Answered step by step

Verified Expert Solution

Question

1 Approved Answer

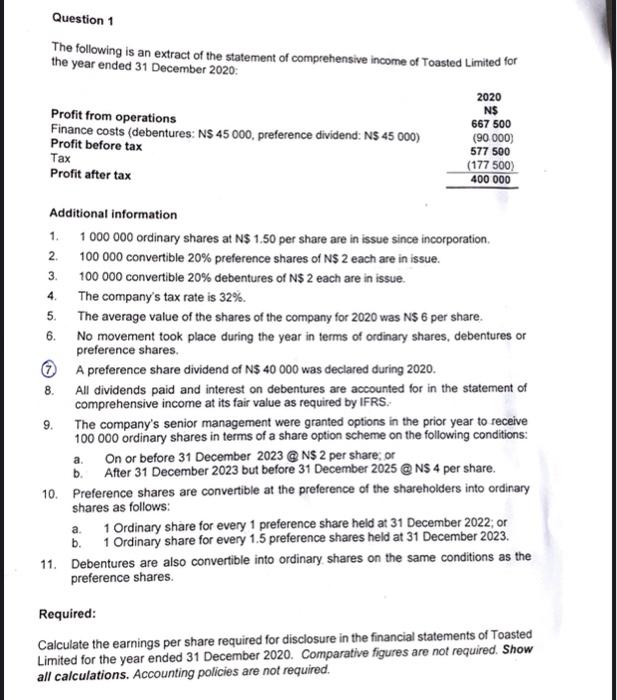

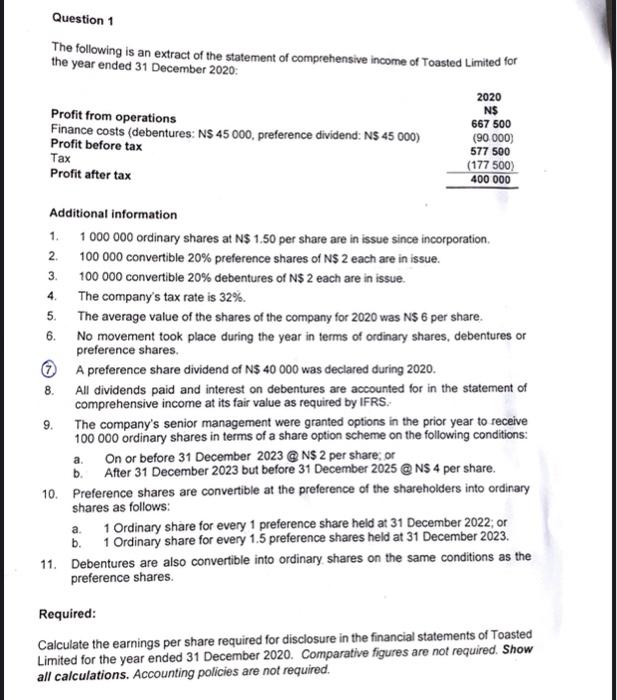

QUESTION 1A Question 1 The following is an extract of the statement of comprehensive income of Toasted Limited for the year ended 31 December 2020

QUESTION 1A

Question 1 The following is an extract of the statement of comprehensive income of Toasted Limited for the year ended 31 December 2020 2020 N$ Profit from operations 667 500 Finance costs (debentures: NS 45 000, preference dividend: N$ 45 000) (90 000) Profit before tax 577 500 Tax (177 500) Profit after tax 400 000 2 4. 8. Additional information 1. 1 000 000 ordinary shares at N$ 1.50 per share are in issue since incorporation 100 000 convertible 20% preference shares of N$ 2 each are in issue. 3. 100 000 convertible 20% debentures of N$ 2 each are in issue. The company's tax rate is 32%. 5. The average value of the shares of the company for 2020 was N$ 6 per share. 6. No movement took place during the year in terms of ordinary shares, debentures or preference shares A preference share dividend of N$ 40 000 was declared during 2020. All dividends paid and interest on debentures are accounted for in the statement of comprehensive income at its fair value as required by IFRS. 9. The company's senior management were granted options in the prior year to receive 100 000 ordinary shares in terms of a share option scheme on the following conditions: a. On or before 31 December 2023 @ N$ 2 per share, or b. After 31 December 2023 but before 31 December 2025 @N$ 4 per share. 10. Preference shares are convertible at the preference of the shareholders into ordinary shares as follows: 1 Ordinary share for every 1 preference share held at 31 December 2022; or b. 1 Ordinary share for every 1.5 preference shares held at 31 December 2023. 11. Debentures are also convertible into ordinary shares on the same conditions as the preference shares a Required: Calculate the earnings per share required for disclosure in the financial statements of Toasted Limited for the year ended 31 December 2020. Comparative figures are not required. Show all calculations. Accounting policies are not required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started