Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 (15 marks, 30 minutes) Part (a) (5 marks) The following information is made available by Glesen Corp: 1. Glesen Corp. purchased land

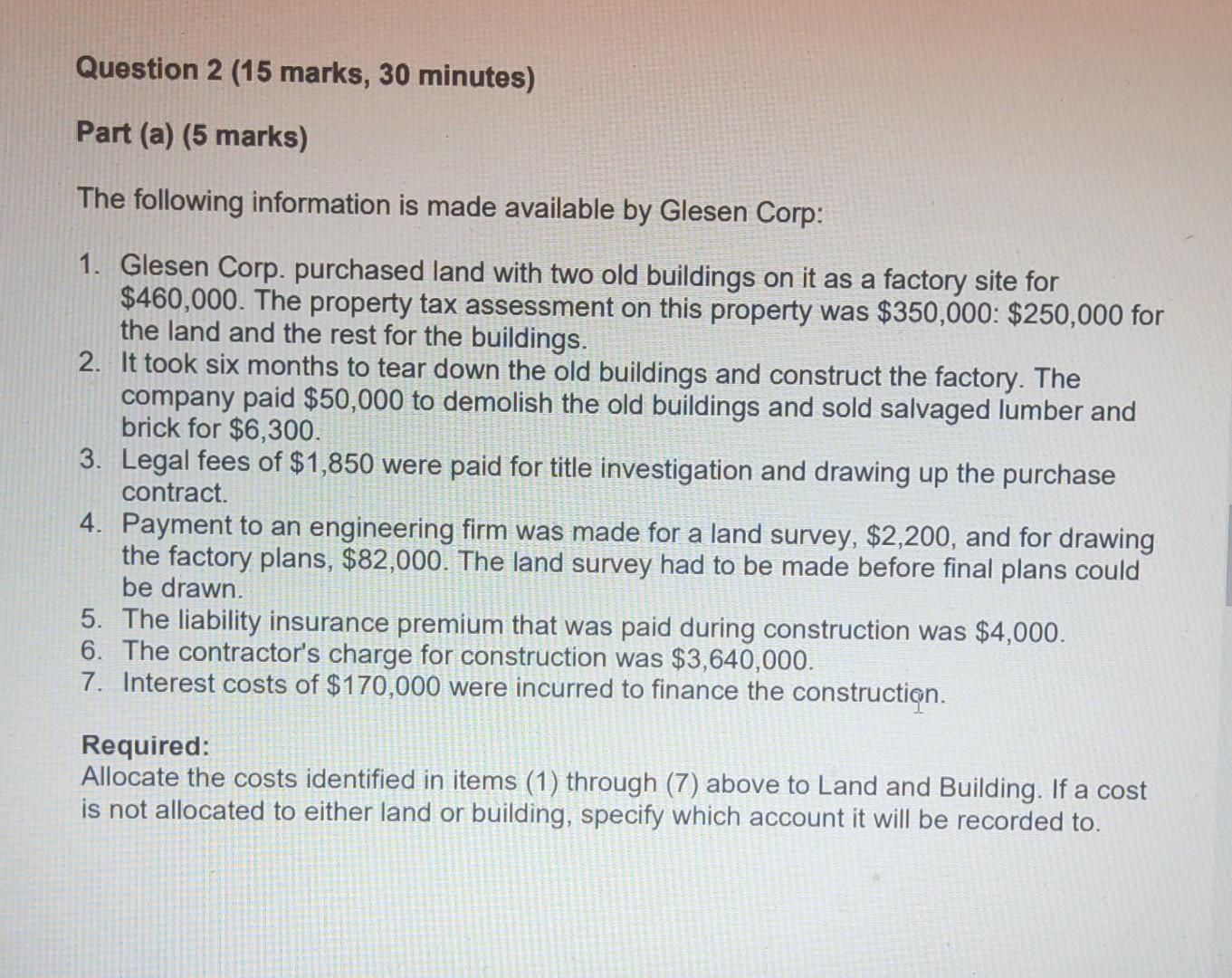

Question 2 (15 marks, 30 minutes) Part (a) (5 marks) The following information is made available by Glesen Corp: 1. Glesen Corp. purchased land with two old buildings on it as a factory site for $460,000. The property tax assessment on this property was $350,000: $250,000 for the land and the rest for the buildings. 2. It took six months to tear down the old buildings and construct the factory. The company paid $50,000 to demolish the old buildings and sold salvaged lumber and brick for $6,300. 3. Legal fees of $1,850 were paid for title investigation and drawing up the purchase contract. 4. Payment to an engineering firm was made for a land survey, $2,200, and for drawing the factory plans, $82,000. The land survey had to be made before final plans could be drawn. 5. The liability insurance premium that was paid during construction was $4,000. 6. The contractor's charge for construction was $3,640,000. 7. Interest costs of $170,000 were incurred to finance the construction. Required: Allocate the costs identified in items (1) through (7) above to Land and Building. If a cost is not allocated to either land or building, specify which account it will be recorded to.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started