Answered step by step

Verified Expert Solution

Question

1 Approved Answer

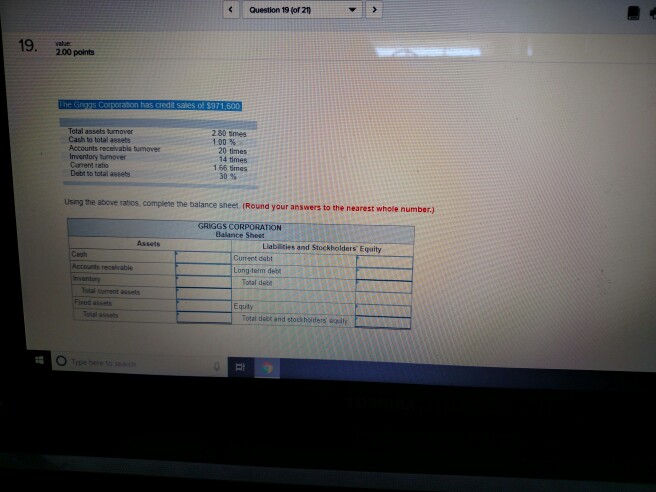

Question 19 (of 2 19.00 200 points Total assets turnover Cash to total assets Accounts receivable tumover Inventory turnover Current ratio Debt to total assets

Question 19 (of 2 19.00 200 points Total assets turnover Cash to total assets Accounts receivable tumover Inventory turnover Current ratio Debt to total assets 280 Smes 100% 20 times 14 times 166 5mes 30 % using the above rabios, complete the balance sneet. (Round your answers to the nearest whole number.) GRIGGS CORPORATION Balance Sheet Assets Liabilities and Stockholders Equity Cash Accounts receivable Current dght Long term debe Total deb Total turrent assets Fired aes Equity Total asses Total debt and equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started