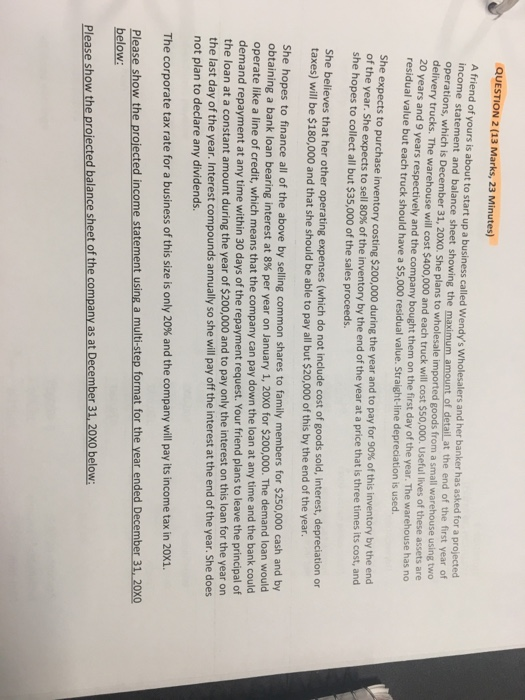

QUESTION 2 (13 Marks, 23 Minutes) A friend of yours is about to start up a business called Wendy's Wholesalers and her banker has asked for a projected income statement and balance sheet showing the maximum amount of detail at the end of the first year of operations, which is December 31, 20x0. She plans to wholesale imported goods from a small warehouse using two delivery trucks. The warehouse will cost $400,000 and each truck will cost $50,000. Useful lives of these assets are 20 years and 9 years respectively and the company bought them on the first day of the year. The warehouse has no residual value but each truck should have a $5,000 residual value. Straight-line depreciation is used. She expects to purchase inventory costing $200,000 during the year and to pay for 90% of this inventory by of the year. She expects to sell 80% of the inventory by the end of the year at a price that is three times it she hopes to collect all but $35,000 of the sales proceeds. the end s cost, and She believes that her other operat taxes) will be $180,000 and that she should be able to pay all but $20,000 of this by the end of the year. ng expenses (which do not include cost of goods sold, interest, depreciation or She hopes to finance all of the above by selling common shares to family members for $250,000 cash and by obtaining a bank loan bearing interest at 8% per year on January 1, 20X0 for $200,000. The demand loan would operate like a line of credit, which means that the company can pay down the loan at any time and the bank could demand repayment at any time within 30 days of the repayment request. Your friend plans to leave the principal of the loan at a constant amount during the year of $200,000 and to pay only the interest on this loan for the year on the last day of the year. Interest compounds annually so she will pay off the interest at the end of the year. She does not plan to declare any dividends. The corporate tax rate for a business of this size is only 20% and the company will pay its income tax in 20X1. Please show the proiected income statement using a multi-step format for the vear ended December 31, 20X0 below: Please show the proiected balance sheet of the company as at December 31, 20XO below