Answered step by step

Verified Expert Solution

Question

1 Approved Answer

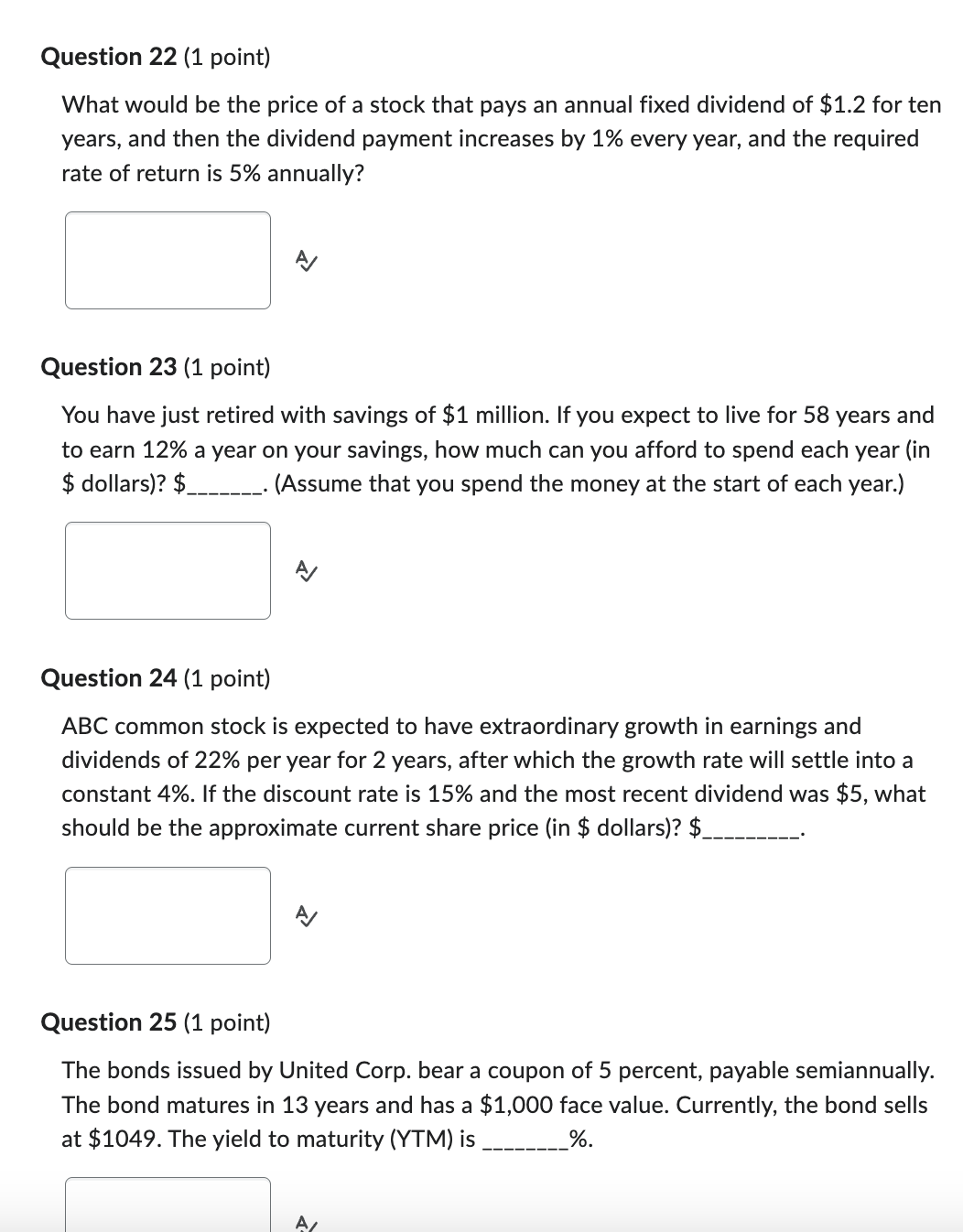

Question 2 2 ( 1 point ) What would be the price of a stock that pays an annual fixed dividend of $ 1 .

Question point

What would be the price of a stock that pays an annual fixed dividend of $ for ten

years, and then the dividend payment increases by every year, and the required

rate of return is annually?

Question point

You have just retired with savings of $ million. If you expect to live for years and

to earn a year on your savings, how much can you afford to spend each year in

$ dollars $ Assume that you spend the money at the start of each year.

Question point

ABC common stock is expected to have extraordinary growth in earnings and

dividends of per year for years, after which the growth rate will settle into a

constant If the discount rate is and the most recent dividend was $ what

should be the approximate current share price in $ dollars $

Question point

The bonds issued by United Corp. bear a coupon of percent, payable semiannually.

The bond matures in years and has a $ face value. Currently, the bond sells

at $ The yield to maturity YTM is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started