 20 Income smoothing indicates that: a. Earnings management techniques cannot be analyzed by portfolio managers b. Earnings management is used to reduce erratic revenues & earnings c. Investors should concentrate on only a few, high performance stocks d. Markets are not efficient QUESTION 21 The Capital Asset Pricing Model describes: a. The relationship between individual security returns & market returns b. Portfolio irrationality & proves that markets are inefficient c. Earnings manipula on d. FASB s due process QUESTION 22 Low earnings quality is usually associated with: a. Earnings manipulation b. Conservative reporting c. Full disclosure d. Stable or growing earnings

QUESTION 19 Bounded rationality suggests that: a. Professional managers cannot outperform a randomly selected stock portfolio b. Stock prices go up most of the time c. Individuals have limited knowledge & limited ability to process information d. Investors make irrational decisions QUESTION 20 Income smoothing indicates that: a. Earnings management techniques cannot be analyzed by portfolio managers b. Earnings management is used to reduce erratic revenues & earnings c. Investors should concentrate on only a few, high performance stocks d. Markets are not efficient QUESTION 21 The Capital Asset Pricing Model describes: a. The relationship between individual security returns & market returns b. Portfolio irrationality & proves that markets are inefficient c. Earnings manipula on d. FASB s due process QUESTION 22 Low earnings quality is usually associated with: a. Earnings manipulation b. Conservative reporting c. Full disclosure d. Stable or growing earnings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started