Answered step by step

Verified Expert Solution

Question

1 Approved Answer

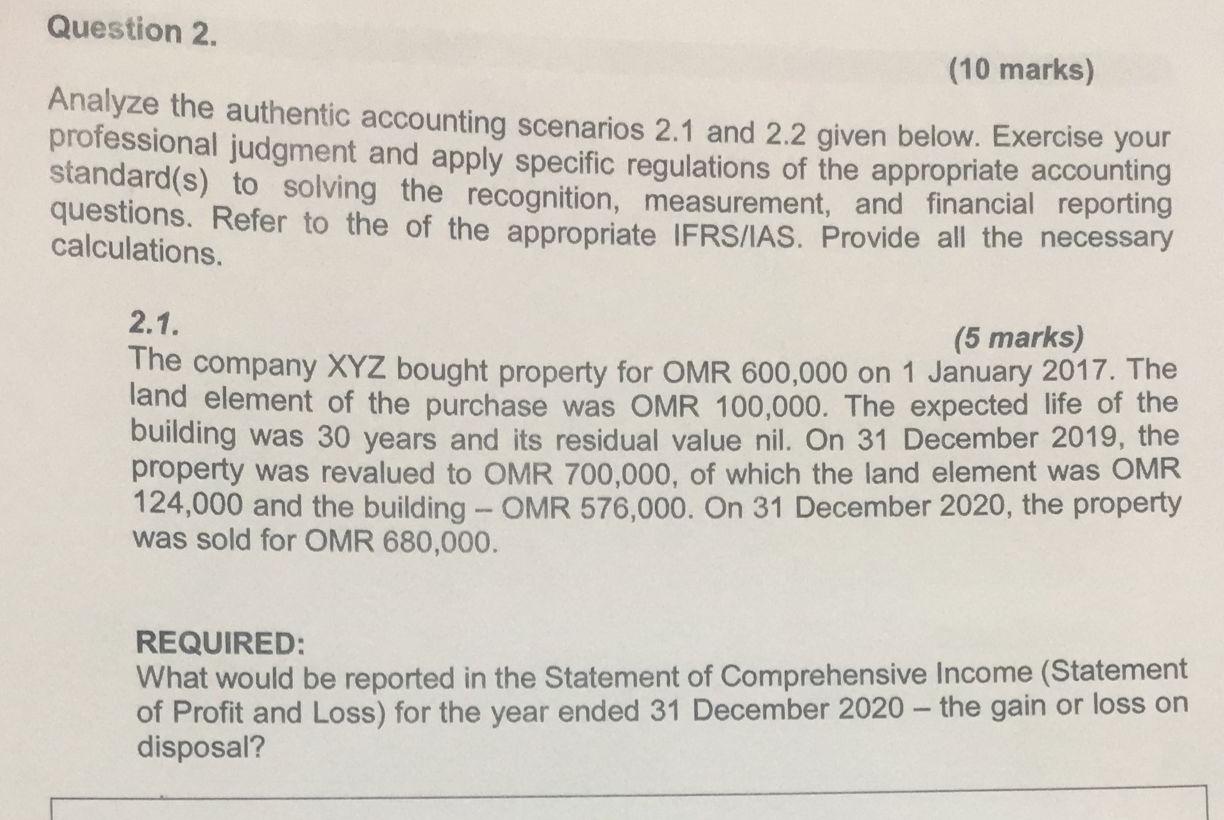

Question 2. (10 marks) Analyze the authentic accounting scenarios 2.1 and 2.2 given below. Exercise your professional judgment and apply specific regulations of the appropriate

Question 2. (10 marks) Analyze the authentic accounting scenarios 2.1 and 2.2 given below. Exercise your professional judgment and apply specific regulations of the appropriate accounting standard(s) to solving the recognition, measurement, and financial reporting questions. Refer to the of the appropriate IFRS/IAS. Provide all the necessary calculations. 2.1. (5 marks) The company XYZ bought property for OMR 600,000 on 1 January 2017. The land element of the purchase was OMR 100,000. The expected life of the building was 30 years and its residual value nil. On 31 December 2019, the property was revalued to OMR 700,000, of which the land element was OMR 124,000 and the building - OMR 576,000. On 31 December 2020, the property was sold for OMR 680,000. REQUIRED: What would be reported in the Statement of Comprehensive Income (Statement of Profit and Loss) for the year ended 31 December 2020 - the gain or loss on disposal? Question 2. (10 marks) Analyze the authentic accounting scenarios 2.1 and 2.2 given below. Exercise your professional judgment and apply specific regulations of the appropriate accounting standard(s) to solving the recognition, measurement, and financial reporting questions. Refer to the of the appropriate IFRS/IAS. Provide all the necessary calculations. 2.1. (5 marks) The company XYZ bought property for OMR 600,000 on 1 January 2017. The land element of the purchase was OMR 100,000. The expected life of the building was 30 years and its residual value nil. On 31 December 2019, the property was revalued to OMR 700,000, of which the land element was OMR 124,000 and the building - OMR 576,000. On 31 December 2020, the property was sold for OMR 680,000. REQUIRED: What would be reported in the Statement of Comprehensive Income (Statement of Profit and Loss) for the year ended 31 December 2020 - the gain or loss on disposal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started